Withdrawals are subject to income tax. Jersey has two ways to calculate tax on a 457 plan distribution:

457 Plan Definition Features How Does It Works

Employees are taxed on distributions from a 457 retirement plan if the distributions are includible in the participant’s income.

How are 457 withdrawals taxed. All withdrawals are taxable, regardless of the participant's age. Early withdrawals from a 457 plan. If you have a 457 plan and you die, your beneficiary can take distributions from the plan immediately.

How much tax do you pay on a 457 withdrawal? Money saved in a 457 plan is designed for retirement, but unlike 401(k) and 403(b) plans, you can take a withdrawal from the 457 without penalty before you are 59 and a half years old. If you made contributions that were subject to income taxes, you may not owe taxes on the entire withdrawal.

By contrast, withdrawals from 401(k) and 403(b) accounts are taxed as regular income. Withdrawals are subject to income tax. However, distributions received after the pensioner turned 59 1/2 would qualify for the private pension and annuity income exclusion of up to $20,000.

Beneficiary distributions avoid the early withdrawal penalty of 10 percent, regardless of the age of the beneficiary.however, distributions are still taxed as ordinary income.beneficiaries can avoid taxation by rolling over the 457 distribution to a qualified. What you really want to be asking if you can roll money over from a 457 (b) to a roth ira. Earlier of when made available or distribution:

1 similar to 401 (k)s and 403 (b)s, all contributions into 457 plans grow. So if you need to tap into your 457(b) contributions before you reach age 59.5 and you’ve left the job that provided you with the 457(b), don’t fret. Unforeseeable emergency (see above) plan termination;

How are 457 withdrawals taxed? All withdrawals are taxable, regardless of the participant’s age. The custodian is required to provide you with a written notice explaining your governmental 457(b) plan rollover options and how certain distributions

In addition, these distributions face the irs 10% early withdrawal penalty. Therefore, distributions from a government section 457 plan received or accrued during the period of residence, less the pension and annuity income exclusion of up to $20,000, are subject to the new york city personal income tax. How are roth 457(b) distributions taxed if they are not qualified?

Amounts deferred under a 457 retirement plan sponsored by a state or local government are includible only when the amounts. That means your distributions will be combined with any other income you have for. Everyone with a 457(b) or 403(b) is taxed for nj purposes.

On your nj tax return, you will recover your contributions tax free. Can a 457(b) plan include designated roth accounts? Distributions from governmental 457(b) plans that are not directly rolled over to an ira or other eligible retirement plan be subject to federal income tax withholding at the rate of 20%.

If you made contributions that were subject to income taxes, you may not owe taxes on the entire withdrawal. This is a very important rule that often times goes overlooked with the 457 plan. The answer to that is yes, you can roll over any amount you want as often as you want, 457 (b) plan permitting, but these rollovers will generally be taxable unless the rollover is from a designated roth account in the 457 (b).

At age 70 1/2, you must begin rmd withdrawals. Are distributions from a state deferred (section 457) compensation plan taxable by new york state? Here is a list of the key rules:

There is actually nothing “basic” about retirement withdrawals. Small account distribution (not to exceed $5,000) attainment of age 70 ½; The amount you have to take out each year depends on the balance remaining.

As with other retirement accounts, 457 distributions are taxed as ordinary income. A 457(b) is subject to irs rules mandating required minimum distributions. Attainment of age 70 ½;

If a distribution is not ‘qualified’, the portion of the distribution attributable to the roth contributions, termed ‘basis’ by the irs, is not taxable since it was taxed at the time it was contributed to the. 5 457 (b) distribution request form 1 page 3 federal tax law requires that most distributions from governmental 457 (b) plans that are not directly rolled over to an ira or other eligible retirement plan be subject to federal income tax withholding at the rate of 20%.

