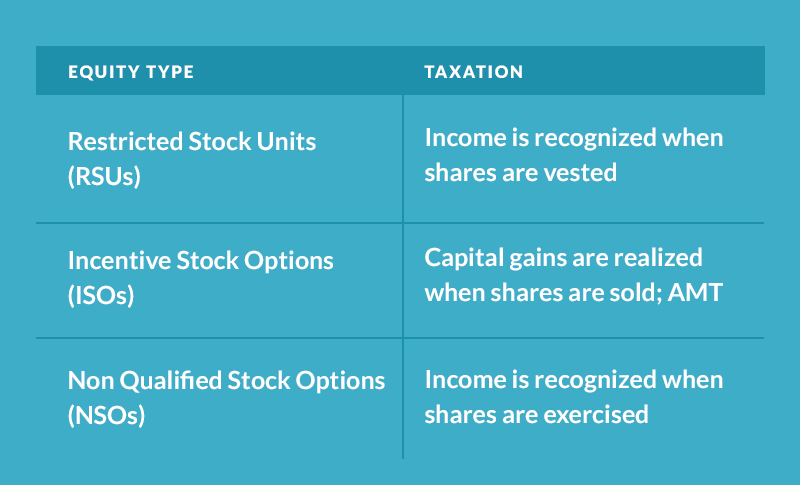

A restricted stock unit (rsu) is a form of compensation issued by an employer to an employee in the form of company shares. The exact tax rate will depend on your specific tax bracket as determined by your income.

Rsus Restricted Stock Units Essential Facts Key Dates Stock Options Capital Gains Tax

