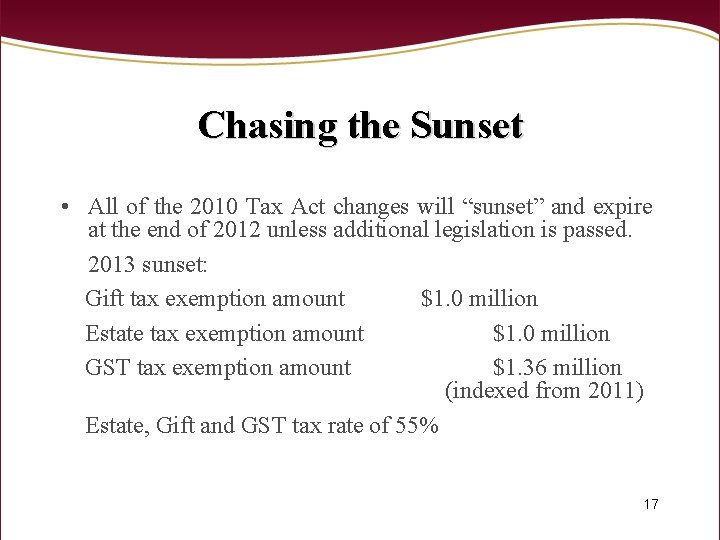

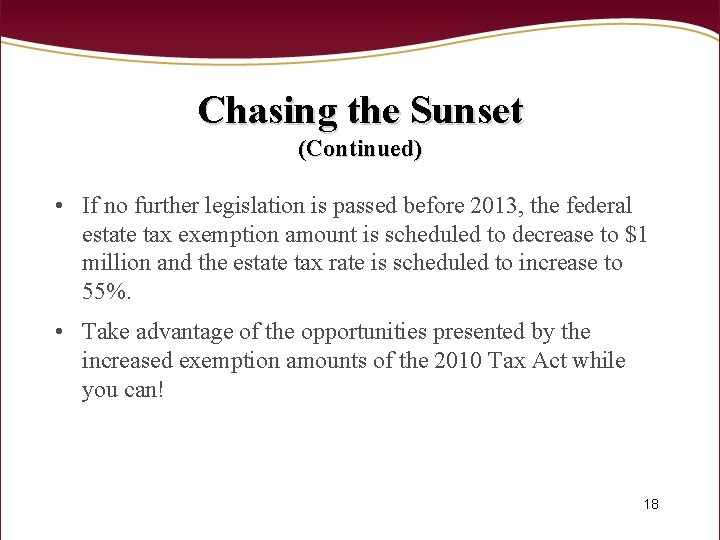

However, the favorable estate tax changes in the tcja are currently scheduled to sunset after 2025, unless congress takes further action. It is important to note that these changes to the federal estate tax exemption amount are scheduled to sunset effective january 1, 2026.

With Gift Taxes And Estate Taxes In Congress Sights Consider Revisiting Your Estate Planning Northwestern Mutual

Barring legislative change, the tax cuts and jobs act will sunset in five years which will, generally, cut the estate tax exemption amount in half.

Estate tax exclusion amount sunset. Congress included a sunset provision in the 2017 tax act so the exclusion amount returns to the 2017 exclusion amount (adjusted for inflation) in 2026. The credit to be applied for purposes of computing b’s estate tax is based on b’s $18.2 million applicable exclusion amount, consisting of the $6.8 million basic exclusion amount on b’s date of death plus the $11.4 million dsue amount, subject to the limitation of section 2010(d). Congress included a sunset provision in the 2017 tax act so the exclusion amount returns to the 2017 exclusion amount (adjusted for inflation) in 2026.

Exemption amount and sunset taxpayers with significant estates were no doubt happy when the estate tax limit was raised to $11,580,000 million from $5,490,000 million in 2017. The current lifetime estate exclusion amount is $11,700,000 per taxpayer, or $23,400,000 for a married couple. The sunset provision of the temporary increase in estate tax exemption

In 2025, you and your spouse give $11.5 million to your heirs and file a gift tax return with the irs. The amount is $11.18 million for an individual in 2018, and $22.36 million dollars for a married couple. Even without any act of congress, the exclusion will be cut in half effective january 1, 2026.

(1) whether the increased exemption presents a “use it or lose it” situation. You both die in 2026 with a combined estate of $11.5 million. Thanks to the tax cuts and jobs act, the gift and estate tax exemption amount has almost doubled to $11.18 million per person in 2018—as opposed to the $5.6 million exemption amount that.

This means that when you pass away, the value of your estate is calculated and any. Under current law, this means that come 2026, the federal estate tax exemption amount will revert back to 2017 levels, as adjusted for inflation. It is important to note that absent further legislative action, these increases to the federal estate tax exemption amount are scheduled to sunset effective january 1, 2026.

