Kaufman county tax office p.o. These guys put the wrong mileage on my title and….

Kaufman Cad Official Site Kaufman Tx

(except for county approved holidays) kaufman county tax office locations:

Kaufman county tax office kemp tx. Kaufman county courts and offices will close at 3 p.m. When contacting kaufman county about your property taxes, make sure that you are contacting the correct office. The current total local sales tax rate in kemp, tx is 8.250%.

Box 339 kaufman, texas 75142 Just print and go to the dps. The tax office, its officers, agents, employees and representatives shall not be liable for the information posted on the tax office website in connection with any actions losses, damages, claims or liability in any way related to use of, distribution of or reliance upon such information.

Dps & dmv locations near kaufman county registration & titling. Address and phone number for kemp police department, a police department, at west 11th street, kemp tx. The kaufman county district clerk’s office is at 100 w.

Change of address on motor vehicle records. Kemp, tx sales tax rate. These records can include kaufman county property tax assessments.

However, any remaining balance not paid by january 31st will begin to accrue penalty and interest. On wednesday, november 24 and will be closed on thursday, and friday, november 25. Kaufman county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in kaufman county, texas.

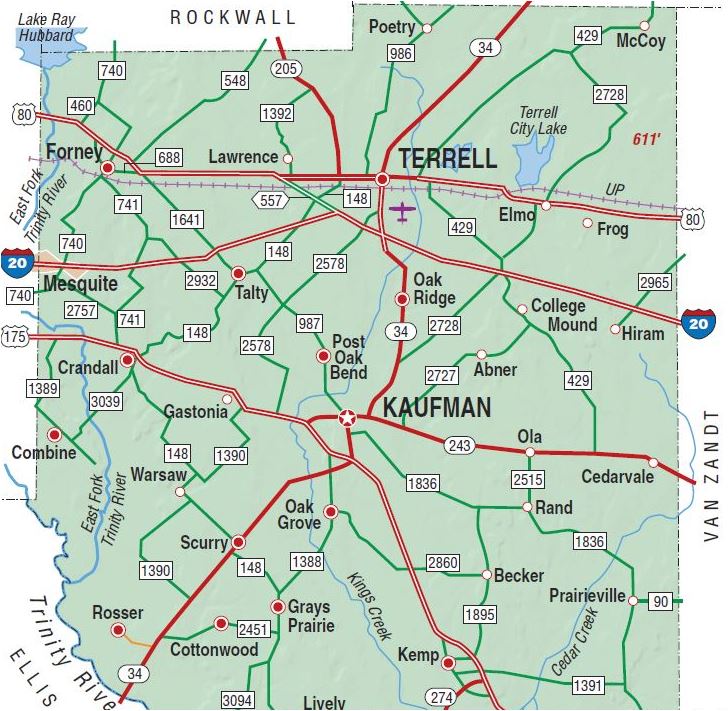

Crandall, combine, dallas, forney, grays prairie, kaufman, kemp, lawrence, mabank, oak grove, oak ridge, post oak bend, rosser, scurry, talty, terrell 9.5 miles terrell driver license office; Kemp is eight miles southeast of kaufman in southeastern kaufman county.

Get reviews, hours, directions, coupons and more for kaufman county sub courthouse. Tract 1 fm road 1895 kemp tx 75143 was recently sold. Kemp police department contact information.

Kemp was named for malvina kemp watkins, wife of john marr watkins, the first postmaster, and was officially established when the post office opened in 1851. Search for other justice courts on the real yellow pages®. Enjoy the pride of homeownership for less than it costs to rent before it's too late.

Texas, select county marriage records, 1837. County & parish government government offices. Registration renewals (license plates and registration stickers) vehicle title transfers.

See detailed property tax report for 15426 county road 236, kaufman county, tx the texas tax code establishes the framework by which local governments levy and collect property taxes. Horrible and rude customer service. County offices/courts closed for thanksgiving.

Passing the texas written exam has never been easier. Get reviews, hours, directions, coupons and more for kaufman county sub courthouse at 103 n main st, kemp, tx 75143. It's like having the answers before you take the test.

It is a 15.50 acre(s) lot, in j s ables surv abs #3. Kemp is on state highways 175 and 274 and farm roads 1895 and 1391 near cedar creek reservoir. The december 2020 total local sales tax rate was also 8.250%.

The supervisor is very ugly over the phone and unhelpful. Kaufman cad strives for excellence in the provision of quality appraisals with sensitivity to the cost of operations and also the interaction with property owners. “improving and maintaining the accuracy and uniformity of appraisals of all property in kaufman county”.

Kaufman county tax office does accept partial payments, but does not make formal payment arrangements other than the over 65 homestead plan. Usually county governments impose the largest taxes, and often there are additional taxes imposed by special taxation districts.

The Kaufman County - Kaufman County Sheriffs Office Facebook

Kaufman County Texas Property Search And Interactive Gis Map

Kaufman Cad Official Site Kaufman Tx

Kaufman-county Property Tax Records - Kaufman-county Property Taxes Tx

Another Way To Fight Property Taxes A Mayor Sues County Appraisal District Over Faulty Appraisals

2 Acres Kemp Tx Property Id 12597227 Land And Farm

Kaufman-county Property Tax Records - Kaufman-county Property Taxes Tx

Kaufman County Tax Sales - Home Facebook

Tax Assessor Kaufman County

Kemp Texas - Wikipedia

Home Kaufman County

Kaufman Cad Official Site Kaufman Tx

Kaufman Cad Official Site Kaufman Tx

Kaufman Cad Official Site Kaufman Tx

Tax Assessor Kaufman County

Kemp Texas - Wikiwand

Kaufman County Sheriffs Office - Home Facebook

Home Kaufman County

Kaufman Cad Official Site Kaufman Tx

Comments

Post a Comment