Congress would restore the incentive for the brand's products. 45 rows the following table shows the federal tax credit and california crvp rebate.

Tesla Hikes Price Of Model 3 Model Y By 2000

Though tesla’s home state could compensate for the tax.

Tesla model y tax credit california. Gm and nissan are also expected to hit the threshold soon. The full ev tax credit will be available to individuals reporting adjusted gross incomes of $250,000 or less, $500,000 for joint filers (decreased from $400,000 for individuals/$800,000 for joint filers currently in place) evs must be made in the us starting. Price indicated does not include taxes and registration fees unless stated otherwise.

By 2020 the subsidy will be zero dollars for tesla. 11th 2021 6:22 am pt. The purchase the car credit is form 8936.

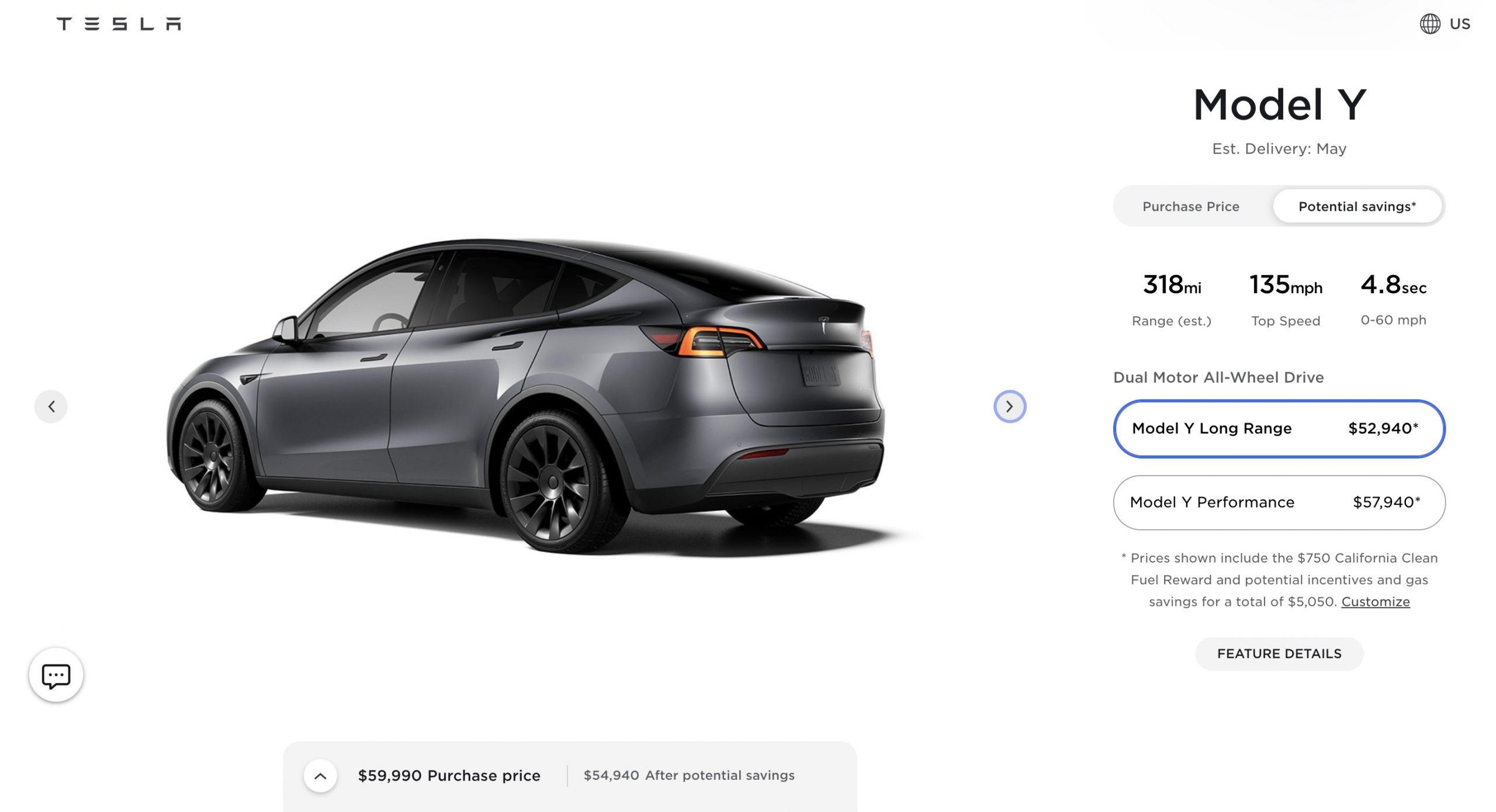

$2,000 or $4,500 rebate (based on income eligibility) for model 3 and model y* *review eligibility prior to applying california clean fuel reward for all new electric vehicles registered in california In 2019, tesla buyers will only have access to a $3,750 federal tax credit. Tesla model s, tesla model 3, tesla model x, tesla model y.

That way, i will claim for federal credit and. Yes, there is another tax credit for the cost of 'installing ev charging infrastructure.' it is form 8911. The credit may also be increased to a maximum of $12,500.

2021 tesla model 3 standard range plus: Tesla says to consult with your tax professional regarding irs form 8911. I am picking up the m3 in california, but my income in 2018 disqualifies me to claim ca 2500 rebate.

