Disposal of a trust asset (or another cgt event) is likely to result in a capital gain or loss for the trust (unless a beneficiary is absolutely entitled to the asset). What is the capital gains tax rate on a trust?

The Ultimate Australia Crypto Tax Guide 2022 Koinly

The trustee must pay tax on any undistributed trust income.

Trust capital gains tax rate australia. Capital gains tax, in the context of the australian taxation system, is a tax applied to the capital gain made on the disposal of any asset, with a number of specific exemptions, the most significant one being the family home. The trust has no current year capital losses or prior year net capital losses, and the trust made no other capital gains during the income year. However the ato allows income earned from assets in a testamentary trust to.

Disposal of a trust asset. Get unlimited capital gain and loss questions answered If you would like help figuring out your tax liability for a trust, contact legalvision’s taxation lawyers on 1300 544 755 or fill out the form on this page.

Capital gains and losses are taken into account in working out the trust’s net capital gain or net capital loss for an income year. Capital gains tax reductions, exclusions and concessions include: Assets acquired before 20 september 1985 are not subject to cgt (unless a subsequent action or event brings them into the cgt net)

Ad a tax expert will answer you now! Depending on how the trust is written and which state the trust is located (state laws apply), it may be possible to include capital gains in dni. Some assets are exempt from cgt , such as your home.

This means you pay tax on only half the net capital gain on that asset. Capital gains disregarded by a foreign resident; Attribution managed investment trust member annual statement;

Ad a tax expert will answer you now! Rollover provisions apply to some disposals, one of the most significant of which are transfers to beneficiaries on death, so that the cgt is not a quasi. Income can be taxed either as trustee income at a 33% tax rate or as a beneficiary income at the marginal tax rate of a beneficiary, unless a distribution is made to a nz resident minor beneficiary in which case the applicable tax rate will be 33%.

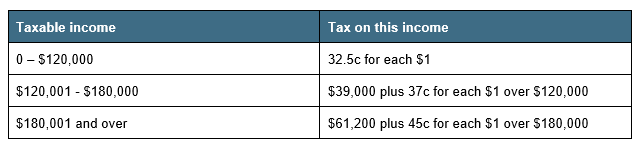

The income tax rates on income earned from assets in a testamentary trust are the same as personal income tax rates. It may be possible to amend the trust to permit the inclusion of capital gains in dni or the trustee may simply be able to exercise his or her. That is because income from trusts is often taxed at the corporate tax rate of 30 per cent, compared to the highest marginal income tax rate of 45 per cent.

There is a capital gains tax (cgt) discount of 50% for australian individuals who own an asset for 12 months or more. Capital gains ordinarily are held by the trust and taxed at the trust level (big tax). In some cases, the cgt discount can lessen the amount of tax an individual has to pay.

Amount of capital gains from a trust (including a managed fund) assessable income; The income of the trust estate is therefore $300 ($100 interest income + $200 capital gain) and the net income of the trust is $200 ($100 interest income + $100 net capital gain because the cgt discount is applied to halve the $200 capital gain). The effective tax rate on the capital gain of $10,000 is 18.5%.

Get unlimited capital gain and loss questions answered

3 Individuals Treasurygovau

Different Types Of Taxes In Australia Are Levied Accounting Services Online Bookkeeping Types Of Taxes

Buy 5cladba 5cladba Online 5cl-adb A 6fbm Buy 5cl-adba Buy 5cladba Near Me 6fbm Buy In 2021 Chemicals

Income Tax Australian Tax Brackets And Rates 202021 And 202122

Pin On Tax Depreciation Schedule

201617 Tax Stats Released Australian Taxation Office

End Of Financial Year Guide 2021 - Lexology

401k Plans No Longer Make Much Sense For Savers How To Plan Income Tax Return Savers

