You can also select future and historical tax years for additional income tax calculations (where figures are held, if you would like to. Individuals are taxed only on the income earned in singapore and the tax rates for resident taxpayers are progressive, with higher rates being applied to higher income levels.

A Guide To Singapore Personal Tax

The singapore income tax calculator is designed for tax resident individuals who wish to calculate their salary and income tax deductions for the 2021 assessment year (the year ending 31 december 2020.

Income tax calculator singapore. Please refer to how to calculate your tax for more details. Calculating taxable income in singapore. From the year of assessment 2018, the total amount of reliefs you can claim is subject to an overall relief cap of $80,000note 2.

Generally, deductible business expenses are those ‘wholly and exclusively incurred in the production of income’. Example salary illustrations for singapore including income tax and expense deductions. Mr heng's tax payable on his chargeable income of $34,750 is calculated as follows:

Welcome to the singapore tax calculator. Filing your singapore corporate tax. The current highest personal income tax rate is at 22%.

Details about income tax in singapore. Simple tax calculator which is used to calculate the income tax for the singapore resident individuals. Enter your gross employment income for the previous year (including any bonuses, fixed allowances and any benefits in kind).

Individual income tax, corporate tax, withholding tax, property tax and goods and services tax. An extra 50% exemption on the next $190,000 of normal chargeable income. The personal income tax rate in singapore is one of the lowest in the world and depends on the residency status.

For singapore tax purposes, taxable income refers to: More details about singapore resident tax rates can be found here. You can also visit the iras website for an updated tax calculator.

Employment income employment income enter your gross employment income for the previous year (including any bonuses, fixed allowances and any benefits in kind). Singapore personal income tax calculator. Income tax rates for singapore residents ya 2019 onwards

Your chargeable income is the amount remaining after deducting from your assessable income the personal reliefs to which you are entitled. To understand what you owe to the iras, you need to know how personal tax calculations are done under the progressive rate system. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates.

Tax clearance calculator y tax clearance is not required for the following scenarios: This website has been made for you to quickly get an idea of the amount of taxes you might have to pay especially for the work visa holders. Director's fees and other income are taxed at the prevailing rate of 22%.

Icalculator singapore income tax salary calculator is updated for the. You are not entitled to tax reliefs. Do not deduct cpf paid.

Year of assessment (ya) 2015 (income generated in the basis period 1 january 2014 to 31 december 2014) income; Please feel free to leave the comments below at the bottom of this page. When it comes to preparing your tax return you want to make sure you have all the bases covered.

You may also use the tax calculator for resident individuals (xls, 96kb) to estimate your tax payable. Other gains that are revenue in nature. Income tax calculators for individuals, businesses, gst, property, etc are conveniently provided by the inland revenue authority of singapore (iras) on its website.

Tax on next $4,750 @ 3.5%. Tax rates range from 0% to 22% for residents. On the first $10,000 of normal chargeable income, there is a 75% exemption;

Type your personal income details in the following form to calculate your tax payable. The personal income tax system in singapore is a progressive tax system. The highest personal income tax rate of 22% are for individuals with an annual taxable income of more than $320,000.

Singapore personal income tax calculator ya2020. This application is a service of the singapore government. Here is a table with details of all the income tax slab structures.

Understanding the concept of taxable income is very important to avoid making filing mistakes. Tax implications for foreigners at a glance (in singapore for 61 to 182 days in a year) your employment income is taxed at 15% or progressive resident rates, whichever results in a higher tax amount. Filing your returns could be daunting if you have zero knowledge about tax filing.

You can work out your annual salary and take home pay using the singapore salary calculator or look at typical earning by entering a figure in the quick calculator or viewing one of the salary examples further down this page. Refer to singapore iras to know exactly how taxation works for you. Mytax portal is a secured, personalised portal for you to view and manage your tax.

If you are a resident in singapore, the rates of tax chargeable are as follows: Code to add this calci to your website just copy and paste the below code to your webpage where you want to display this calculator. For example, individual tax residents can utilise the income tax calculator under individual income tax to compute their tax liability.