The current $11.7m[1] estate and gift tax exclusion was provided under a temporary law. This means that a wealthy individual can now gift or bequeath up to $11,580,000 million in assets without being subject to the onerous gift and estate tax regime (death tax regime). Because the exclusion amount is back to $11.5 million, your estate tax is $4.6 million.

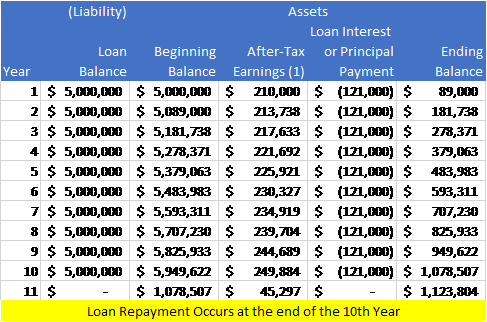

The grantor of the trust has the flexibility to forgive the loan prior to. The exemption is indexed for inflation and increases annually based on the cost of living. The tax cuts and jobs act in 2017 provides that the estate tax exclusion amount, is $10 million adjusted for inflation through 2025, will revert back to $5 million adjusted for inflation, for people who pass away in 2026 and beyond.

The scheduled sunset of the estate and gift tax exemption amount raised several practical questions, including: Under current law, this means that come 2026, the federal estate tax exemption amount will revert back to 2017 levels, as adjusted for inflation. Nothing has happened politically, and the doubling of the estate and gift tax exemption is scheduled to “sunset” on january 1, 2026 (at the end of the 7 th year).

Estates in excess of the exclusion are currently taxed at 40%. Unified credit against estate tax:the basic exclusion amount is $11,580,000 for determining the amount of the unified credit against estate tax under sec. 'while the build back better act provides a temporary reprieve for those with assets in excess of the exclusion amount, it does nothing.

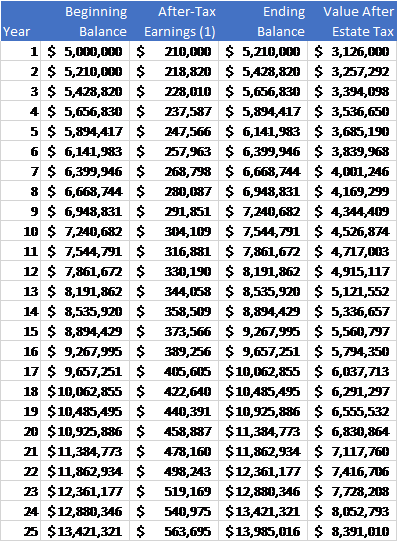

This inflation adjustment results in a 2018 applicable exclusion amount of $11,180,000. The act effectively doubled the 2017 lifetime exemption amount to $11.18 million per individual for 2018. It is invested and managed just like option 1.

To the extent that any credit remains at death, it is applied against the estate tax. A key component of this exclusion is the basic exclusion amount (bea). Any tax due is determined after applying a credit based on an applicable exclusion amount.

The tax reform law doubled. For 2021, the personal federal estate tax exemption amount is $11.7 million (it was $11.58 million for 2020). The option of portability that existed before the tcja continues, meaning that through proper planning, a married couple can maximize their use of the exemption.

How did the tax reform law change gift and estate taxes? The credit is first applied against the gift tax, as taxable gifts are made. In 2017 the lifetime gift and estate tax exemption amount was $5.49 million per individual.

No tax is due at the time of the gift. Annual exclusion gift amount the gift tax annual exclusion (also simply called the annual exclusion) was not.

What Is The New Residential Property Tax Being Considered In Hawaii - Mansion Global

Global Guide To Force Majeure Amid Covid-19 Indonesia Global Law Firm Norton Rose Fulbright

Proposed Tax Changes In 35 Trillion Spending Package

Preparing For Sunset

Sunrise Sunset The Federal Estate Tax Is Back

Sunrise Sunset The Federal Estate Tax Is Back

Danielle Laporte Dreamjob Organized Creative I Am Kim Astin Dream Job Boundless Outdoor

Terms And Conditions Latam Pass

Sunset Provision Definition

Will The Lifetime Exemption Sunset On January 1 2026 - Agency One

No Matter The Challenge We May Face We Will Keep Marching Forward Shadow Photooftheday Sunset Soldiers Brave Israel Defense Forces Us Soldiers Soldier

Top Five Strategies For Avoiding Estate Taxes Estate Tax Garden Center Social Media Infographic

Surabaya Manufacturing A Treasured Potential For Doing Business

Lombok Sunset Tour

Sunrise Sunset The Federal Estate Tax Is Back

Hawaiis Revised Get Tax Rates By County New Tat Requirement 2019 -

Will The Lifetime Exemption Sunset On January 1 2026 - Agency One

Before The Estate Tax Exclusion Sunsets In 2026 Glorious Days Glorious Angels In Heaven

Cape Town Has To Be One Of The Most Beautiful Places On Earth This Is What It Looks Like When The Sun Sets In Cape Beautiful Places On Earth Sunset

Comments

Post a Comment