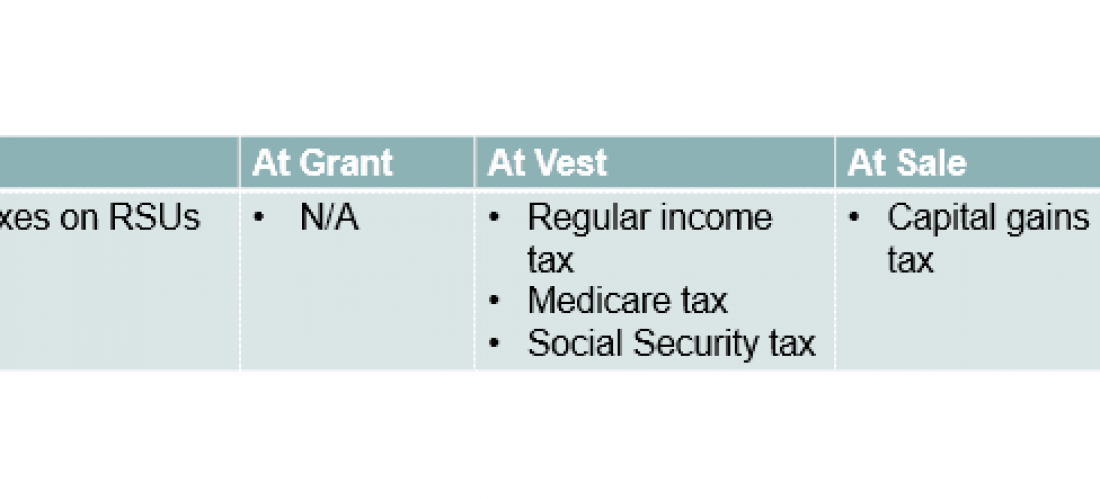

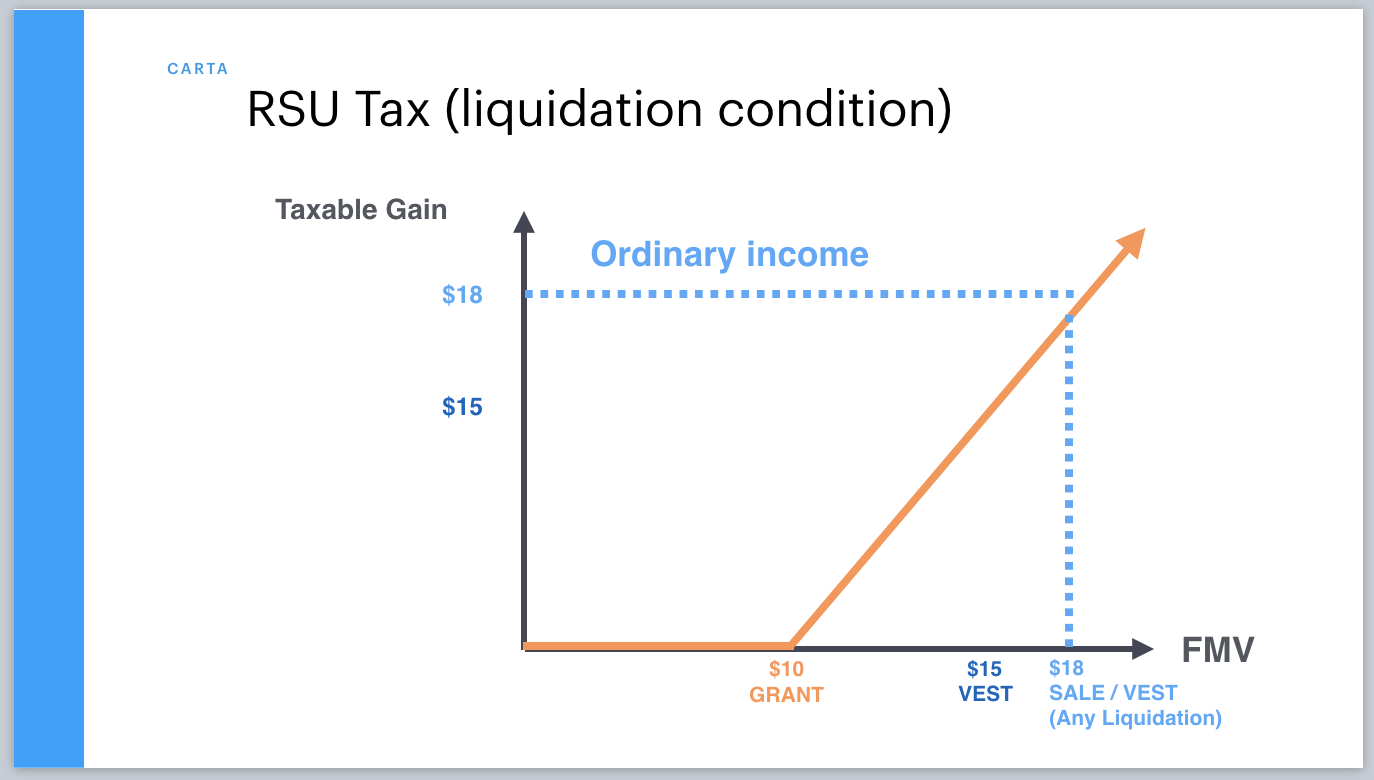

The ordinary earned income tax rate when the rsus vest, or;

Rsu tax rate us. The capital gains tax rate when you sell the shares you own; So it’s up to you to enter a percentage. It indicates that there is a 30.9% of tax withholding for local tax.

For rsus, the profit/gain is the difference between the. The withholding rate is what might be different, which is a common source of confusion. When you become vested in your stock, its fair market value gets taxed at the same rate as your ordinary income.

I work in germany and get regular rsu awards into an account in us (etrade). Employee total salary before rsu is £150,000. The taxation of rsus is a bit simpler than for standard restricted stock plans.

