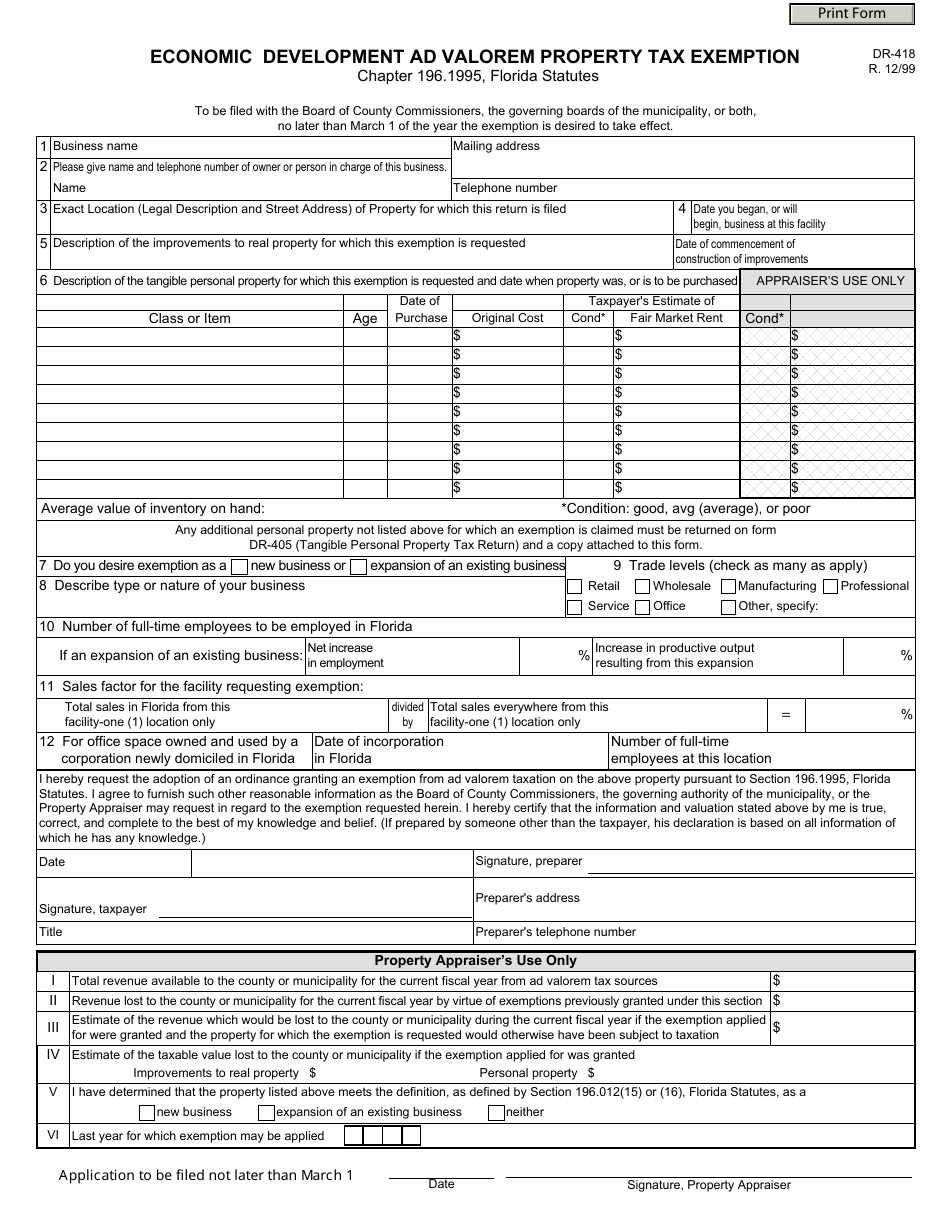

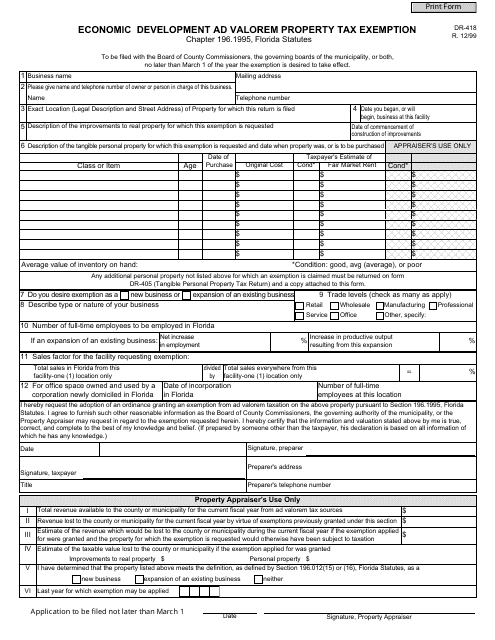

Ad valorem tax exemption application # application and return 196.197, 196.1978, 196.198, 196.2001, 196.2002, florida statutes this application is for ad valorem tax exemption under chapter 196, florida statutes, for organizations that are organized and operate for one or more of the following purposes: The economic development ad valorem tax exemption is a local option tax incentive for new or expanding businesses, which may be granted at the sole discretion of the board of county commissioners.