Below is a snapshot of a personal income tax calculator in excel format. Singapore’s personal income tax rate ranges from 0% to 22%. Example of a standard personal income tax calculation in singapore this site uses cookies to collect information about your browsing activities in order to provide you with more relevant content and promotional materials, and help.

Excel Investment Singapore Iras Income Tax Calculator

Your Cheat Sheet Personal Income Tax In Singapore

Donation Tax Calculator - Giving Nus Yong Loo Lin School Of Medicine Giving Nus Yong Loo Lin School Of Medicine

Singapore Individual Income Tax Filing For 2016

Personal Income Tax Calculator Singapore

How To Calculate Your 2013 Expatriate Individual Income Tax In China - China Briefing News

Taxation System In Indonesia Your Guide To Income Taxation

Personal Income Tax Rates For Singapore Tax Residents Ya 2010-2019

How To Calculate Foreigners Income Tax In China China Admissions

Income Tax Singapore Vs Us

Taxation System In Indonesia Your Guide To Income Taxation

How To File Income Tax In Singapore And What You Need To Know

How Much Income Tax Should I Pay Calculator - Tax Walls

Calculating Individual Income Tax On Annual Bonus In China - Updates Dezan Shira Associates

Singapore Tax Calculator On Google Spreadsheet Just2me

Singapore Income Tax Calculator - Corporateguide Singapore

Personal Income Tax Rates For Singapore Tax Residents Ya 2010-2019

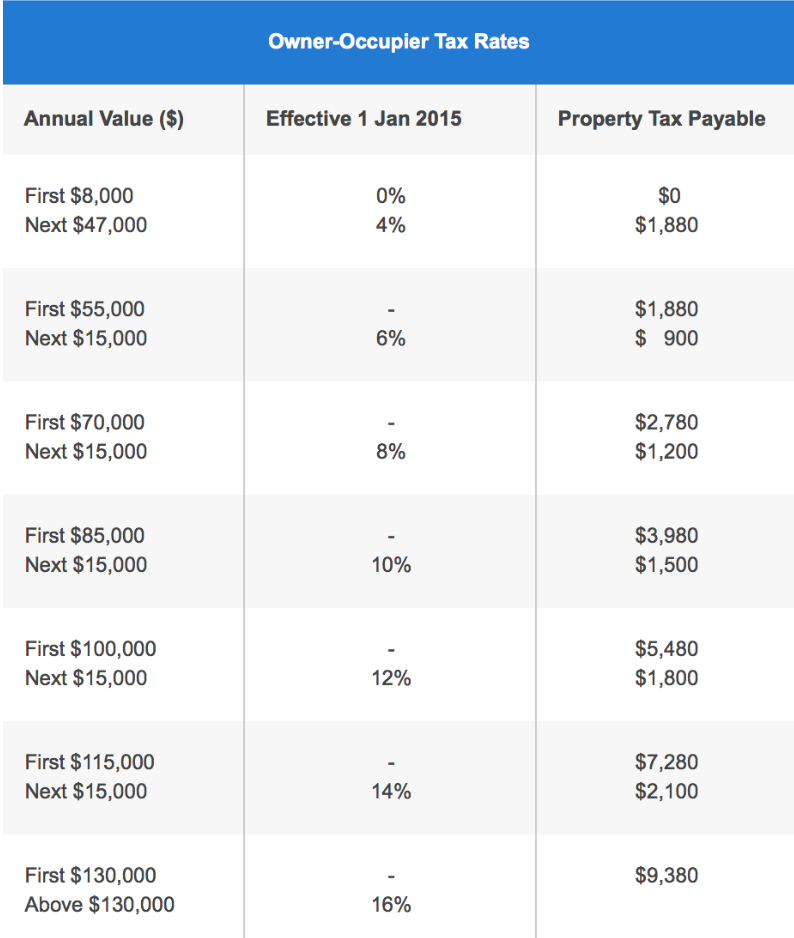

Property Tax For Homeowners How Much To Pay Rebates Deadline 2021 Update

Singapore Personal Income Tax Taxation Guide

Comments

Post a Comment