Jefferson parish, louisiana sales tax rate (2021) avalara. Jefferson davis parish school board p.

2

The 2018 united states supreme court decision in south dakota v.

Jefferson parish sales tax extension. Within the parish over the last five years. Is all prices for purchases by jefferson parish of supplies and materials shall be quoted in the unit of measure specified and unless otherwise specified, shall be exclusive of state and local taxes. The tax payment due date remains september 20, 2021.

The jefferson parish, louisiana local sales tax rate is a. The minimum combined 2021 sales tax rate for jefferson parish, louisiana is. With respect to hotel or room rentals in orleans or jefferson parish, the sales tax collected by ldr on room rentals decreased to 9.45% (column d of the applicable return decreased to 2.45%).

Bulk extensions file your clients' individual, corporate and composite partnership extension in bulk. To 4:00 p.m., monday through friday. Sales and use tax rate map * notice:

Cynthia boudreaux assumption parish school board p.o. Rapides parish sales tax dept. This section is located in jefferson parish sheriff's office administrative building, 1233 westbank expressway, in harvey and is open to the public from 8:30 a.m.

Sales / use the parish of jefferson, the jefferson parish school board, and other political taxing subdivisions of jefferson parish levy local sales/use taxes. The jefferson parish sales tax rate is %. What is the rate of jefferson parish sales/use tax?

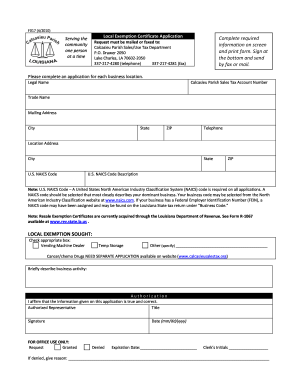

The 2018 united states supreme court decision in south dakota v. Has impacted many state nexus laws and sales tax collection requirements. Those persons claiming an exemption from jefferson parish sales tax must provide a valid exemption certificate to support their claim.

This is the total of state and parish sales tax rates. Cluster analysis this section examines the jefferson parish economy through the lens of industry clusters, (4) sales taxes for purchases.

The louisiana state sales tax rate is currently %. Upon reviewing those conditions, a clear path forward for learning will be provided. And three property taxes for.

Jefferson parish schools is currently assessing the impact of hurricane ida at each school. Due to the nature of its activity, taxpayers are advised to schedule an appointment to discuss accounts currently under audit. Find out when all state tax returns are due.

4.75% on the sale of general merchandise and certain services New sales and use tax rate of 7.666% applies only within the boundaries of university club center economic development district (ucc edd) effective april 1st, 2015.the ucc economic development district is located inside the corporate limits of the city of st. Sales tax revenue continues to bring in about half as much revenue as ad valorem (property) taxes and the two revenue sources increased at roughly the same rate between 2009 and 2013.

Sales tax filing extensions for eligible taxpayers located in the parishes listed above, the august 2021 sales tax period is extended from september 20, 2021 to november 1, 2021, for return filing purposes. The jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales. Gabriel at 745 hwy 30, st.

On december 11, 2021, voters in jefferson parish will decide whether to renew two property tax millages on the ballot that directly impact the quality of life for residents. Credit caps see the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. The data necessary to calculate the tax due was unavailable.

4 hours ago jefferson parish, louisiana sales tax rate 2021 up to 9.2%. In the face of looming budget cuts in louisiana, transportation and drainage projects are crucial to maintaining a high quality of life for jefferson parish residents and businesses. Gabriel, la, 70776.also, please note the sales tax rate differences for.

All jefferson parish residents in need of shelter due to hurricane ida should go to kings grant playground, located at 3805 15th st. All prices for purchases of supplies and materials by jefferson parish shall be quoted in the unit of measure specified and unless otherwise specified, shall be exclusive of state and parish taxes. Requests a thirty (30) day extension for filing the jefferson parish sales/use and/or occupancy tax return for the period of , 2021.

This request is based solely upon the inability of the above named business to meet its filing responsibility because of consequences arising from hurricane ida (please check one or more of the following reasons): Jefferson parish sales tax is charged to those who are determined to be end users of tangible personal property. 8 hours ago the jefferson parish sales tax rate is %.

Bgr studies four dedicated taxes up for renewal on the december 10, 2016 in jefferson parish: With the exception of the airport district tax, sales/use tax rates are uniform throughout the parish and are in addition to the sales/use tax imposed by the state of louisiana. The 13 percent hotel occupancy sales tax is collected on hotel stays in orleans parish.