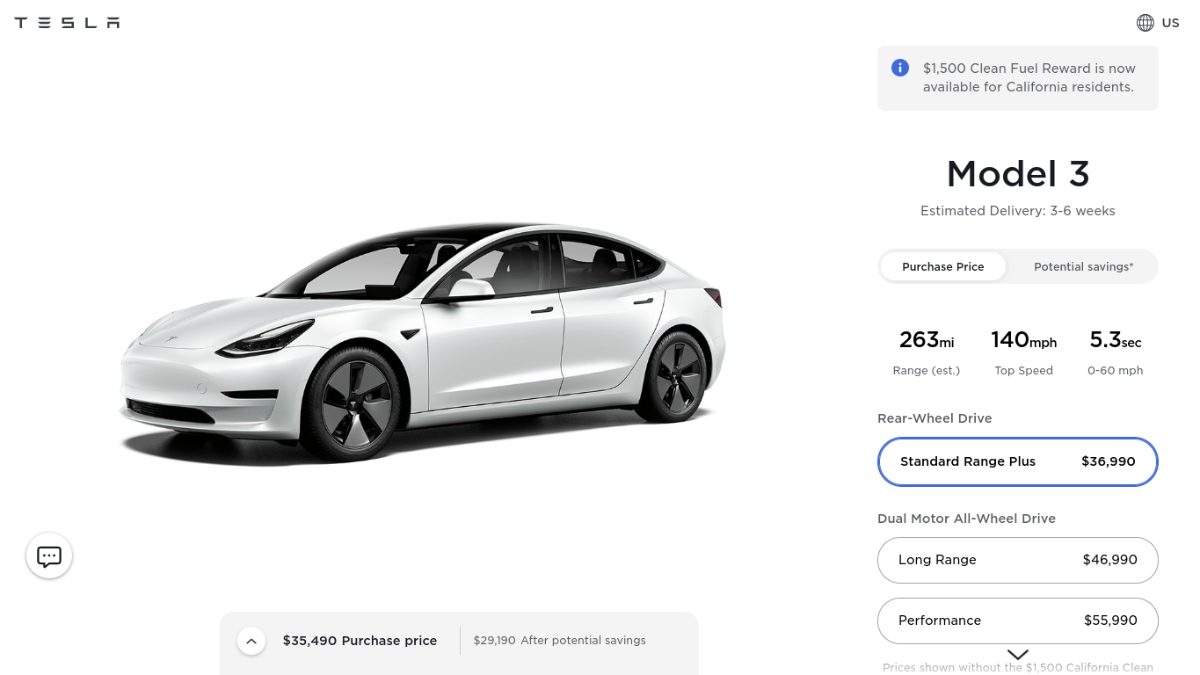

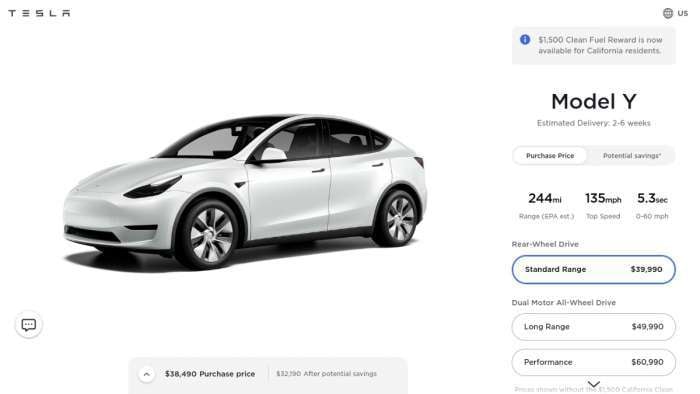

Year in gifts tech life social good entertainment deals The tesla model y had a meteoric rise in california in 2020. When you order a tesla model 3, y, s, or x from the state of california, your purchase automatically includes a $1,500 california clean fuel reward deduction (see.

Tesla has been selling the model s, model x and model 3 for years already, and gm’s eligibility for any portion of the tax credit ended march 31. Tesla to get access to $7,000 tax credit on 400,000 more electric cars in the us with new incentive reform. You will be responsible for these additional taxes and fees.

When you order a tesla model 3, y, s, or x from the state of california, your purchase order automatically includes a $1,500 california clean fuel reward deduction (see example below) — no need to apply for this grant separately. Gm’s chevy bolt continues to do well too. The federal ev tax credit is the first to run out for electric carmaker tesla on dec.

Tesla's no longer qualify for the $7,500 federal tax credit available for electric vehicles, but a proposal in the infrastructure bill currently being debated by the u.s. I am wondering if it's possible to put up my dad as a second registrant, whose tax liability is not as much as $7500. Earlier this week, the company updated tesla.

The j1772 gen 2 wall connector qualifies for a 30% federal tax credit in the united states for most customers.

2021 Ford Mustang Mach-e Vs Tesla Model Y The Next Normal

How Teslas Model Y Compares To Other Electric Suvs Charts Wired

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

2021 Tesla Model Y Monthly Car Payment Calculator Us News World Report

Tesla Inc Tesla Increases Model 3 Model Y Prices Report Auto News Et Auto

Tesla Brings Back Cheaper Model Y Standard Range But Only In Hong Kong - Electrek

Teslas Just Got 1500 Less Expensive In California Carbuzz

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate - Roadshow

2021 Tesla Model Y Performance Awd - Pge Ev Savings Calculator

Teslas Us Sales Slowed In 22 States In 2020 - The New York Times

2021 Tesla Model Y Performance Awd - Pge Ev Savings Calculator

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

Teslas Just Got 1500 Less Expensive In California Carbuzz

Tesla Brings Back Cheaper Model Y Standard Range But Only In Hong Kong - Electrek

2021 Tesla Model Y Performance Awd - Pge Ev Savings Calculator

Tesla Moves To Build The Model Y After A Gangbusters 2018 Wired

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate - Roadshow

2022 Tesla Model Y Prices Reviews And Pictures Edmunds

Tesla Model 3 Model Y Gets 1k Price Increase New Free Paint Option

Comments

Post a Comment