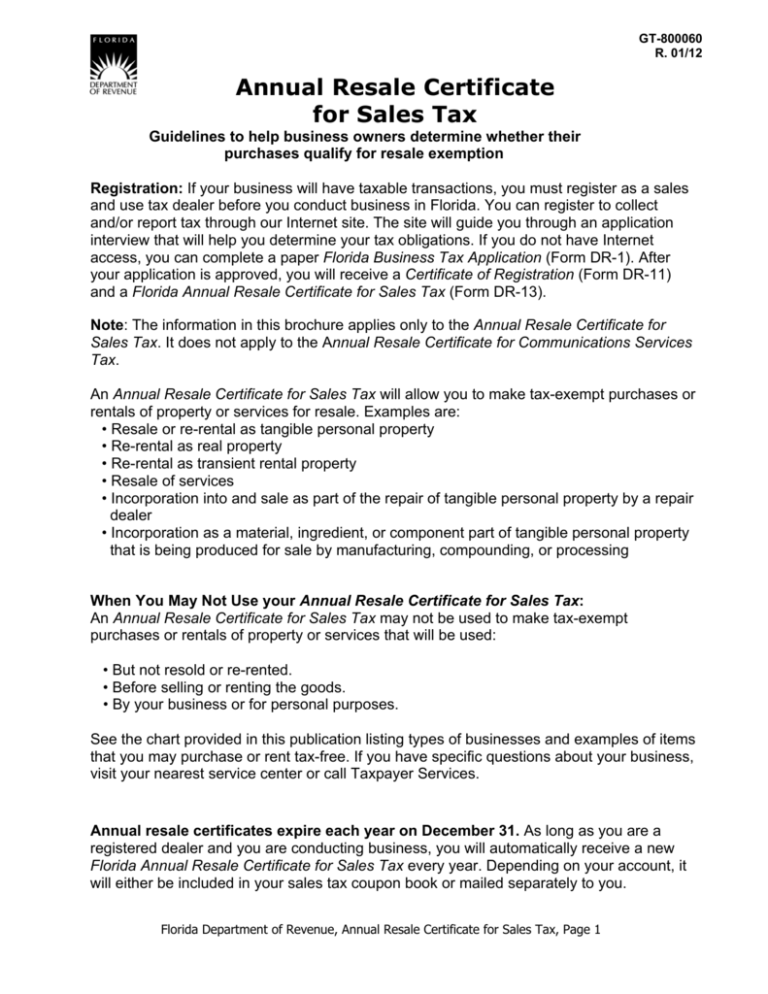

The florida annual resale certificate is issued to active, registered sales and use tax dealers. What is a florida annual resale certificate?

2

Resale certificates in florida expire every year on december 31 and need to be renewed.