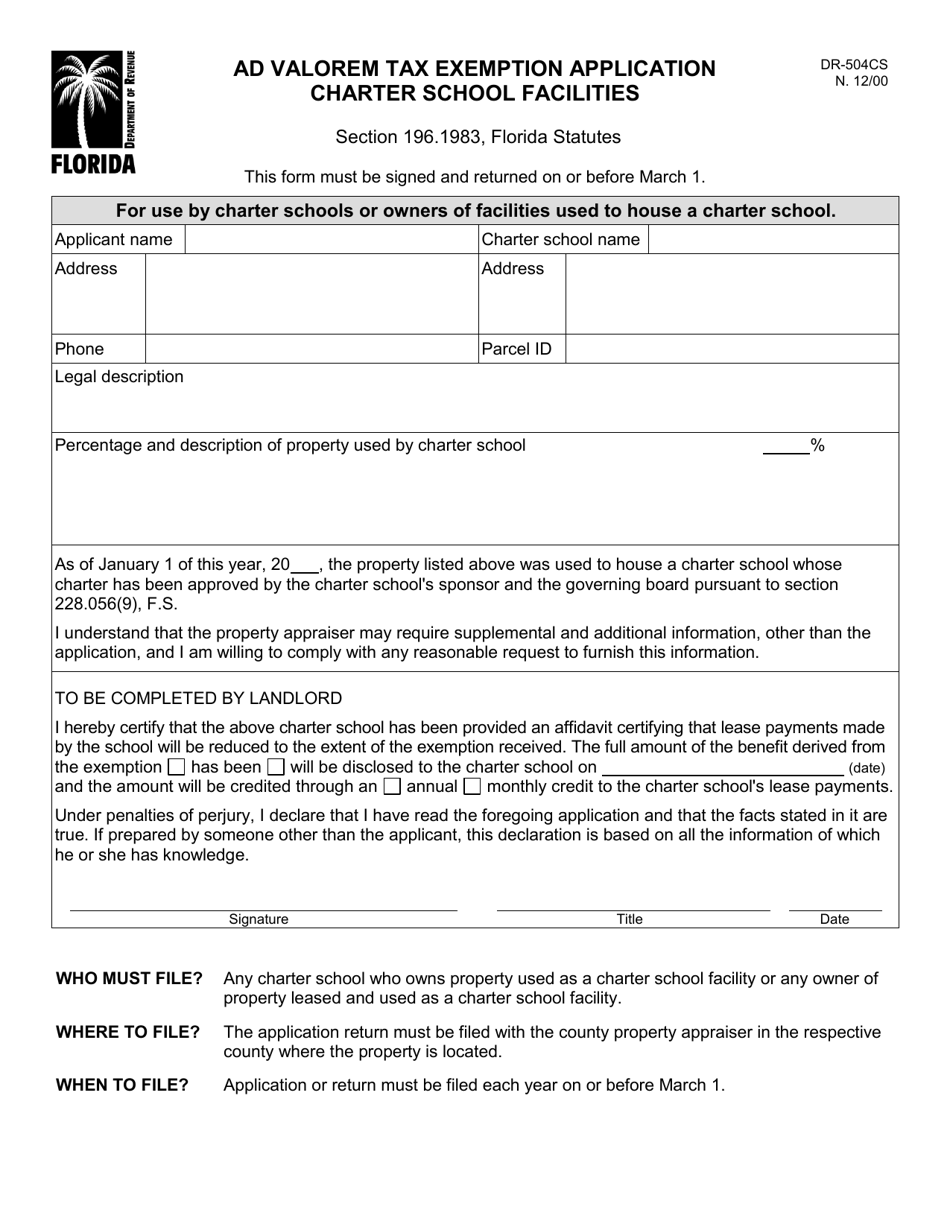

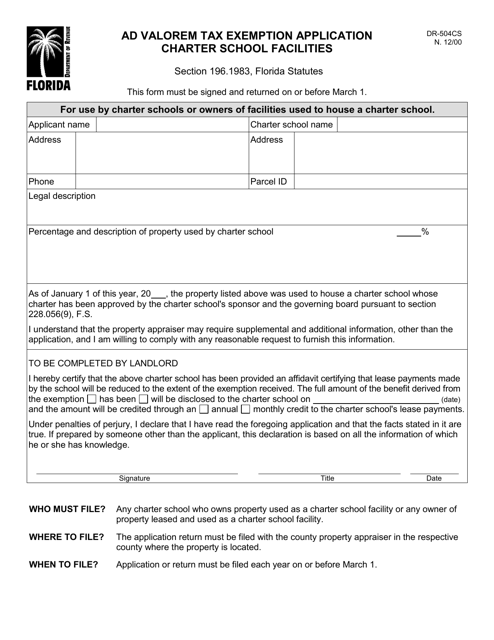

Form Dr-504cs Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application Charter School Facilities Florida Templateroller