Capital Gains Tax Calculator For Australian Investors Sharesight

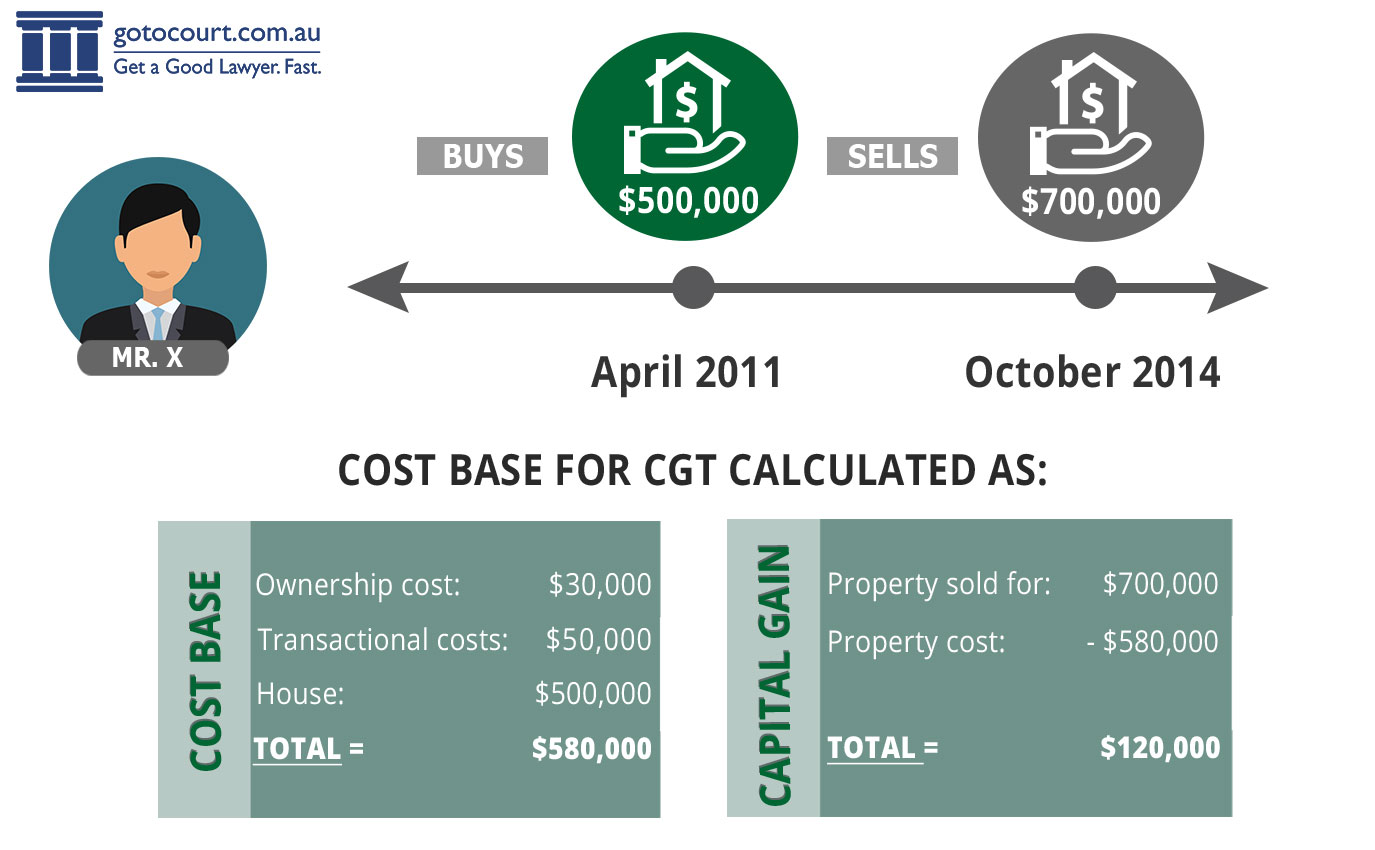

Calculating Capital Gains Tax Cgt In Australia

Calculating Capital Gains Tax Cgt In Australia

Saham Bri Berpotensi Melonjak Usai Rights Issue Di 2021 Ekosistem Publik Pedalaman

3 Simple Methods How To Calculate Capital Gains Tax And Concessions You Can Take Advantage Of - Box Advisory Services

Crypto Tax Australia Crypto Capital Gains Obligations - Pop Business

Rayvat Accounting - Income Distribution To Beneficiaries Tax Brackets Inheritance Tax Trust Is Commonly Used Forms Of Bu Accounting Accounting Firms Business