/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)

Estimating Taxes In Retirement

How To Access Retirement Funds Early

2

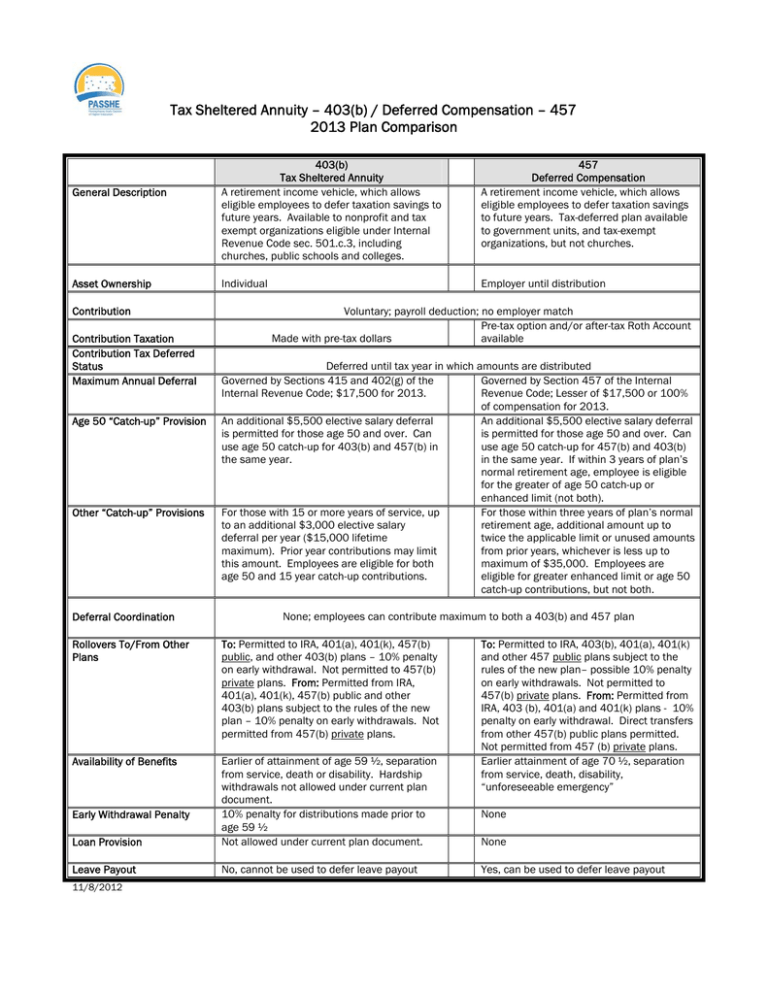

Tax Sheltered Annuity 403b Deferred Compensation 457

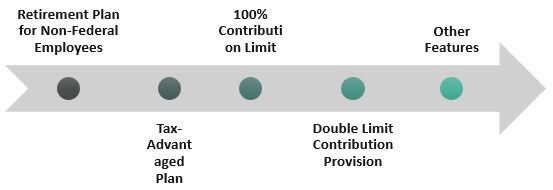

Everything You Need To Know About A 457 Real World Made Easy

457 Plan Definition Features How Does It Works

2

2

2

2

The Most Tax-efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

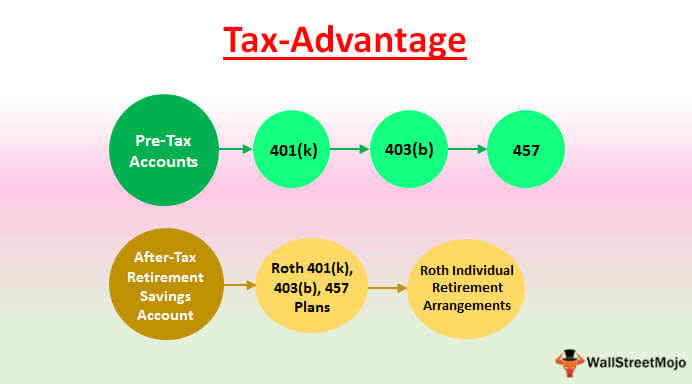

Tax-advantage Definition Types Of Tax-advantage Accounts

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

2022 401k Contribution Limits Rules And More

New York City Deferred Compensation Plan

2

Retirement Income Calculator Faq -

Should You Use Your 457b White Coat Investor

2

457 Plan Withdrawal Calculator

Comments

Post a Comment