An article detailing the differences and unique algorithm used by the application from crypto tax calculator australia. Now that you are clear on how to use our crypto tax calculator and what taxes you will pay on crypto, consider how you want to earn it.

Crypto Tax In Australia - The Definitive 2021 Guide

The world of cryptocurrency and taxation is a murky one.

Crypto tax calculator australia. Crypto tax calculator australia use the free crypto tax calculator below to estimate how much cgt you may need to pay on your crypto asset sale. We can see the gain/loss on each transaction clearly. If you sold tax on cryptocurrency or used it to buy goods and services, you will owe taxes if the realized value (the sale price of bitcoin, for example) is more than the price at which you bought bitcoin.

Crypto tax calculator for australia. Both koinly and crypto tax calculator provide software to help you keep track of your gains and losses, and easily convert transactions as they happen into their australian dollar equivalent. Whilst this article is based on the most recent information available from the ato, the space is always evolving, and information provided may be subject to change.

The australian tax office has released official guidance on the tax treatment of cryptocurrencies. Crypto tax calculator australia is a crypto tax calculator that has been developed for australian crypto traders. Our easy to use crypto tax calculator allows you to import your data and calculate your taxes in seconds.

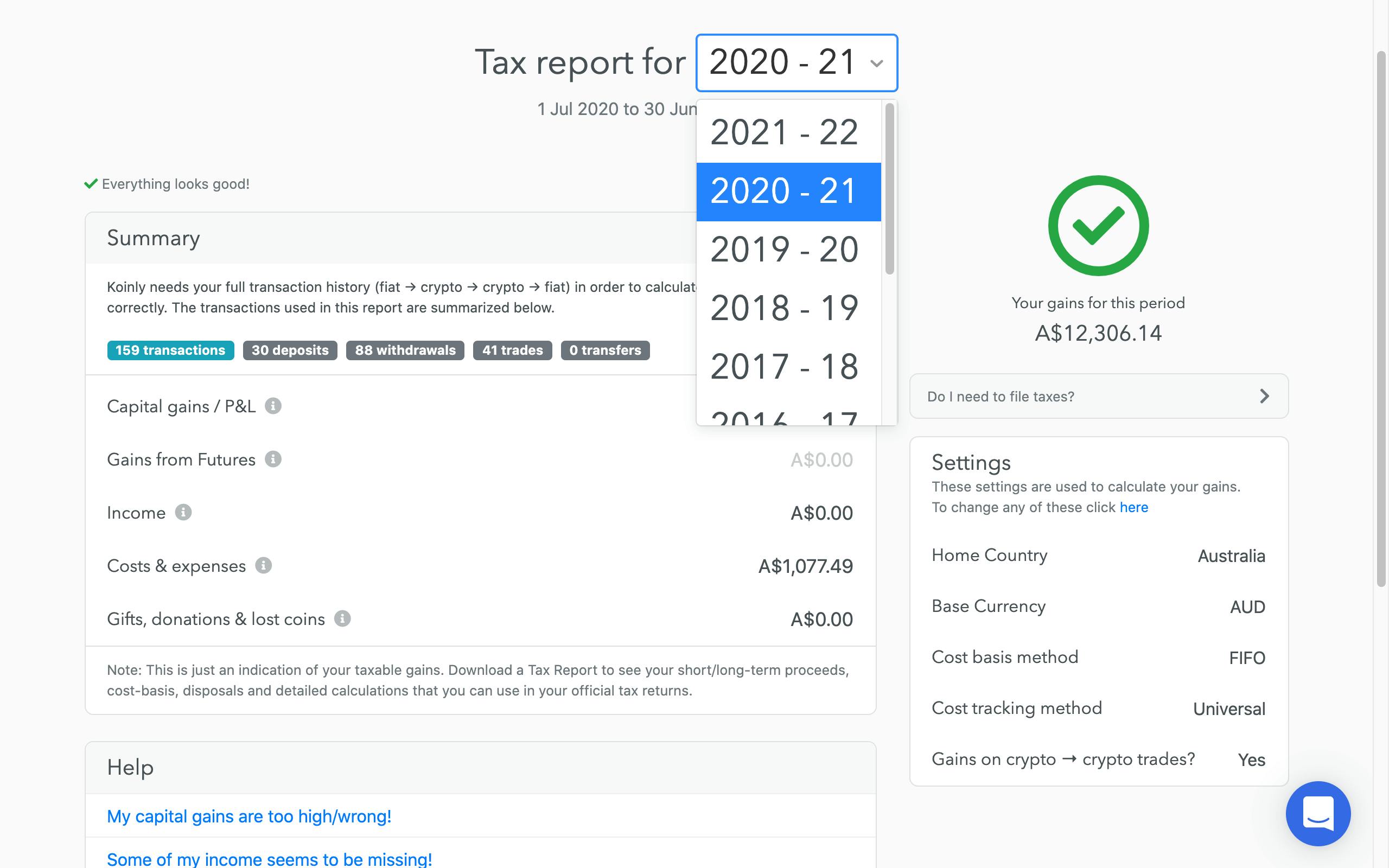

It's an application that shows crypto holders their capital gains, the amount of capital gains tax they need to pay and which coin they made a profit on. To calculate the crypto taxes for jed we are going to use koinly which is a free online crypto tax calculator. The best crypto tax calculator in australia:

Cointracking is the best crypto tax software for australian investors, enabling the importing of trades from hundreds of exchanges, including defi/dexes, binance smart chain, matic, nfts, and more! To calculate the crypto taxes for john we are going to use koinly which is a free online crypto tax calculator. You can then generate your necessary gains, losses, and income reports in.

In this article we’ll cover a range of cryptocurrency tax topics that may assist you during tax time. By syncing your swyftx account, koinly and crypto tax calculator both securely access your trading data to calculate your crypto taxes. The cost of crypto tax after a year in australia.

