The spokane county, washington sales tax is 8.10%, consisting of 6.50% washington state sales tax and 1.60% spokane county local sales taxes.the local sales tax consists of a 1.60% county sales tax. Spokane in washington has a tax rate of 8.8% for 2022, this includes the washington sales tax rate of 6.5% and local sales tax rates in spokane totaling 2.3%.

Doordash Tax Calculator 2021 What Will I Owe How Bad Will It Hurt

The current total local sales tax rate in elk, wa is 8.100%.the december 2020 total local sales tax rate was also 8.100%.

Spokane wa sales tax calculator. How 2014 sales taxes are calculated in spokane. How 2021 sales taxes are calculated in spokane. 2021 cost of living calculator:

Utilize leading marketing tools to boost your business and get found online. But since cities and counties collect additional sales taxes on top of that rate, rates are typically at least 8%, and sometimes higher than 10%. Spokane county sales tax rates (pdf) spokane county sales tax breakdown (pdf) sales tax descriptions (pdf) maps of sales tax rates sales tax rate/location code for place of sale as defined by the washington state department of revenue.

Tax rates can be looked up at the department of revenue's tax website. To calculate sales and use tax only. Depending on the zipcode, the sales tax rate of spokane may vary from 6.5% to 8.9%.

There is no applicable county tax or special tax. 2020 rates included for use while preparing your income tax deduction. You can print a 9% sales tax table here.

The spokane valley, washington sales tax is 8.80%, consisting of 6.50% washington state sales tax and 2.30% spokane valley local sales taxes.the local sales tax consists of a 2.30% city sales tax. Groceries are exempt from the spokane and washington state sales taxes Depending on the zipcode, the sales tax rate of spokane may vary from 6.5% to 8.7%.

The minimum combined 2021 sales tax rate for spokane, washington is. The sales tax jurisdiction name is not downtown spokane tpa sp, which may refer to a local government division. The spokane, washington, general sales tax rate is 6.5%.

Working together to fund washington's future. The spokane, washington sales tax is 8.80%, consisting of 6.50% washington state sales tax and 2.30% spokane local sales taxes.the local sales tax consists of a 2.30% city sales tax. Spokane, washington vs sarasota, florida.

Decimal degrees (between 45.0° and 49.005°) longitude: The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. P.t.b.a local sales taxes.the local sales tax consists of a 2.30% special district sales tax (used to fund transportation districts, local attractions, etc).

The latest sales tax rate for chattaroy, wa. The spokane sales tax is collected by the merchant on all qualifying sales made within spokane; The state general sales tax rate of.

Every 2014 combined rates mentioned above are the results of washington state rate (6.5%), the spokane tax rate (0% to 2.2%), and in some case, special rate. The current total local sales tax rate in spokane, wa is 9.000%. A salary of $120,000 in spokane, washington should increase to $134,459 in sarasota, florida (assumptions include homeowner, no child care, and taxes are not considered.

101 rows how 2021 sales taxes are calculated for zip code 99201. Utilize leading marketing tools to boost your business and get found online. The spokane valley sales tax is collected by the merchant on.

See reviews, photos, directions, phone numbers and more for sales tax calculator locations in spokane, wa. Elk, wa sales tax rate. 16 rows how 2021 sales taxes are calculated in washington.

Washington has a 6.5% statewide sales tax rate , but also has 218 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an. The washington sales tax rate is currently %. 0.6% lower than the maximum sales tax in wa.

The spokane county sales tax is collected by the merchant on. Washington (wa) sales tax rates by city (s) the state sales tax rate in washington is 6.500%. The county sales tax rate is %.

The 9% sales tax rate in spokane consists of 6.5% washington state sales tax and 2.5% spokane tax. The spokane, washington, general sales tax rate is 6.5%. Every 2021 combined rates mentioned above are the results of washington state rate (6.5%), the spokane tax rate (0% to 2.4%), and in some case, special rate.

The state’s base sales tax rate is 6.5%. This is the total of state, county and city sales tax rates. P.t.b.a, washington sales tax is 8.80%, consisting of 6.50% washington state sales tax and 2.30% spokane county unincorp.

With local taxes, the total sales tax rate is between 7.000% and 10.500%. 101 rows calculation of the general sales taxes of 99205, spokane, washington for 2021. You can find more tax rates and allowances for spokane and washington in the 2022 washington tax tables.

Ad start your dropshipping storefront. The december 2020 total local sales tax rate was 8.900%. Find 279 listings related to sales tax calculator in spokane on yp.com.

This rate includes any state, county, city, and local sales taxes. Ad start your dropshipping storefront.

Doordash Tax Calculator 2021 What Will I Owe How Bad Will It Hurt

Washington Income Tax Calculator - Smartasset

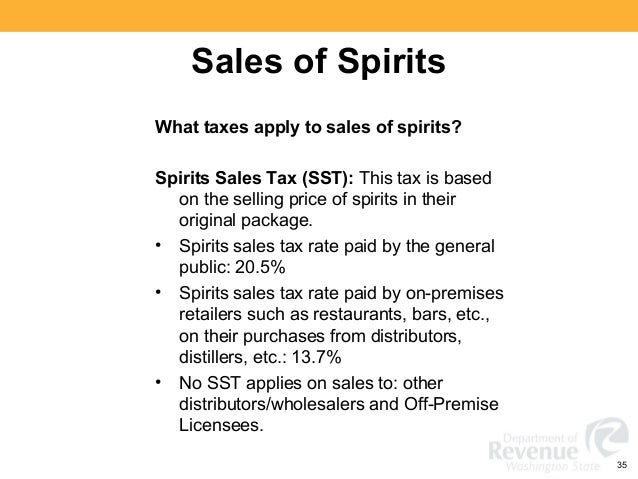

Washington State Sales Use And Bo Tax Workshop

Washington Sales Tax - Small Business Guide Truic

Sales Tax Fundamentals - Taxjar

Washington Sales Tax - Taxjar

States With Highest And Lowest Sales Tax Rates

Washington Sales Tax Rates By City County 2021

Washington State Sales Use And Bo Tax Workshop

Is Software As A Service Saas Taxable In Washington - Taxjar

Washington Income Tax Calculator - Smartasset

Washington State Sales Use And Bo Tax Workshop

How To Calculate Sales Tax - Youtube

Is Food Taxable In Washington - Taxjar

Sales Tax Fundamentals - Taxjar

Sales Tax Fundamentals - Taxjar

Sales Tax Fundamentals - Taxjar

States With Highest And Lowest Sales Tax Rates

Washington Sales Use Tax Guide - Avalara

Comments

Post a Comment