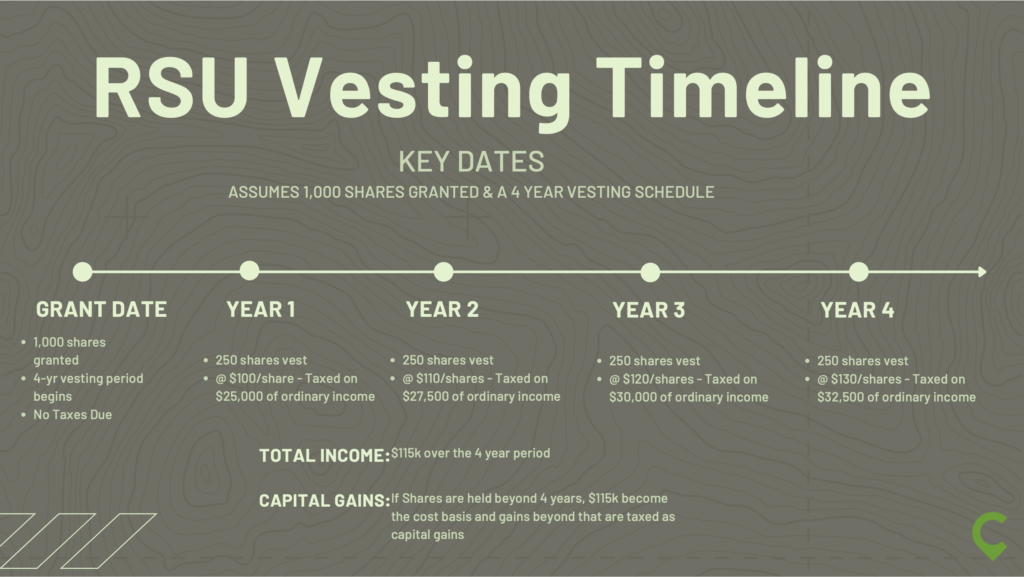

At any rate, rsus are seen as supplemental income. So if company is giving 100 rsu’s with condition of 25% rsu vesting each year, then 25 shares will vest in first year, then another 25% in 2nd year and like this, only after 4th. Rsu and capital gain tax rates.i have an rsu that vests this year.

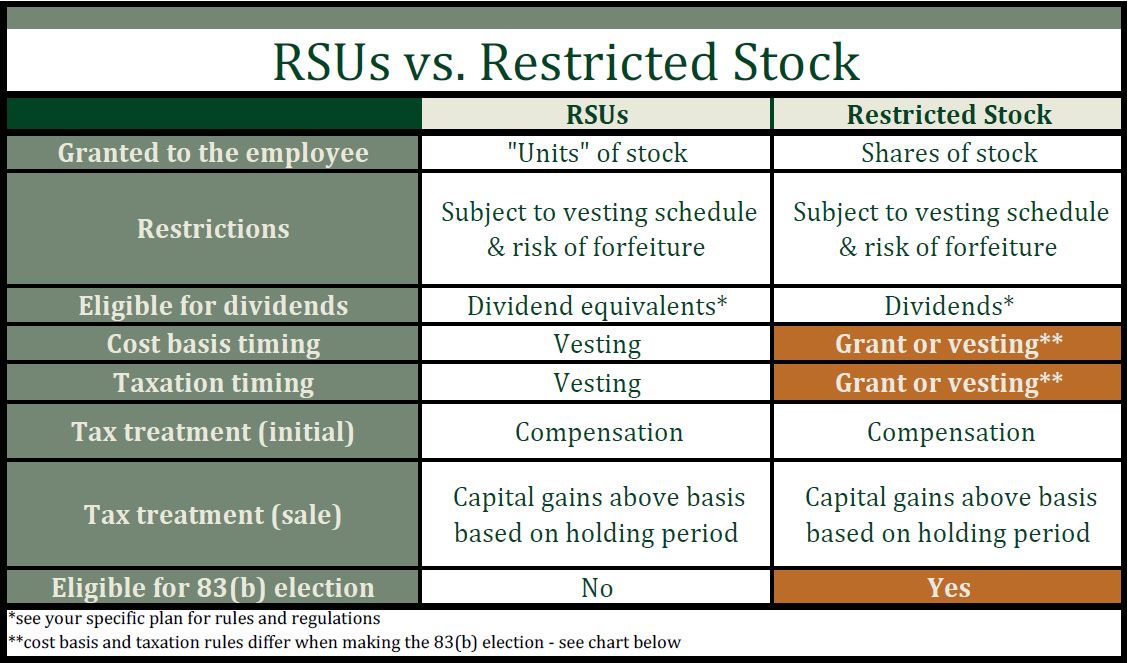

Another 25% or 50 shares can then be claimed in the second year, and only at the end of the fourth year will an employee receive all 200 shares. The shares have to be held for more than 1 year after vesting for. Rsus aren't eligible for the irc 83(b) election, which allows an employee to pay tax before vesting, as the internal revenue service (irs) doesn't consider them to be tangible property.

