Read through the recommendations to determine which info you will need to give. The date of the transaction follows.

Fillable Online Home Depot Tax Exemption Document Home Depot Tax Exemption Document Fax Email Print - Pdffiller

Customers are shocked when it doesn't work on door installations.

Home depot tax exempt canada. Many of our home depot pro customers make purchases that qualify for tax exemption. Once you complete this process and receive your id number, you can use your tax exemption at home depot stores immediately. May 11, 2010 10:30 am et cbc's journalistic standards and practices | about cbc news

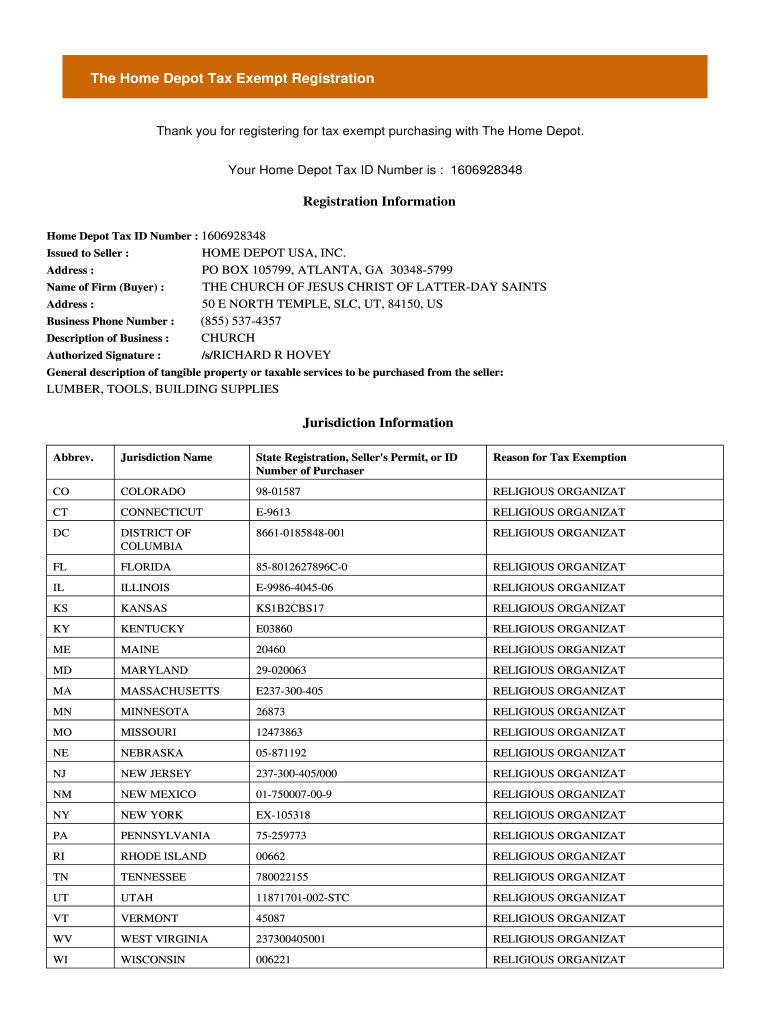

The number is auto assigned by the system during the registration process. 1501 page mill road, palo alto, california. To get started, we’ll just need your home depot tax exempt id number.

Yes, books which are always exemption from any pst. The home depot foundation since 2011, the foundation has invested more than $400m in veteran causes and improved more than 50,000 veteran homes and facilities. This version replaces the one dated march 2001.

Sadly most large vendors (home depot, walmart, grocery stores.) have a custom process too, on top of the states but the 1 home depot tax exempt id should work for all the states listed above. The foundation has pledged to invest half of a billion dollars in veteran causes by 2025 and $50 million in training the next generation of skilled tradespeople through the path to pro program. If your purchases qualify for exemptions, we’re here to help you.

For instance if the number reads: Just to show that this one is really a book: Here’s a quick list of retailers you can gain tax exempt status with:

Weekly specials for your nearest store. The process of applying a tax exemption to an online order begins with placing the order online. In fact, in that province, home depot does not sell products that are exempt from provincial sales tax.

Keep to these simple instructions to get home depot tax exempt ready for sending: (canada) and whose property is exempt from taxation under section 87 of the. There are nearly endless retailers that can provide you with tax exempt purchases if you.

