State sales tax is 7% of purchase price less total value of trade in. $2.12 per $100 assessed value.

Tennessee Sales Tax - Taxjar

In tennessee, the excise tax, which is essentially an income tax, is a flat rate of 6 percent.

Knoxville tn state sales tax rate. Thus the sale of each property is made subject to these additional taxes. In asheville, nc, the rate is a seemingly low 1.18 percent per $100 of assessed value; City of knoxville revenue office.

Tax rates for knoxville, tn. Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax There is no applicable city tax or special tax.

Depending on the zipcode, the sales tax rate of knoxville may vary from 7% to 9.25% depending on the zipcode, the sales tax rate of knoxville may vary from 7% to 9.25% Capital losses are claimed in the year they occurred. The 2018 united states supreme court decision in south dakota v.

The comparison is difficult, as the tax base varies from state, county and city. Local collection fee is $1 Tennessee sales and use tax county and city local tax rates county city local tax rate effective date situs fips code ^ county city local tax rate effective date situs fips code ^ jackson 2.75%

For purchases in excess of $1,600, an additional state tax of 2.75% is added up to a maximum of $44. For example, if you buy a car for $20,000, then you'll pay $1400 in state sales tax. 101 rows the 37914, knoxville, tennessee, general sales tax rate is 9.25%.

The current total local sales tax rate in knoxville, tn is 9.250%. Tennessee also has a state single article rate of 2.75% on any single item sold in excess of $1,600 but not more than $3,200. The knoxville sales tax rate is %.

[ the total of all income taxes for an area, including state, county and local taxes. Counties and cities can charge an additional local sales tax of up to 2.75%, for a maximum possible combined sales tax of 9.75%; > $ 50,000 or 25% of total property by value in tn o payroll:

Knox county, tennessee has a maximum sales tax rate of 9.25% and an approximate population of 337,101. The minimum combined 2021 sales tax rate for knoxville, tennessee is. This is the total of state, county and city sales tax rates.

The tennessee sales tax rate is currently %. For tax rates in other cities, see tennessee sales taxes by city and county. Since penalty and interest continue to accrue on the taxes, the purchaser should pay them as soon as possible and keep the receipts so that the expense can be reimbursed to the purchaser if the property is.

Groceries are taxed at 5% (some locations charge more), and some services have a different tax rate. The 9.25% sales tax rate in knoxville consists of 7% tennessee state sales tax and 2.25% knox county sales tax. Local sales tax is 2.25% of the first $1,600.

Sales tax rates in knox county are determined by three different tax jurisdictions, knox county, farragut and knoxville. This amount is never to exceed $36.00. The estimated 2021 sales tax rate for 37934 is.

Knoxville, tn sales tax rate. The state imposes a 5% tax on net earnings from businesses operating within its borders. Has impacted many state nexus laws and sales tax collection requirements.

You can print a 9.25% sales tax table here. The county sales tax rate is %. However, where in knoxville (and all of tennessee) the assessed value is 25 percent of appraised, in north carolina it is set at 100% of appraised value.

As reported by carsdirect, tennessee state sales tax is 7 percent of a vehicle's total purchase price. 9.25% (7% state, 2.25% local) city property tax rate: This bid will not include the 2013, 2014 or the 2015 taxes due to the city of knoxville, tennessee or knox county, tennessee;

[ the total of all sales taxes for an area, including state, county and local taxes. The knoxville, tennessee, general sales tax rate is 7%. Sales or use tax [tenn.

> $ 50,000 or 25% of compensation paid in tn registration are. Federal income taxes are not included. > $ 500,000 or 25% of total receipts from sales in tn o property:

$2.4638 per $100 assessed value. The december 2020 total local sales tax rate was also 9.250%. The tennessee state sales tax rate is 7%, and the average tn sales tax after local surtaxes is 9.45%.

This tax is generally applied to the retail sales of any business, organization, or person engaged Guests who book airbnb listings that are located in the state of tennessee will pay the following tax and fees as part of their reservation: 7% of the listing price including any cleaning fees and guest fees, for reservations 89 nights and shorter.

There is a state sales tax of 7%, as well as local tax imposed by city, county or school districts, no higher than 2.75%.

Tennessee Sales Tax Rates By City County 2021

Tennessee County Tax Statistics Ctas

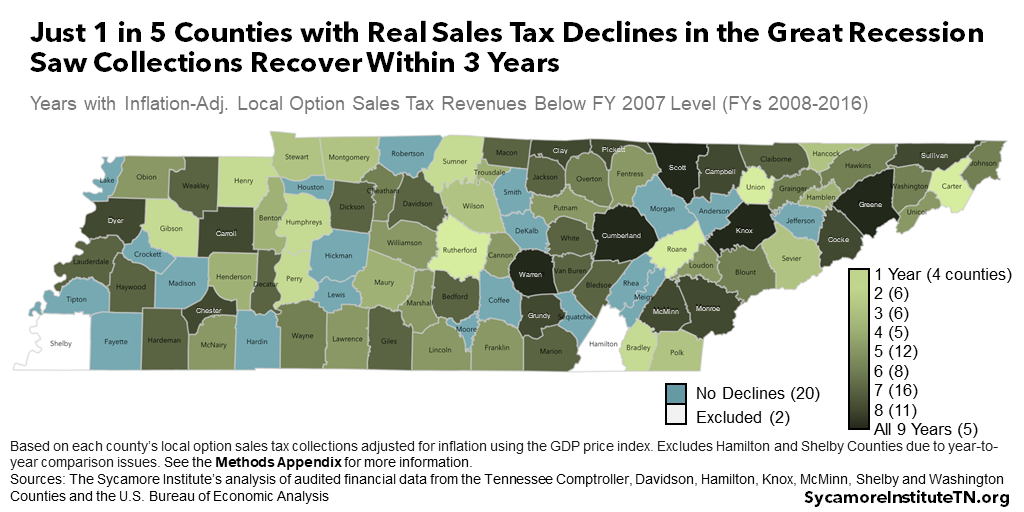

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Sample Boutique Business Plan - Google Search Business Plan Template Free Business Plan Template Retail Business Plan Template

Histogram Of Sales Tax Revenue Total State Revenue For The 50 Download Scientific Diagram

Historical Tennessee Tax Policy Information - Ballotpedia

2

Year-specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

Tennessee Sales Tax And Other Fees - Motor Vehicle - County Clerk - Knox County Tennessee Government

Tennessee Car Sales Tax Everything You Need To Know

Tennessee Sales Tax - Small Business Guide Truic

Year-specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

United Methodist Church 2021 Lectionary Events Broadway United Methodist Church With United

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Comments

Post a Comment