Koinly is the only cryptocurrency tax calculator that is fully compliant with atos crypto tax guidance We’re here to help you navigate your crypto tax. Automated crypto trading with haru.

After entering the 3 transactions into koinly manually, this is the output: Sort out your tax nightmare. Your tax authority wants to know your equivalent profits or losses in the local fiat (usd, gbp, aud, or cad).

If you sell or swap your cryptocurrency and make a profit, you may need to pay tax on that profit, as crypto profits are subject to capital gains tax (cgt) in australia (unless you are a professional trader). It's an application that shows crypto holders their capital gains, the amount of capital gains. With this in mind, you’ll need to keep records of all your crypto trades so you can calculate any capital gains or losses and include them on your tax return.

Welcome to the best crypto tax calculator application in australia. Log in to your account.

![]()

Cointracking - Crypto Tax Calculator

40sew5vo56oo-m

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Next Steps - Australia Crypto Tax Report Cryptotradertax

Crypto Tax Reporting Tools For Accountants Koinly

Cryptotaxcalculator Partners With Coinspot Local Social Media Finance Google Trends

Crypto Tax Calculator

Antarimediacom - Cryptocurrency Adalah Sebuah Teknologi Membuat Mata Uang Digitalteknologi Ini Menggunakan Kript Top 10 Cryptocurrency Cryptocurrency Bitcoin

Crypto Tax In Australia - The Definitive 2021 Guide

Do You Mine Coins Whether Your Mining Is Active Passive Or Hobby Income Depends On How Much Time And Personal Bitcoin Mining Bitcoin What Is Bitcoin Mining

Bitpay In New Partnership Allows You To Receive Tax Return In Btc Tax Return Bitcoin Tax Refund

Koinly Crypto Tax Calculator For Australia Nz

Top 10 Crypto Tax Return Software For Australia - Crypto News Au

Australia Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Calculate Bitcoin Taxes For Capital Gains And Income Capital Gain Bitcoin Income

Top 10 Crypto Tax Return Software For Australia - Crypto News Au

Crypto Tax Australia Cryptocurrency Tax 2021 Guide Fullstack

10 Best Crypto Tax Software 2021 Selective

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Comments

Post a Comment