This is the total of state, county and city sales tax rates. The omaha sales tax rate is %.

Nebraskas Sales Tax

Detailed nebraska state income tax rates and brackets are available on this page.

Nebraska sales tax percentage. All the states surrounding nebraska have a sales tax, and nebraska's rate is about average. Notification to permitholders of changes in local sales and use tax rates effective january 1, 2022. The nebraska (ne) state sales tax rate is currently 5.5%.

The county sales tax rate is %. Lb 432 reduces the corporate tax rate for nebraska taxable income in excess of $100,000 from 7.81% to 7.50% in tax year 2022, and to 7.25% for tax year 2023 and beyond. , ne sales tax rate.

The nebraska sales tax rate is currently %. Questions answered every 9 seconds. The state sales tax rate in.

The nebraska sales tax rate is currently %. The county sales tax rate is %. 31 rows nebraska (ne) sales tax rates by city.

The lincoln sales tax rate is %. The maximum local tax rate allowed by nebraska law is 2%. The minimum combined 2021 sales tax rate for omaha, nebraska is.

The nebraska state sales and use tax rate is 5.5% (.055). In addition to the state tax, some nebraska cities assess a city sales and use tax, in 0.5% increments, up to a maximum of 1.5%. The nebraska income tax has four tax brackets, with a maximum marginal income tax of 6.84% as of 2021.

535 rows nebraska has state sales tax of 5.5%, and allows local governments to collect a. The nebraska state sales and use tax rate is 5.5% (.055). Questions answered every 9 seconds.

The corporate tax rate for the first $100,000 of nebraska taxable income remains 5.58%. Ad a tax advisor will answer you now! Food and ingredients that are generally for home preparation and consumption are not taxable.

Nebraska has a state sales and use tax of 5.5%. Raymond, ne sales tax rate the current total local sales tax rate in raymond, ne is 5.500%. The current total local sales tax rate in valley, ne is 7.000%.

This is the total of state, county and city sales tax rates. The december 2020 total local sales tax rate was also 5.500%. The december 2020 total local sales tax rate was also 7.000%.

The current total local sales tax rate in pender, ne is 7.000%. The december 2020 total local sales tax rate was also 7.000%. This table shows an annual summary of the state net taxable sales and sales tax for other than motor vehicles, motor vehicles, a combined state sales total, local sales tax, and a combined state and local sales tax total.

The minimum combined 2021 sales tax rate for lincoln, nebraska is. Nebraska has a statewide sales tax rate of 5.5%, which has been in place since 1967. Dakota county levies an additional 0.5% county sales tax.

Ad a tax advisor will answer you now! For sellers with a sales percentage greater than 75 percent who sell items that contain four or more servings packaged as one item sold for a single price, the item does not become prepared Depending on local municipalities, the total tax rate can be as high as.

Nebraska Sales Tax - Small Business Guide Truic

Nebraskas Sales Tax

Nebraska Sales Tax Rates By City County 2021

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

Nebraskas Sales Tax

Nebraskas Sales Tax

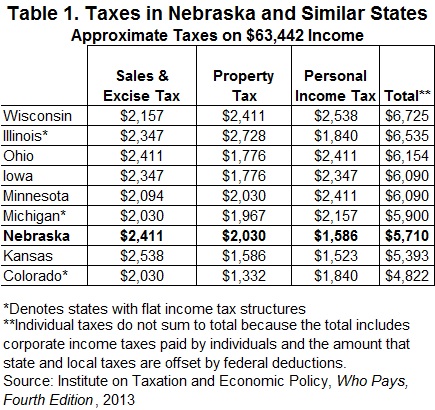

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

Nebraskas Sales Tax

Combined State And Local General Sales Tax Rates Download Table

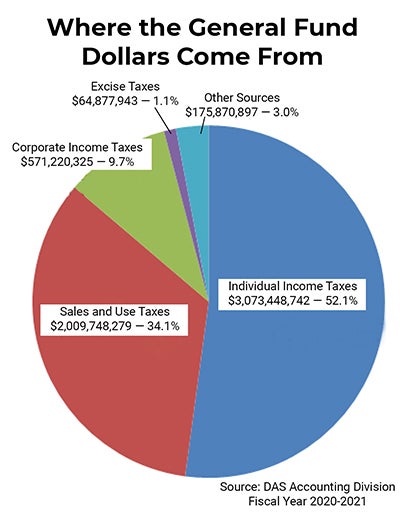

General Fund Receipts Nebraska Department Of Revenue

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

General Fund Receipts Nebraska Department Of Revenue

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Taxes And Spending In Nebraska

Nebraskas Sales Tax

Comments

Post a Comment