Now i am not sure whether the tax withholding is. Income tax @ 45% of remaining = £7,758; Unlike the much more complicated espp, they get taxed the same way as your income.

Salary £150,000, rsu value £20,000. This is because rsus, stock grants, and bonuses are treated as. Total tax and nic = £3,450+£8,620+£5,000+£431=£17,500;

The value of over $1 million will be taxed at 37%. But i did receive the rsu release and the tax withholding details. To use the rsu projection calculator, walk through the following steps.

Sell vests assumes you sell immediately upon vesting shares, while hold all assumes you keep your granted shares. Rsu can also be given in phased manner sometimes, like 25% rsu each year. Total tax and nic = £10,862;

So right around what you had. Because there is no actual stock issued at grant, no section 83 (b) election is permitted. Estimate how much your rsu value will increase per year.

A big note here, you must enter a value even if the value is 0%. In case a company is granting 200 rsus with a condition of 25% rsu vesting every year, then 25% (50 shares) can be claimed at the end of the first year. In some states, such as california, the total tax withholding on your rsu is around 40%.

On the sale of rsus, esops and espps, the gains/profit made are subject to capital gains tax. For your state tax rate, it’d be a little much for us to pull each state’s income tax and include it. The rsus are subject to ni and income tax at your marginal rate on their value at the time they vest.you can either choose to pay the tax yourself and receive all the shares,but most people will opt to have shares deducted to pay for these deductions.so if you are a higher rate tax payer you will be due to pay 42% tax and ni which would mean your 50 shares would be netted down to 29 shares,which are.

This is true whether we’re talking about: Theapayroll operator is satisfied thattaxa foreign income tax applies and has established the effective tax rates on the doubly taxed amount. 25% federal income tax + 6.8% fica & medicare, + 10% state would be 41.8%;

Input your current marginal tax rate on vesting rsus. It’s important to remember that the rsu tax rate will be the same as your income tax rates. When they vest, etrade applies a tax rate of.

Restricted stock units are issued to an employee through a vesting plan and distribution schedule after achieving required performance milestones or upon remaining with their employer for a particular length of time. Employee nic @ 2% = £344; You didn't mention your state but since the number.

What is the tax rate for an rsu? This doesn’t include state income, social security, or medicare tax withholding. The beauty of rsus is in the simplicity of the way they get taxed.

Most companies will withhold federal income taxes at a flat rate of 22%. Rsus are taxed at the ordinary income tax rate when they are issued to an employee, after they vest and you own them. Rsus can trigger capital gains tax, but only if the stock holder chooses to not sell the stock and it increases in value before the stock holder sells it in the future.

70% tax and nic paid. I did not receive a 1099 from the brokerage firm as well. An rsu, or a proportion of an rsu, is liable to income tax under the paye system and is also a income tax in a state with which there is a double taxation agreement.

Deducting employer’s nic @ 13.8% = £2,760;

Nike Restricted Stock Understanding Rsus And Rsas Human Investing

Blog Upstart Wealth

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Why Rsus Can Make Tax Season Painful Schmidt

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

A Tech Employees Guide To Rsus - Cordant Wealth Partners

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Equity Compensation 101 Rsus Restricted Stock Units

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Switching From Options To Rsus - Carta

Why Rsus Are Edging Out Restricted Stock - Cfo

Are Rsus Taxed Twice - Rent The Mortgage

Navigating Your Equity-based Compensation Restricted Stock Restricted Stock Units - Verum Partners

Comments

Post a Comment