How does tavt impact vehicles that are leased? It has to fit into the same $10,000 limit as your sales tax, but if it does, you’ll want to take it.

The New Title Ad Valorem Tax - Tavt - In Simple Terms - Lake Lanier

The full amount is due upon titling any motor vehicle.

Georgia ad valorem tax rv. It replaced sales tax and annual ad valorem tax (annual motor vehicle tax) and is paid every time vehicle ownership is transferred or a new resident registers the vehicle in georgia for the first time. I didn't think much about it since it was new. The two changes that apply to most vehicle transactions are:

From the ga dept of rev motor vehicle dept. Seeking the fair market value under the title ad valorem tax (tavt), please refer to the tavt assessment manual. Title ad valorem tax estimator (calculator) get the estimated tavt tax based on the value of the vehicle

Other states register rvs just like a car.11 years and above are eligible for permanent registration with a fee of $237.50. Georgia sales or use tax is not due. Motor vehicle dealers should collect the state and local title ad valorem tax fee (“tavt”) from customers purchasing vehicles on or after march 1, 2013, that will be titled in georgia.

The basis for ad valorem taxation is the fair market value of the property, which is established january 1 of each year. You only pay this tax one time. An ad valorem tax lien attaches to a vehicle on (1) the date an individual permanently brings the vehicle into alabama, (2) the date the

The tax must be paid at the time of sale by georgia residents or within six months of establishing residency by those. This morning when the young lady said $665.36, i almost died. Therefore, unlike registration fees, taxes accumulate even when a vehicle is not used on the highway.

$20 for 5yrs (or $35 for 10 years) tax when registering vehicle from out of state: How does tavt apply to veterans? 0.5% title ad valorem tax.

You may also email your vin and current address to tag@gwinnettcounty.com to get an estimate. Ad valorem tax, more commonly known as property tax, is a large source of revenue for governments in georgia. Having done this we just went get our $20.00 tag and were hit with $50.00 highway impact fee which will be an annual fee!

This tax is based on the value of the vehicle. Get the estimated tavt tax based on the value of the vehicle using: When registering a rv in georgia, be prepared to pay the total ad valorem tax up front.

Some states, like massachusetts and georgia, apply a use tax to cars, boats, and rvs. The georgia title will be. Ad valorem tax or ‘use tax’ deduction.

Vehicles, purchased on or after march 1, 2013 and titled in georgia, are subject to title ad valorem tax (tavt) and are exempt from sales and use tax and the annual ad valorem tax. The ad valorem calculator can also estimate the tax due if you transfer your vehicle to georgia from another state. The new law covers all counties in ga!

Valid driver's license or picture id. You pay it upfront when you get your tags, but it’s deductible on your schedule a. Last year the ad valorem tax on the solitude was $586.56.

If you have a lienholder: We have since relocated up to georgia and brought the rv with us. If you are registering during the registration period for that vehicle, you will need to pay the ad valorem tax due at this time.

The commissioner of the georgia department of revenue is charged by law (title 48, chapter 5 article 10) with the annual valuation of the motor vehicles subject to taxation in this state. In the most recent legislative session, the georgia general assembly passed senate bill 65, which made several changes to the title ad valorem tax (tavt) code sections, which apply to vehicles purchased or sold on or after january 1, 2020. I asked why it went up when all other vehicles come down every year and she didn't have a.

The tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. Vehicles purchased on or after march 1, 2013 and titled in this state will be exempt from sales and use tax and the annual ad valorem tax. Problem is there's a 7% ad valorem tax that will be assessed on our rv when we register it based on fair market value.

Proof of residency (e.g., utility bill, lease, etc.). The tavt rate will be lowered to 6.6% of the fair. In 2013, georgia created the title ad valorem tax, or ga tavt, for vehicles purchased in march 2013 and later.

This calculator can estimate the tax due when you buy a vehicle. The dealership is responsible for paying the title ad valorem tax and may include this cost in the term of the lease. Title ad valorem tax (tavt) became effective on march 1, 2013.

Dealerships will be required to collect the tavt on behalf of the customer and Payment of the tavt provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax, or. Ad valorem tax is based on the value of property, not a usage tax and follows the property from owner to owner.

Rv sales tax (ad valorem) is actually 7%. Most of these fees are reoccurring. Contact us with your vehicle identification number (vin) and current address, and we can calculate an estimate of taxes due.

All of these fees vary by state, so these georgia state taxes are something to compare and to take into consideration when choosing an rv domicile.

Tax Rates Gordon County Government

2

Motor Vehicle Division Georgia Department Of Revenue

2

Georgia Motor Vehicle Ad Valorem Assessment Manual

Georgia Used Car Sales Tax Fees

Sales Tax On Cars And Vehicles In Georgia

Vehicle Taxes Dekalb Tax Commissioner

Middle Georgia Commercial Property Georgia Commercial Real Estate Commercial Real Estate Commercial Property Industrial Park

Georgia Listed As A Tax-friendly State For Retirees

2

Georgia Motor Vehicle Ad Valorem Assessment Manual

2

Tax Commissioner Camden County Ga - Official Website

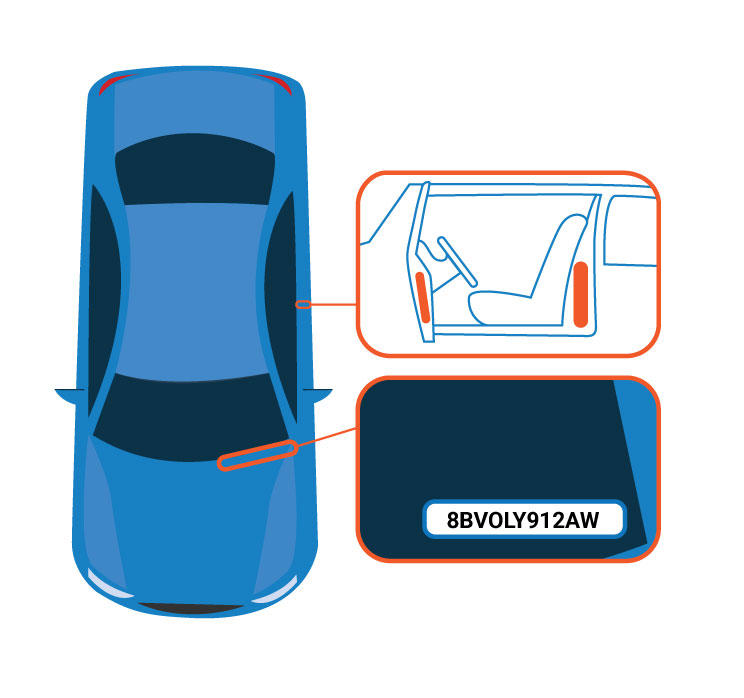

Vin Check Georgia Department Of Revenue

2

Tax Rates Gordon County Government

Middle Georgia Commercial Property Georgia Commercial Real Estate Commercial Real Estate Commercial Property Milledgeville Georgia

Georgia Bill Of Sale Form Printable - Images Nomor Siapa

Comments

Post a Comment