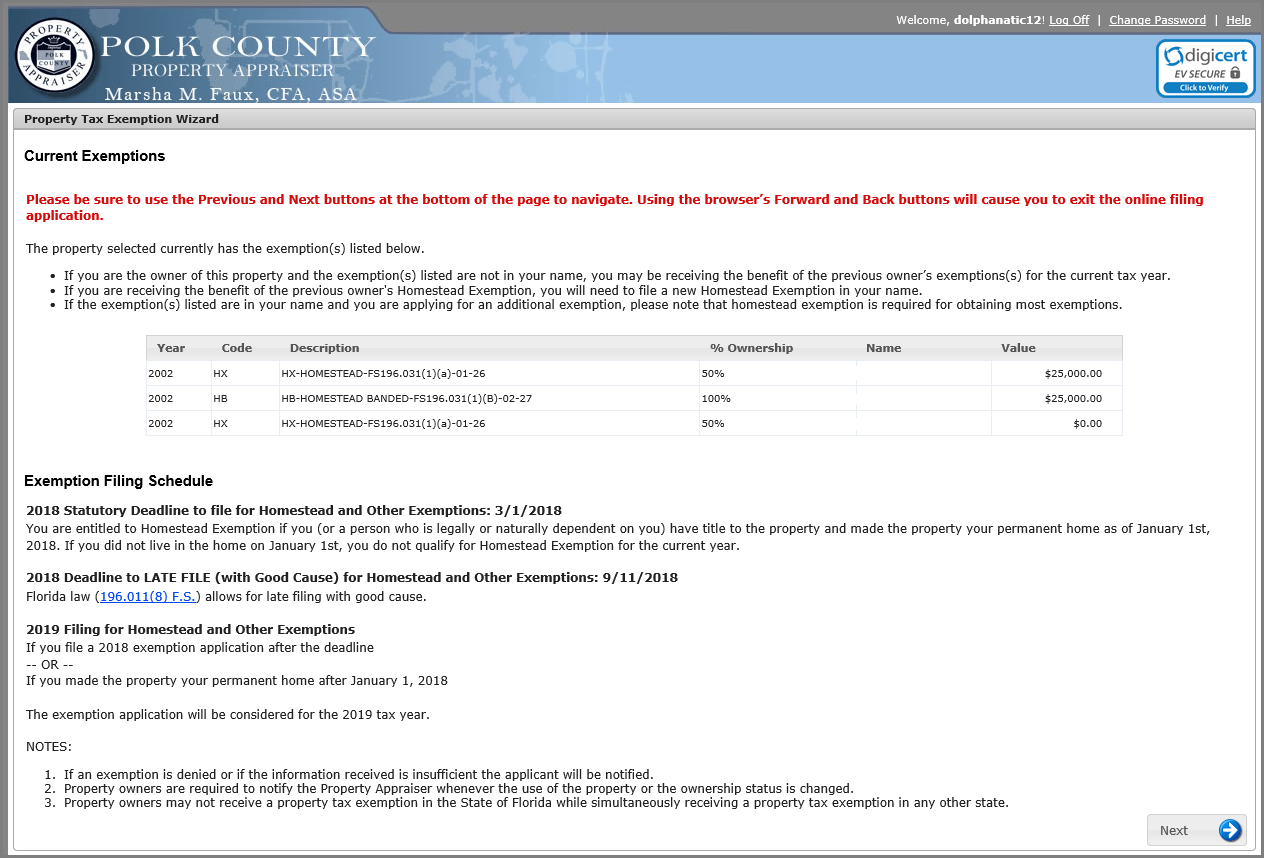

A permanent resident of florida that owns his or her principal residence in florida qualifies for 1) a $50,000 exemption (and an additional $50,000 exemption if the owner is age 65 or older) from the value of the property for ad valorem tax purposes;

Ad valorem tax florida exemption. Ad valorem tax exemption application and return for educational property. One valuable tax break, which is available in a number of florida counties and cities, is the economic development ad valorem tax exemption. # resident spouse yes no yes no 1.

