Claims for this offset are restricted to net eligible expenses for: This manual provides comprehensive guidance in relation to tax relief for health expenses.

Can I Claim Tax Relief For My Glasses And Hearing Aid - Friend And Grant

Keep in mind our expertise at southwestern is hearing aids, not tax filing.

Are hearing aids tax deductible as a business expense. Thus for the employee, the father, as necessary business expense, and ordinarily used by any hearing impaired individual, the hearing aids would have been prior to tcja deductible, but now not until after 2025. According to the internal revenue service, the taxpayers can deduct various kinds of medical expenses. Are hearing aids tax deductible as a business expense.

However, there are saidsome things to consider and take note of before filing your taxes to ensure you are fully benefiting. Expenses related to hearing aids are tax deductible. Many of your medical expenses are considered eligible deductions by the federal government.

The only eligible medical expenses that can be claimed under the net medical expenses offset in 2016 must relate to disability aids, attendant care or aged care. Are hearing aids tax deductible? Can hearing aids be claimed as a business expense?

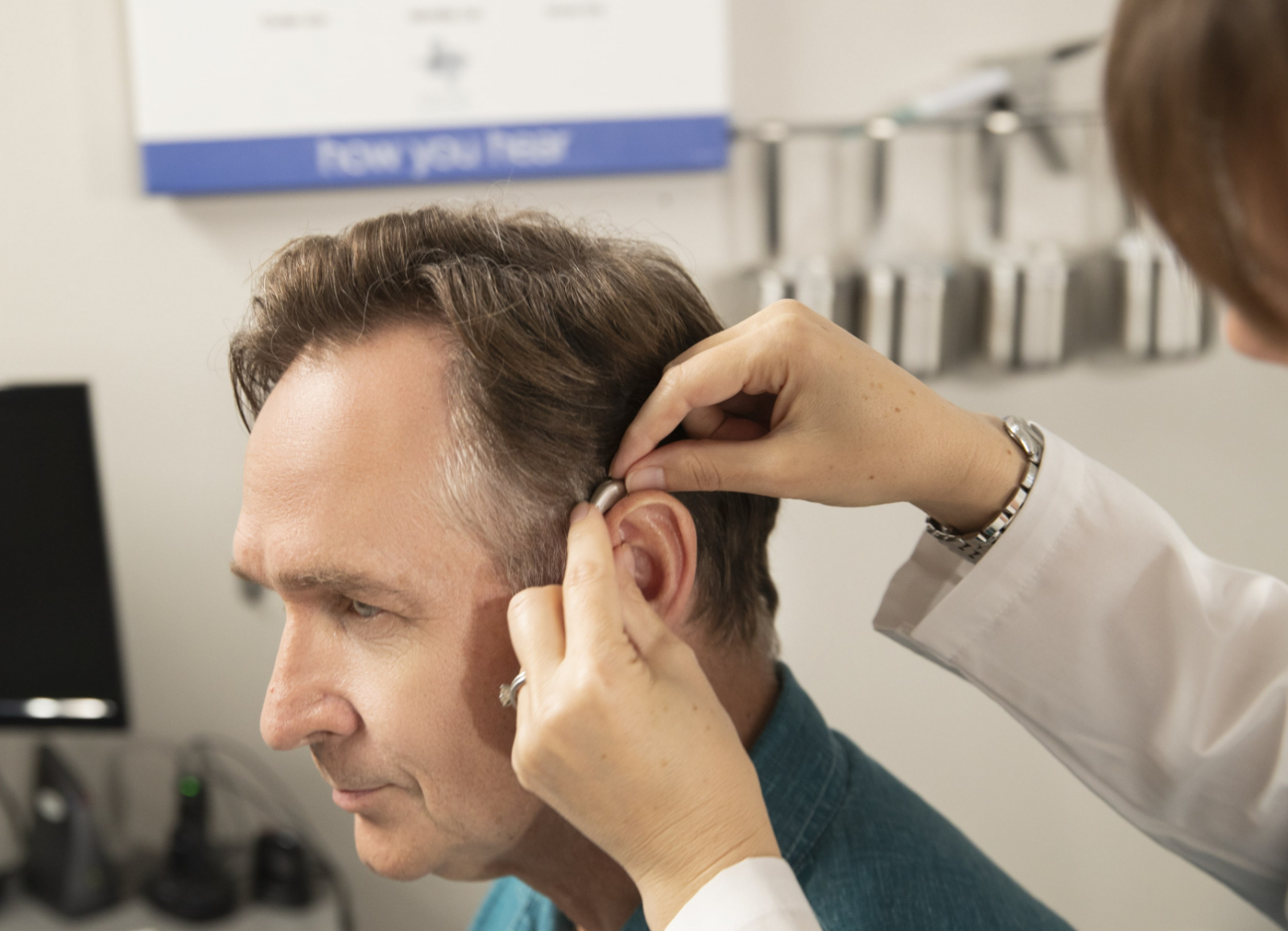

Hearing aid the cost of the provision of a hearing aid on the advice of a medical practitioner. The use of any hearing aid may not fully restore normal hearing and does not prevent future hearing loss. It seems clear to me that if you require hearing equipment to help you do your work, it's exempt from tax and bik and doesn't need to be reported.