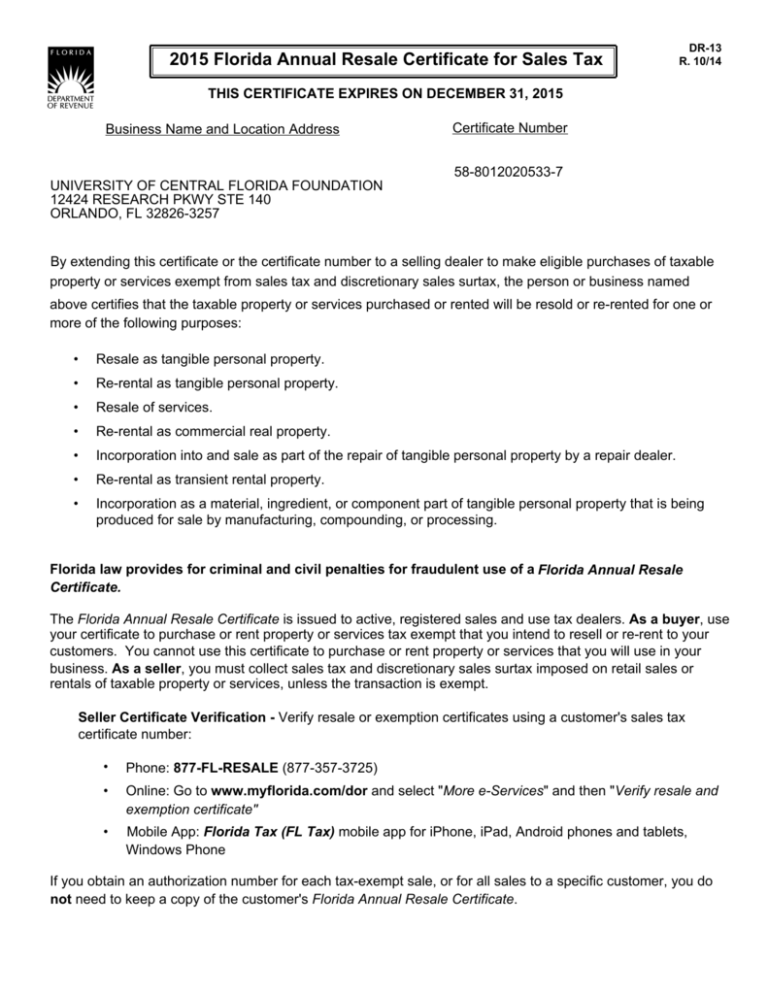

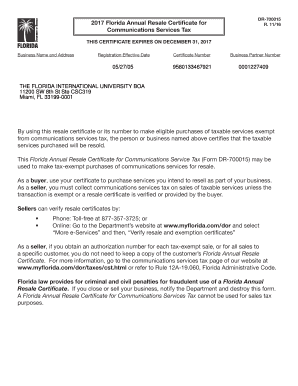

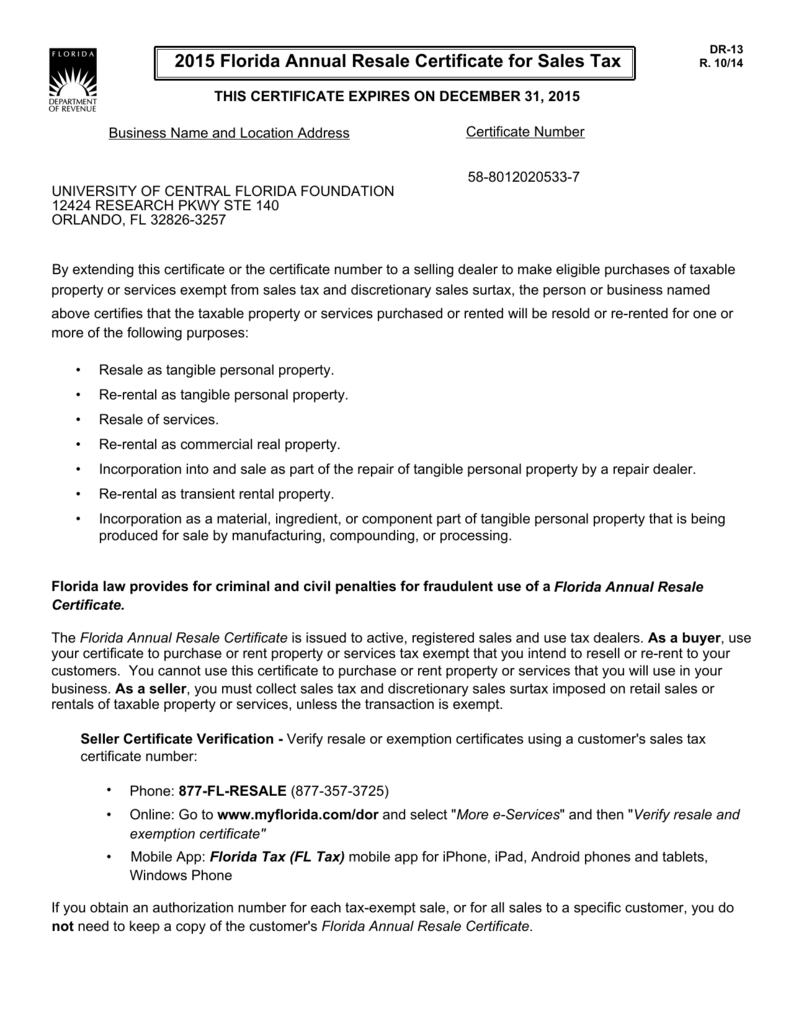

Florida annual resale certificate for communications services tax. Resale certificates are only issued to businesses registered with the state department of revenue to collect sales and use tax. A florida resale certificate (officially called a florida annual resale certificate for sales tax) allows a business to purchase goods free of tax so long as these items are to be resold later. Florida law provides for criminal and civil penalties for fraudulent use of a florida annual resale certificate.