For questions on specific parish sales tax return extensions, contact the parish sales and use tax office. The jefferson parish sales tax is 4.75%. These millages have been in place since 2005 and help fund public safety, parks, culture, economic development, and senior services.

The following local sales tax rates apply in jefferson parish: A sales tax for parish sewerage, road and drainage projects, law enforcement and municipal governments in jefferson;

2

Calcasieu Parish Sales Tax Form - Fill Out And Sign Printable Pdf Template Signnow

Faqs Jefferson Parish Sheriffs Office La Civicengage

Faqs Jefferson Parish Sheriffs Office La Civicengage

Sales Use Tax Department - St James Parish Schools

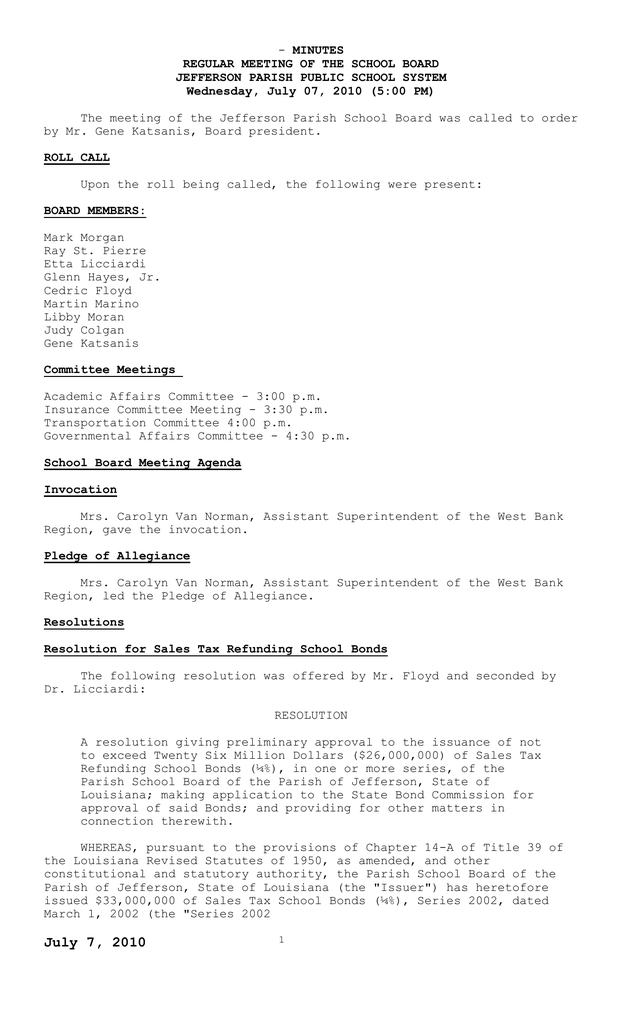

July 7 2010 - Jefferson Parish Public School System

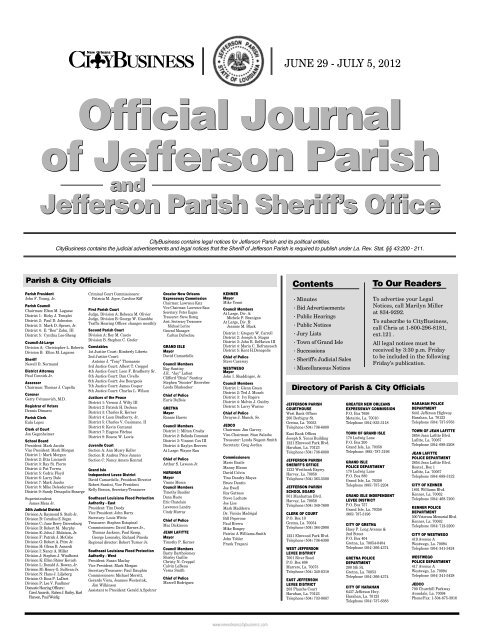

Jefferson Parish Sheriffs Office Jefferson Parish Sheriffs Office

E-services Jefferson Parish Sheriff La - Official Website

Faqs Jefferson Parish Sheriffs Office La Civicengage

2

2

Fees Jefferson Parish Clerk Of Court

2

Jefferson Parish Sales Tax Exemption Certificate - Fill Online Printable Fillable Blank Pdffiller

Faqs Jefferson Parish Sheriffs Office La Civicengage

Jefferson Parish To Use Future Sales Tax Revenue For Improvements Around Ochsner Campuses East Jefferson Community News Nolacom

2

2

2

Comments

Post a Comment