Gis maps are produced by the u.s. This includes zooming and panning the map, selecting features to gain additional information, and, in some cases, conducting analysis on geospatial information.

Bakers Map Of Wayne Co Ohio Library Of Congress

Historical and contemporary maps of, and documents relating to, tuscarawas county dating from the 1890s to 1980s are included in pdf format.

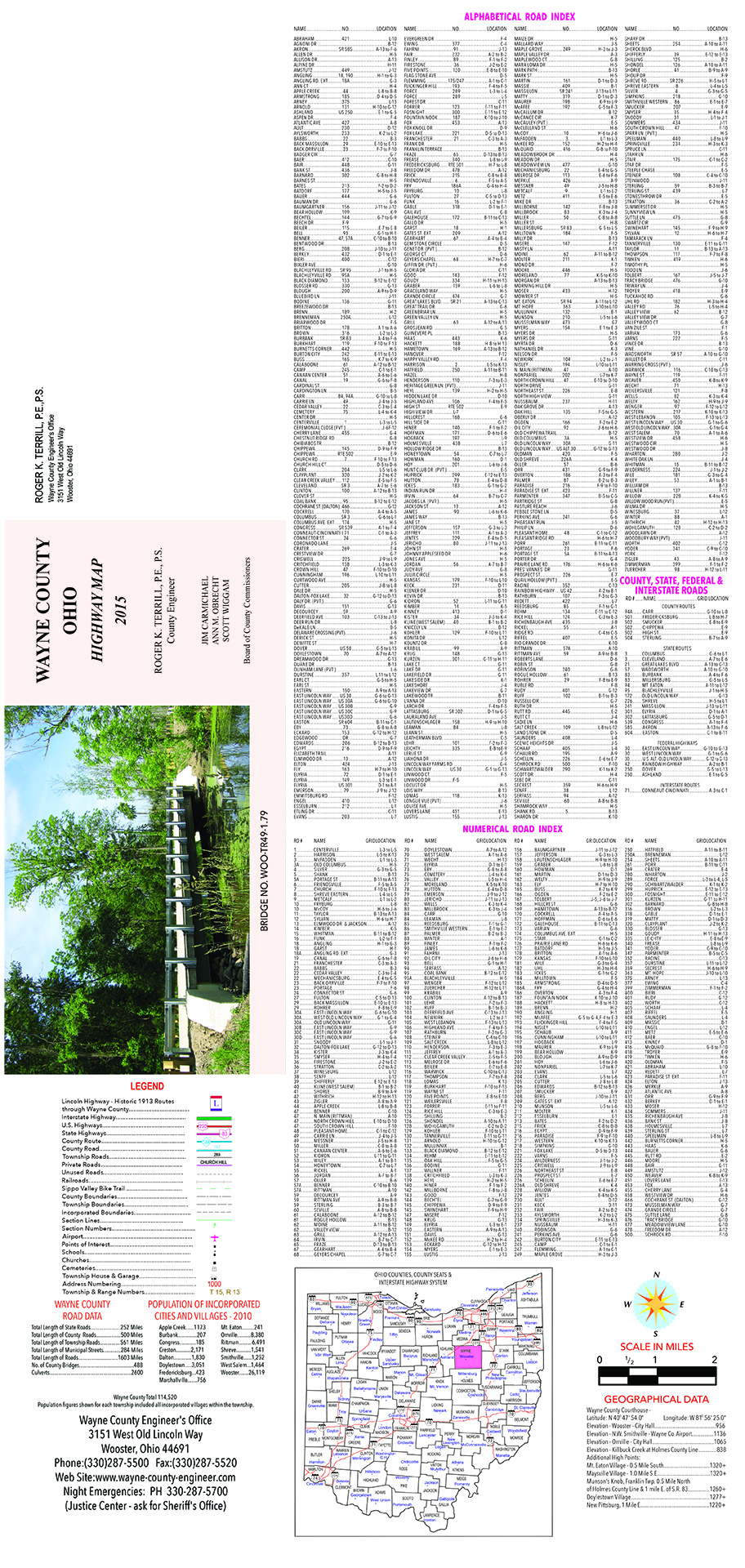

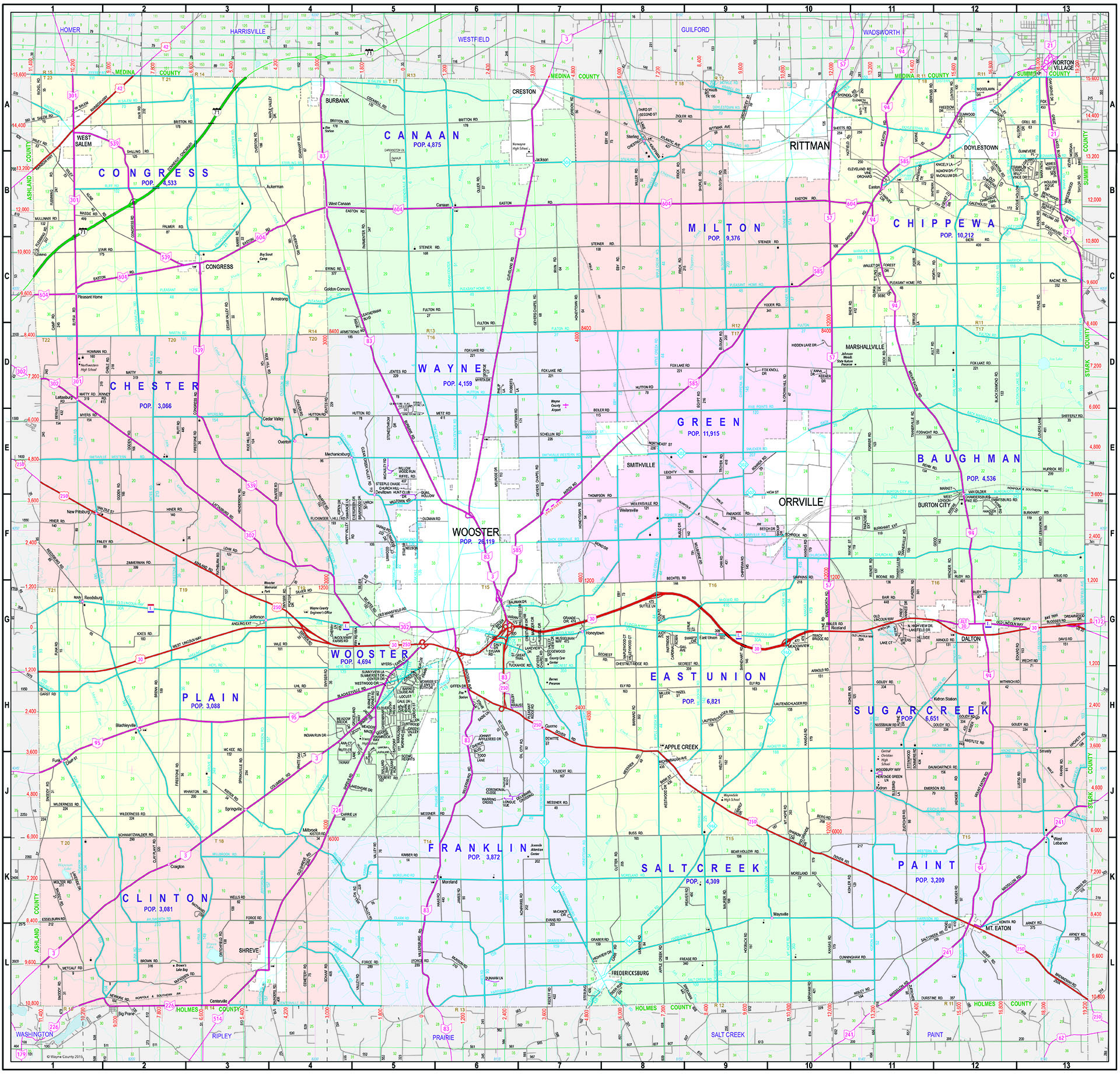

Wayne county tax maps ohio. The mapping department receives documents recorded in the recorder of deeds office. Effective may 3, 2021 parcel data can be found here: Gis stands for geographic information system, the field of data management that charts spatial locations.