Resale certificates in florida expire every year on december 31 and need to be renewed annually. This certificate is given by the buyer to the seller at the time of the initial transaction. Sellers should not sell taxable items tax free unless the buyer can produce a valid exemption certificate or resale certificate.

A florida resale certificate (officially called a florida annual resale certificate for sales tax) allows a business to purchase goods free of tax so long as these items are to be resold later. Print a sales tax annual resale certificate in five easy steps your certificate number is located on the front of the certificate of registration. Your business partner number is located on the back of the certificate of registration.

Sellers should not sell taxable items tax free unless the buyer can produce a valid exemption certificate or resale certificate. The information in this brochure applies only to the annual resale certificate for sales tax. The department issues florida annual resale certificates to active, registered sales tax and communications services tax dealers.

All certificates expire at the end of the calendar year. Retrieve user id and password. Active and registered dealers should automatically.

As long as you are a registered dealer and you are conducting business, you will automatically receive a new florida annual resale certificate for. Annual resale certificates expire each year on december 31. Resale certificates are available through the sales and use tax or communications services tax file and pay webpages.

Florida annual resale tax certificate. ***do not enter new name or new address information here. The state will automatically renew your resale certificate for sales tax each year.

This annual resale certificate is separate from the one issued for sales and use tax. Visit your nearest service center or call taxpayer services. As a seller, you must collect communications services tax on sales of taxable services unless the transaction is exempt or a resale.

As a buyer, use your certificate to purchase services you intend to resell as part of your business. It does not apply to the annual resale certificate for communications services tax. You cannot use this certificate to purchase or rent.

Welcome to the florida communications services tax website. This annual resale certificate is separate from the one issued for sales tax. In florida, your sales tax registration is only for one year at a time.

1 2 3 from the department of revenue’s homepage, floridarevenue.com, select print annual resale certificates. Businesses that register with the florida department of revenue to collect sales tax are issued a florida annual resale certificate for sales tax (annual resale certificate). If you are experiencing problems with your request, select the “back” button and access this website by using your business partner (bp), contract object (co), license,.

If your business buys or rents property or services that will be resold or rerented, an annual resale certificate allows you to avoid paying taxes upon the purchase or rental. Annual resale certificate for communications services tax. The purpose of a resale certificate, also known as a tax exemption certificate, is to allow you to buy goods through your business without paying local sales tax.

Enter your contract object (co) and business partner (bp) numbers. You will also find your bp number printed on the top, right of most notices that are mailed to you by the department. You are then required to collect sales tax on the items when they are resold or rerented.

This certificate is given by the buyer to the seller at the time of the initial transaction. Enter your current account information as shown on your certificate of exemption, certificate of registration, tax return, or other correspondence issued to you by the department. To print your resale certificate, use the button below to log in, then select the print annual resale certificate button from the choose activity menu.

Starting in november, you can download your resale certificate for the following year.

Floridarevenuecom

2

2

2015 Florida Annual Resale Certificate For Sales Tax

2

Pinnaclecommunicationscom

2

2

Annual Resale Certificate For Sales Tax Guidelines To Help Business Owners Determine Whether Their Purchases Qualify For Resale Exemption - Pdf Free Download

Fillable Online Finance Fiu 2017 Florida Annual Resale Certificate For Fax Email Print - Pdffiller

2

2

Floridarevenuecom

Attn All Florida Dealers It Is - Lesco Distributing Inc Facebook

Florida Annual Resale Certificate

2015 Florida Annual Resale Certificate For Sales Tax

Annual Resale Certificate For Sales Tax Guidelines To Help Business Owners Determine Whether Their Purchases Qualify For Resale Exemption - Pdf Free Download

Resale Certificate Florida - Fill Online Printable Fillable Blank Pdffiller

2

Comments

Post a Comment