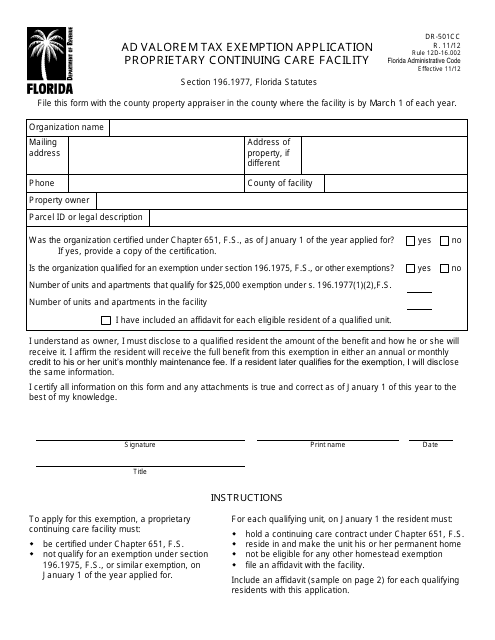

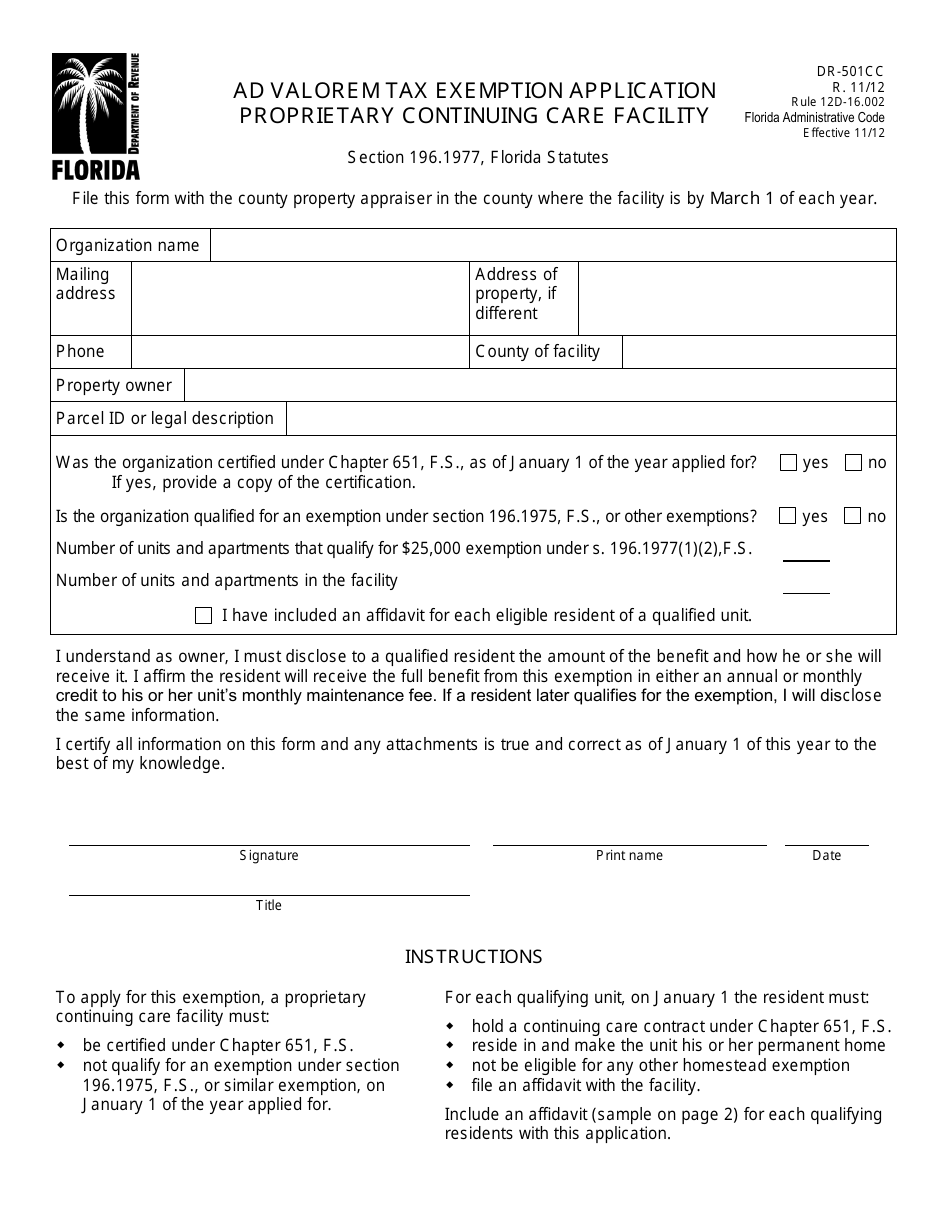

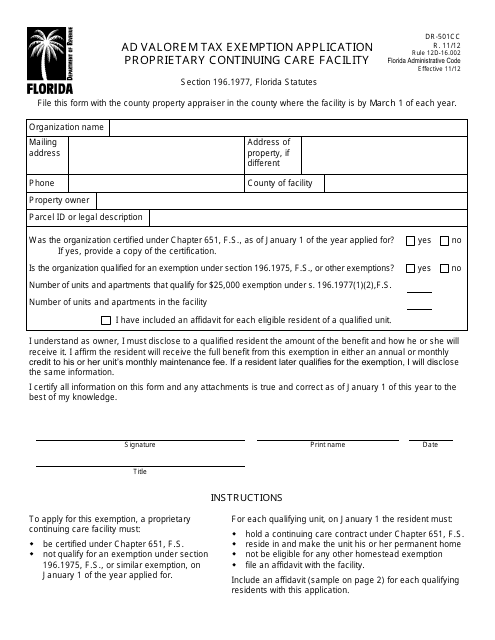

[1] thus, to qualify for this exemption from ad valorem. Ad valorem tax exemption application and return for charitable, religious, scientific, literary organizations, hospitals, nursing. Ad valorem tax exemption application and return for proprietary continuing care facility section 196.1977, florida statutes this application is for use by certified continuing care facilities that are not qualified for exemption as a nonprofit home for the aged to apply for an ad valorem tax exemption, as provided in section (s.) 196.1977,