Fortunately, the federal government—through the internal revenue service (irs)—does recognize hearing aids as a deductible medical expense. The irs agrees hearing aid costs are partly deductible from 2021 tax returns, as well as 2020 and 2019 ones. A client (lawyer) wants to deduct hearing aids as a business expense (not medical for obvious 7.5% reason), since he bought the aids to hear the judge during evidentiary hearings.

Cost of purchasing, maintaining and repairing medical, surgical, dental or nursing appliances. The short and sweet answer is yes! With 2021 taxes already being filed, we explore what you need to know.

Net expenses are your total eligible medical expenses minus refunds you, or someone else, receive. Track your hearing loss expenses. I have found that medical expenses are the least understood area of tax deductions.

He has had to purchase a hearing aid in order to continue his self employment (although there is a significant private benefit). Complimentary hearing assessment is not valid at these locations. Hearing aids can often qualify as a tax deduction, though there are still several stipulations that the 10 million americans with hearing aids will want to pay attention to.

It includes hearing aid also. Tax tips some of the most common overlooked deductions tax return tax time deduction. Special diet expenses for coeliacs and diabetics;

The rules state that if your hearing aids are to be used entirely for your business, you can apply for tax relief from them. If the hearing aids are traditional hearing aids that can be used to improve your hearing in normal everyday life, they are only going to be deductible as a medical expense on your schedule a. The tax rules state that if the expense is incurred wholly and exclusively for your business then you can have tax relief for it.

However, hearing aids are not entirely tax free in the united states because irs imposes limits. Since hearing loss is considered a medical condition and hearing aids are medical devices regulated by the fda, you may be able to deduct these costs. 2 legislation section 469 of the taxes consolidation act 1997 (tca 1997) provides for tax relief in.

The following information is accurate to the best of our knowledge, but if you have questions please contact your tax professional. I believe that in the case of a director, the cost of hearing aids would be an allowable expense for the company, but would indeed be considered a p11d benefit. Disability aids are defined as items manufactured as, or generally recognised to be, an aid to the functional capacity of a person with a disability.

Schedule c deductible, or 'no way' and move them to schedule a?. (there are conditions that apply to the purchase of these items. Specifically, according to irs publication 502 (medical and dental expenses), “the cost of a hearing aid and batteries, repairs, and maintenance needed to operate it” all count toward your medical expense deduction.

The net medical expenses tax offset is no longer available from 1 july 2019. Medical expenses, including hearing aids, can be claimed if you itemize your deductions.

![]()

Are Hearing Aids Tax Deductible Earpros Uk

Great News For Tax Season Your Hearing Aids Are Deductible - Hearing Associates Of Northern Virginia

What Are Business Expenses What Expenses Can I Claim

Jonathan Silveira Real Estate Phone 778-861-5467 - By Taking Advantage Of All Of The Tax Deductions Credits And Strategies That Apply In Your Situation Its Possible To Reduce Your Tax Bill And

Are Hearing Aids Tax Deductible - Sound Relief Hearing Center

Are Hearing Aids Tax Deductible - Sound Relief Hearing Center

What Are Business Expenses Deductible Non-deductible Costs

Taxpayers With High Medical Bills May Qualify For Deductions

Are Hearing Aids Tax Deductible Anderson Audiology

Hearing Aids And Tax Time Is A Hearing Aid Tax Deductible

The Deductibility Of Medical Expenses - Hawkins Ash Cpas

Are Hearing Aids Tax Deductible - What You Should Know

Which Expenses Are Deductible In 2020 Cpa Practice Advisor

Tax Deductible Medical Expenses In Canada

Are Hearing Aids Tax Deductible - Sound Relief Hearing Center

Are Hearing Aids Tax Deductible - Sound Relief Hearing Center

/f/45415/1200x630/1c7810ada9/save-money-image.jpg)

Paying For Hearing Aids Tax Breaks From Uncle Sam With Hsas And Fsas

Are Hearing Aids Tax Deductible Anderson Audiology

Are Hearing Aids Tax Deductible - What You Should Know

Comments

Post a Comment