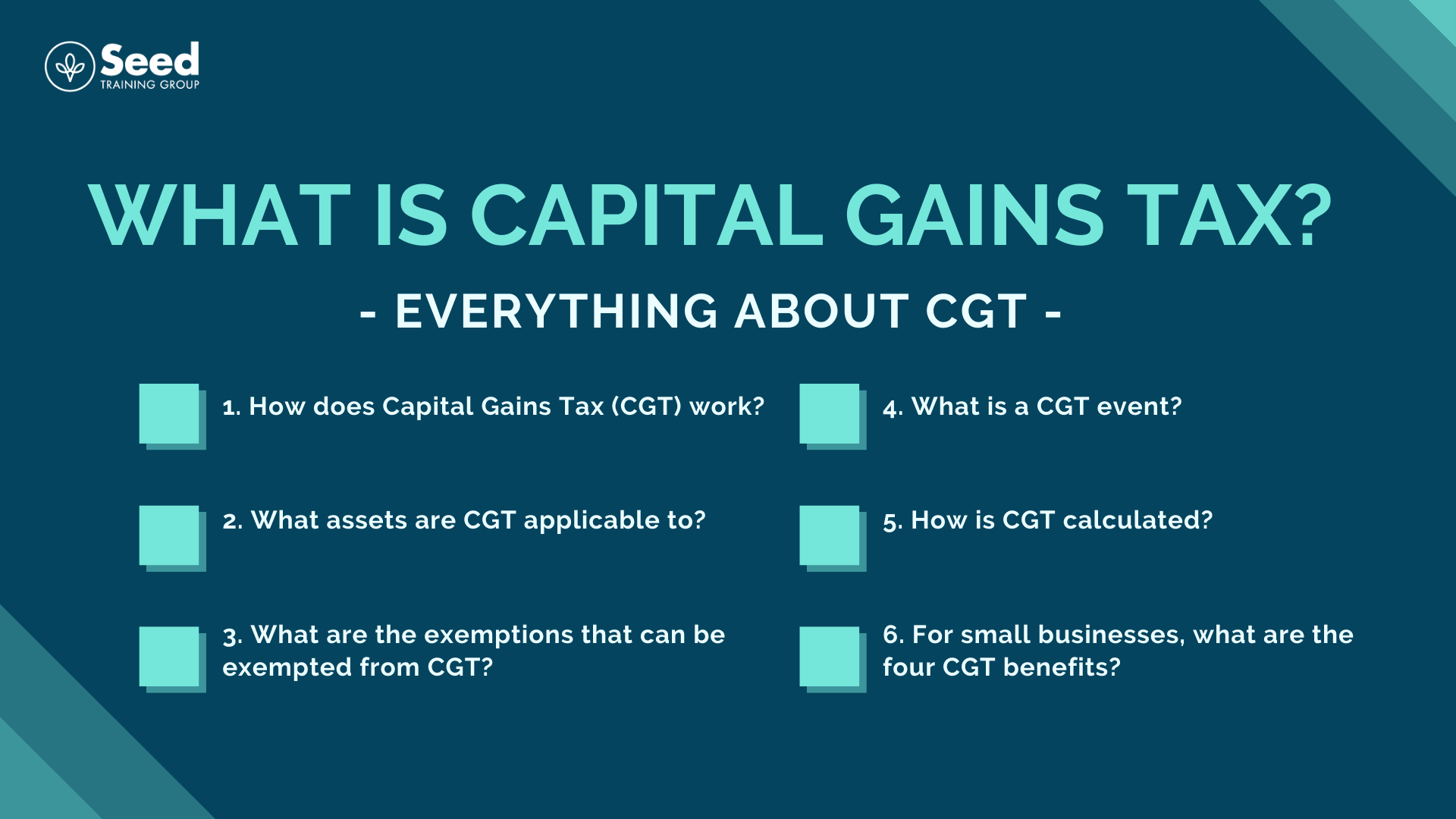

What Is Capital Gains Tax Cgt - Everything About Cgt

How Long Do You Have To Live In A House To Avoid Capital Gains Tax

Capital Gains Tax On Shares In Australia - Explained Sharesight

Harga Emas Hari Ini Tiada Ramalan Ngeri Malah Berseri-seri Di 2021 Emas Logam Mulia Logam

Comments

Post a Comment