The current total local sales tax rate in butler county, oh is 6.500%. Renew your vehicle tags online through the kansas motor vehicle online renewal system.

Ksrevenueorg

You will need your renewal forms sent to you from the kansas department of motor vehicle to complete this process.

Butler county kansas vehicle sales tax rate. The butler county, kansas sales tax is 6.75%, consisting of 6.50% kansas state sales tax and 0.25% butler county local sales taxes.the local sales tax consists of a 0.25% county sales tax. This is the total of. The alabama state sales tax rate is currently %.

Butler county clerk 2016 proposed amended ex enditures 1 760 000 actual tax rate page no. In addition to taxes, car purchases in kansas may be subject to other fees like registration, title, and plate fees. The butler county sales tax is 0.75%.

The current total local sales tax rate in butler county, pa is 6.000%. This is the total of state and county sales tax rates. Search through information on properties in the county.

To get the difference you will need to contact the county treasurer and give them the year, make and model of the new as well as the old vehicle and tell them you need. The butler county, kansas sales tax is 6.75%, consisting of 6.50% kansas state sales tax and 0.25% butler county local sales taxes.the local sales tax consists of a 0.25% county sales tax. Has impacted many state nexus laws and sales tax.

The december 2020 total local sales tax rate was also 6.500%. The butler county sales tax rate is %. To be notified of the next tax sale by email or text message please use the notify me sign up.

, pa sales tax rate. The local sales tax to be collected on the purchase price of motor vehicles, trailers, watercraft, and motors at the time application is made for title, if the address of the applicant is within a city or county listed below. This is the total of state and county sales tax rates.

This is the total of. You can find these fees further down on the page. The butler county sales tax is collected by the merchant.

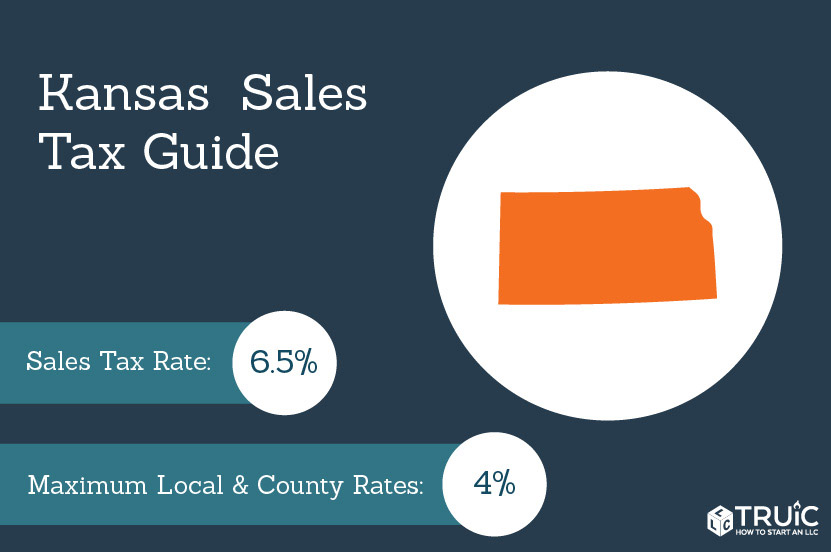

Kansas has state sales tax of 6.5% , and. Learn how to renew motor vehicle tags. The 2018 united states supreme court decision in south dakota v.

The fee to transfer is $12.50 plus the difference in the property tax. The kansas state sales tax rate is currently %. Butler county treasurer butler county courthouse 205 w.

Butler county, pa sales tax rate. For additional information click on the links below: Sales tax rates in butler county are determined by four different tax jurisdictions, butler county, elbing, andover and el dorado.

Butler county, ks sales tax rate. Butler county clerk 2016 proposed amended ex enditures 1 760 000 actual tax rate page no. Butler county, kansas has a maximum sales tax rate of 7.5% and an approximate population of 51,882.

Missouri department of revenue motor vehicle bureau The butler county sales tax rate is %. , oh sales tax rate.

638 rows average sales tax (with local): Contact your county treasurer for an closer estimate of costs. Central 2nd floor el dorado, ks 67042 ph:

The sales tax rate varies by county. Home » motor vehicle » sales tax calculator. This information will help you understand the sale process and assist you in purchasing property at the next tax sale.

If you did not receive the forms in the mail, you will need to visit the local county motor vehicle office. There are also local taxes up to 1%, which will vary depending on region. Some cities and local governments in butler county collect additional local sales taxes, which can be as high as 0.75%.

This rate is in addition to the state tax rate of. The minimum combined 2021 sales tax rate for butler county, kansas is. Home » motor vehicle » sales tax calculator.

The 2018 united states supreme court decision in south dakota v. This rate is in addition to the state tax rate of 4.225%. The december 2020 total local sales tax rate was also 6.500%.

The current total local sales tax rate in butler county, ks is 6.500%. Motor vehicle titling and registration. Home » motor vehicle » sales tax calculator.

The december 2020 total local sales tax rate was also 6.000%. The local sales tax is to be collected on the purchase price of motor vehicles, trailers, watercraft, and motors at the time application is made for title, if the address of the applicant is within a city or county listed below. The butler county, kansas sales tax is 6.75%, consisting of 6.50% kansas state sales tax and 0.25% butler county local sales taxes.the local sales tax consists of a 0.25% county sales tax.

Find information on paying taxes. Find information on the mill levy, or the tax rate that is applied to the assessed value of a property. The minimum combined 2021 sales tax rate for butler county, alabama is.

Kansas collects a 7.3% to 8.775% state sales tax rate on the purchase of all vehicles.

Dormogov

Butler County Kansas Detailed Profile - Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Www2ljworldcom

Sales Tax On Cars And Vehicles In Kansas

Butler County Kansas Vehicle Sales Tax Rate - Iae News Site

Kansas Department Of Revenue - Property Valuation - Data By County

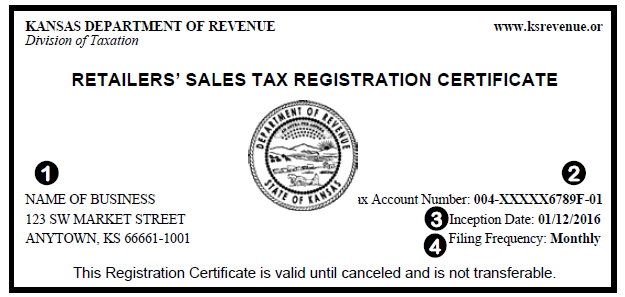

Kansas Department Of Revenue - Pub Ks-1510 Sales Tax And Compensating Use Tax

Butler County Kansas Detailed Profile - Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Kansas Sales And Use Tax Rates Lookup By City Zip2tax Llc

Bucokscom

Dormogov

Kansas - Wikipedia

Kansas Sales Tax Rate Rates Calculator - Avalara

Kansas Sales Tax - Small Business Guide Truic

Kansas Sales Tax Calculator And Local Rates 2021 - Wise

Butler County Kansas Detailed Profile - Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

Motor Vehicle Butler County Ks - Official Website

Comments

Post a Comment