Individual affidavit for ad valorem tax exemption. Granted a homestead exemption from ad valorem taxes, it shall be the duty of the property appraiser making such determination to serve upon the owner a notice of intent to record in the public records of the county a notice of tax lien against any property Sections 196.195, 196.196 and 196.197, florida statutes.

Incentives could be provided to businesses of diverse industries that would have a positive impact on the county’s economy. Under florida law, failure to file homestead exemption by march 1, 20constitutes 22 a waiver of the exemption privilege for the year. Part a.completed by each resident.

In 1992, the florida state constitution was amended to allow local governments the option of offering ad valorem tax exemptions on improvements to historic properties. And other organizations (chapter 196, f.s.) for more information: Pinellas county’s economic development ad valorem tax exemption is authorized under section 196.1995, florida statutes, and provides certain ad valorem tax exemption for bqualified usinesses at the sole and absolute discretion of the pinellas county board of county commissioners (board).

This application is for ad valorem tax exemption under chapter 196, florida statutes, for organizations that are organized and operate for one or more of the following purposes: This application is for use by nonprofit organizations to apply for an ad valorem tax exemption for property An ad valorem tax is a tax based on the assessed value of an item, such as real estate or personal property.

Vii of the state constitution to historic properties if the owners are engaging in the. Hospitals, nursing homes, and homes for special services; To qualify for the economic development ad valorem tax exemption in section 196.1995 (5), florida statutes, improvements to real property must be made or tangible personal property must be added or increased after the date the ordinance authorizing the exemption is adopted.

As to a claim for exemption based on religious use, you have stated that the property is being used as a. To encourage job growth and new investment in pinellas county, on august 26, 2014, pinellas voters authorized the pinellas county board of county commissioners to consider granting property tax exemptions for existing expanding businesses or new businesses that are creating new jobs. The most common ad valorem taxes are.