Gst/hst memorandum 17.16 august 2014. If it were up to me, the customer would have to show an id. Tax exemption is across the board.

(cbc)cecile dumont, a retired bell canada employee, told cbc news the incident happened thursday morning when she requested a provincial sales tax exemption for a $17 purchase of some replacement. Open the form in the online editor. Books must be taxed only with 5% gst portion of hst.

Find the document you want in our library of legal templates. Never pay more than you need to. View or make changes to your tax exemption anytime.

Retail giant home depot has been mistakenly charging customers seven per cent provincial sales tax on dozens of tax exempt items for the past year and a. Ad find the latest the home depot flyer online. It also cancels and replaces the following gst/hst policy statements:

The id number will be numeric only and is displayed on the printed registration document. Select the fillable fields and put the necessary data. That work with volunteers with the goal to improve the health of their community.

Once the order is placed, you must email proof of tax exception as well as your order number to: Provincial sales tax (pst) bulletin. 2455 paces ferry road, atlanta, georgia doing business as:

It's too easy to memorize some of these numbers. And canada are eligible, though they are only presented in terms of usd. Home depot donation request for community impact grants.

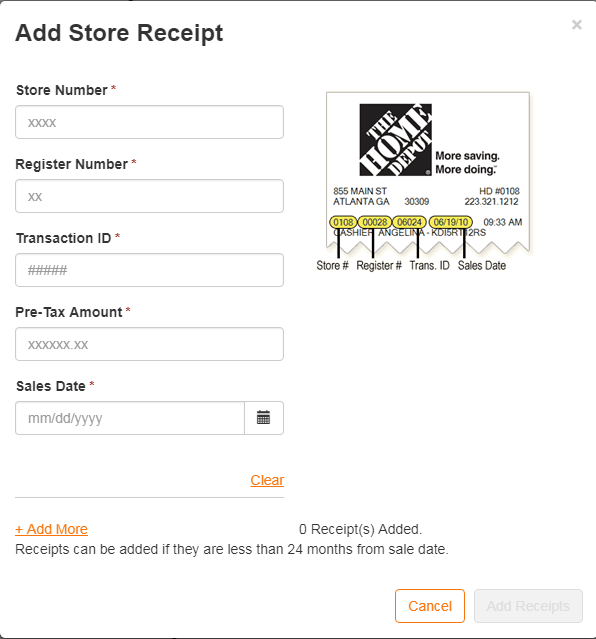

Get the best sale prices. It is very important that these details are received promptly and before the payment method is charged and the order is shipped. If you have tax exempt status, use our online form to provide your tax exempt information, and we will provide you with a home depot tax id, allowing you to make tax exempt purchases in our stores.

Et monday through friday view tax exempt customer faqs Once you complete this process and receive your id number, you can use your tax exemption at home depot stores immediately. What is tax exempt at home depot?

The home depot sites the home depot the home depot canada the home depot mexico need help with your registration? The home depot tax exempt id number is used when making tax exempt purchases in lieu of the state issued tax exempt id number. 1246 00000 00117 then you made the 117th purchase in store 1246 in the current year.

Home Depot Charges 13 Hst On Tax Exempt Items Again Trueler

Add Home Depot Store Receipt - Hammerzen

Tax Exempt Purchases For Professionals At The Home Depot

Career Pivot Small Business Ideas Passive Income Marketing Content Marketing Business Ent Start Up Business Small Business Start Up Relationship Marketing

Document

Home Depot 2008 Proxy Statement

26 Ways To Save At Home Depot Every Time You Shop

Tax Exempt The Home Depot

Help You Get Homedepot Tax Exempt All States The Legal Way By Ayoubhassab Fiverr

Simbolo De Libra De Ouro Simbolo Da Libra Esterlina Isolado No Branco Foto Premium Tax Consulting Tax Advisor Firm

Home Depot Tax Exempt - Fill And Sign Printable Template Online Us Legal Forms

Home Depot Charges Bc Tax On Exempt Items Cbc News

Supplyworks - The Home Depot Pro Institutional - Office Work And Janitorial Supplies - The Home Depot Pro - Institutional

Pro Customer Support Help Center

2

Home Depot 2007 Annual Report

Example Of A Youtube Ad Youtube Advertising Youtube Ads Youtube

Do Home Depot Sales Tax Exemption By Rawal16 Fiverr

Home Depot Tax Exemption Application - Youtube

Comments

Post a Comment