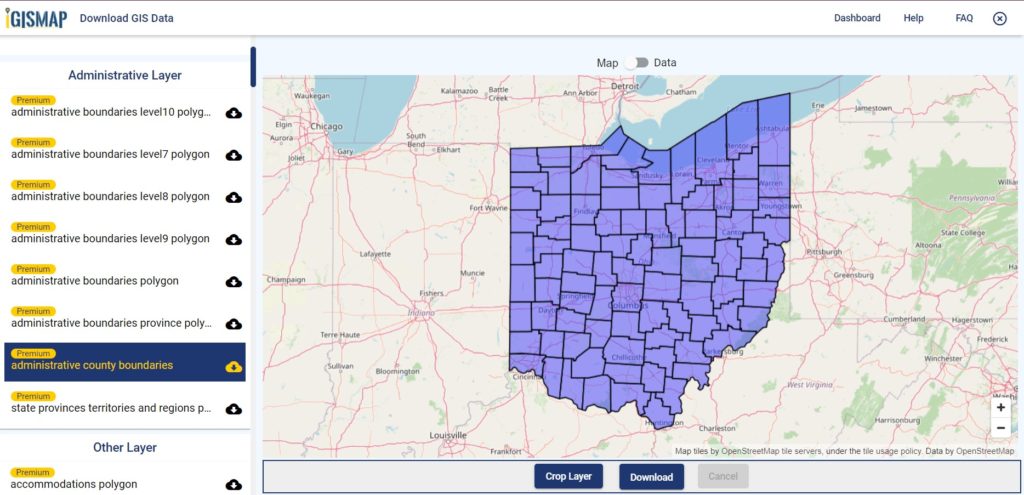

Includes gis data in shapefile format of wayne county, ohio. This table shows the total sales tax rates for all cities and towns in wayne county,. Wayne county ohio government web site | maps office.

Map group information full atlas title: Acrevalue helps you locate parcels, property lines, and ownership information for land online, eliminating the need for plat books. Wayne county gis data by wayne county auditor's office.

Wayne county collects, on average, 1.23% of a property's assessed fair market value as property tax. The acrevalue wayne county, oh plat map, sourced from the wayne county, oh tax assessor, indicates the property boundaries for each parcel of land, with information about the landowner, the parcel number, and the total acres. Wayne county is a sixth class county.

Additional geographic information systems (gis) data and maps can be downloaded from the wayne county website or purchased from the wayne county department of technology. Includes bloomfield directory, 1850 population and agricultural statistical table/data, distance table, views of. Search for ohio plat maps.

Map of pickaway county, ohio. Interactive maps dynamically display gis data and allow users to interact with the content in ways that are not possible with traditional printed maps. The median property tax in wayne county, ohio is $1,686 per year for a home worth the median value of $136,800.

Lc land ownership maps, 663 available also through the library of congress web site as a raster image. These instructions will show you how to find historical maps online. These documents are reviewed and processed by mapping technicians who update property tax maps and property ownership.

Plat maps include information on property lines, lots, plot boundaries, streets, flood zones, public access, parcel numbers, lot dimensions, and easements. The assessment office is administered under title 53, chapter 28 of the consolidated assessment law. Type the place name in the search box to find the exact location.

Ohio has a 5.75% sales tax and wayne county collects an additional 0.75%, so the minimum sales tax rate in wayne county is 6.5% (not including any city or special district taxes). The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. Welcome to wayne county's geographic information systems (gis) data hub.

Pay tax bills online through point and pay. 37 source institution souce media original document Pay real estate or manufactured home tax bills online through point and pay.

Wayne county gis maps are cartographic tools to relay spatial and geographic information for land and property in wayne county, ohio. Here you can download gis data, use map applications, and find links to other useful information. County auditor | wayne county, ohio home;

Caldwell number maps in the atlas: Doug green, supervisor of the wayne county tax map office, talks about some of the responsibilities of the office. The wayne county parcel viewer provides public access to wayne county aerial imagery collected in 2015 and parcel property information located within wayne county boundaries.

1 | p a g e wayne county tax map office formatting examples 428 w liberty st wooster, oh 44691 p: You can further adjust the search by zooming in and out. Wayne county has one of the highest median property taxes in the united states, and is ranked 642nd of the 3143 counties in order of median property taxes.

Cuyahoga County Ohio Public Records Directory Cuyahoga County Ashtabula County Park

County Map Wayne County Engineers Office

Cities Villages Wayne County Ohio

Counties And Road Map Of Ohio And Ohio Details Map Ohio Map Political Map County Map

Ohio Townships Map - Ohio Township Association

County Map Wayne County Engineers Office

Hancock County Ohio 1863 Old Wall Map Reprint With Etsy Wall Maps Hancock County Map

Map Of Townships In Clermont County Ohio - Wikipedia Samuelanderson Sarahanderson Mahlonanderson Clermont Ohio Ohio Map

Ohio Section Township Range Shown On Google Maps

Download Ohio State Gis Maps Boundary Counties Rail Highway -

Ohio County Map Ohio History Ohio Map County Map

Ohio County Map Ohio History Ohio Map County Map

Map - County Auditor Website Wayne County Ohio

De Kalb County Ohio Vintage Map From 1863 Old County Map Etsy In 2021 Vintage Map Map Art Print Map Art

Map Geology Of Wayne County 1921 Cartography Wall Art - 24in X 20in In 2021 Wayne County Historical Maps Cartography

Map Of Miami Co Ohio Library Of Congress

Heres The 3 Ways Ohio Districts Plan To Return To School

Ohio County Map

Recommended Locations Ohio - Httptravelsfinderscomrecommended-locations-ohiohtml Ohio Map Ohio Ashtabula Ohio

Comments

Post a Comment