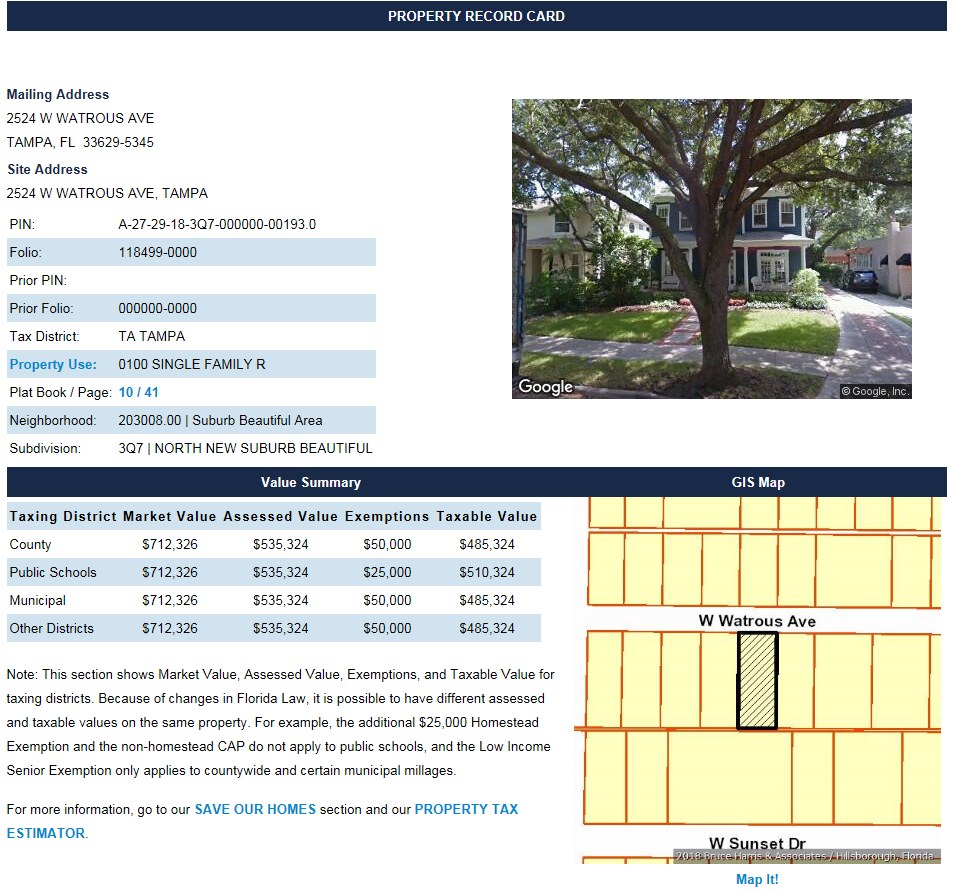

The exemption shall apply only to eligible ad valorem taxes levied by the county. The property appraiser is responsible for preparation of the current ad valorem tax roll, which includes assessed value, exemptions, owner’s names and address, legal property description and all address changes. This application is used by owners of certain educational institutions to apply for an ad valorem tax exemption for property used exclusively for educational purposes as provided in section (s.) 196.198, florida statutes (f.s.), by (select one):

12/08original application for ad valorem tax exemptionaddress of each owner not fillableproof of residence for all ownersother ownerspouseowner residing on property date you last became a permanent resident of florida date of occupancyflorida driver license numberflorida vehicle tag numberflorida voter registration number date: It is possible for the church to claim an ad valorem tax exemption on the parking lot in that the property is allegedly being used for a religious or charitable purpose. 2) a 3% cap on the annual increase in the ad valorem tax value of the home;

(1) the board of county commissioners of any county or the governing authority of any municipality may adopt an ordinance to allow ad valorem tax exemptions under s. Authorized by florida statute 196.1995, this incentive provides an exemption of up to 10 years from the property taxes (both real property taxes and tangible personal property taxes) payable with respect to business improvements such as a new building, building. The purpose of providing this exemption was to stimulate revitalization of historic properties and to.

Affordable and multifamily houses projects. Economic development ad valorem tax exemption or exemption means an ad valorem tax exemption granted by the city commission in its sole and absolute discretion to a qualified business pursuant to this article as authorized in article vii, section 3 of the constitution of the state of florida and Name spouse’s name tax year 20 building name apt.

Owners of historic buildings in florida considering rehabilitating their property have a variety of programs to choose from. Homes, and homes for special services.

Real Estate Taxes City Of Palm Coast Florida

Protect Your Property From Creditors And Reduce Your Property Taxes Using Floridas Homestead Exemption

Explaining The Tax Bill For Copb

Form Dr-504cs Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application Charter School Facilities Florida Templateroller

Homestead Portability Transferring Your Florida Homestead Cap To Your New Home Infinity Realty Group

Form Dr-501cc Download Printable Pdf Or Fill Online Ad Valorem Tax Exemption Application Proprietary Continuing Care Facility Florida Templateroller

Understanding Property Taxes

Form Dr-504ha Fillable Ad Valorem Tax Exemption Application And Return - Homes For The Aged N 1101

Exemptions Hardee County Property Appraiser

Real Estate Property Tax - Constitutional Tax Collector

Form Dr-418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

Floridas Ad Valorem Tax Exemption Dean Mead

Current Exemptions Page

Form Dr-418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

Florida Property Taxes Explained

Broward County Property Taxes What You May Not Know

Form Dr-501cc Download Printable Pdf Or Fill Online Ad Valorem Tax Exemption Application Proprietary Continuing Care Facility Florida Templateroller

Understanding Your Tax Bill Seminole County Tax Collector

Are Veterans Exempt From Property Taxes In Florida - Tax Walls

Comments

Post a Comment