Shop cars in your budget. Your county vehicle property tax due.

3 Ways To Set Aside Money For Taxes - Wikihow

Estimate your monthly payments with cars.com's car loan calculator and see how factors like loan term, down payment and interest rate affect payments.

Nc estimated tax payment calculator. Federal and state tax for lottery winnings on lump sum payment in usa. This is a free online estimator tool; This link opens in a new window.

Estimate your monthly payments with pmi, taxes, homeowner's insurance, hoa fees, current loan rates & more. This is computed as federal taxes + state taxes. Please try again later for the most accurate estimations.

Our calculator has recently been updated to include both the latest federal tax rates, along with the latest state tax rates. North carolina salary tax calculator for the tax year 2021/22 you are able to use our north carolina state tax calculator to calculate your total tax costs in the tax year 2021/22. Should i be making quarterly (estimated) tax payments to the irs?

This basically means you need to pay a portion of your expected tax bill four times per year, instead of all at the end of the tax year. Your household income, location, filing status and number of personal exemptions. Check out the web's best free mortgage calculator to save money on your home loan today.

If you make $55,000 a year living in the region of new york, usa, you will be taxed $12,213.that means that your net pay will be $42,787 per year, or $3,566 per month. Now you know more about small business taxes than the vast majority of their owners. The taxes you will have to pay in order to receive your prize.

For example, if an employee earns $1,500 per week, the individual’s annual income would be 1,500 x 52 = $78,000. Also, learn more about auto loans, experiment with other car related calculators, or explore other calculators covering finance, math, fitness, health, and many more. Use zillow’s home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for pmi, property taxes, home insurance and hoa fees.

The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. This calculator is designed to estimate the county vehicle property tax for your vehicle. You can also pay your estimated tax online.

Your payment amount (use our calculator!) your ssn. We strive to make the calculator perfectly accurate. Percent of income to taxes = 34%.

Lottery tax calculator calculates the lump sum payments, taxes on the lottery and tries to provide accurate data to the user. This calculator is intended for use by u.s. The irs uses many factors to calculate the actual tax you may owe in any given year.

It's fast and free to try and covers over 100 destinations worldwide. Total estimated tax burden $25,676. Our income tax calculator calculates your federal, state and local taxes based on several key inputs:

** estimated monthly payment may be inaccurate without title, taxes, and fees. The provided information does not constitute financial, tax, or legal advice. Utilize the many free tax tools courtesy of efile.com here.if you just want to estimate your tax refund date or the date you can expect your tax refund money in your bank account during.

Additional tax withheld, dependent on the state. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Also offers loan performance graphs, biweekly savings comparisons and easy to print amortization schedules.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. If you expect to owe more than $1,000 on taxes, then you should be making quarterly estimated tax payments. Your spouse’s ssn (if married) bank account details.

Estimated tax title and fees are $0, monthly payment is $384, term length is 72 months, and apr is 7%. Secondly, you’ve learned that the state. Due to federally declared disaster in 2017 and/or 2018, the irs will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

Irs tax tables and tax rate schedules and forms. Your average tax rate is 22.2% and your marginal tax rate is 36.1%.this marginal tax rate means that your immediate additional income will be taxed at this rate. Please enter the following information to view an estimated property tax.

Most of the lottery winners want a lump sum payment immediately. This calculator helps you to calculate the tax you owe on your taxable income. For details, visit www.ncdor.gov and search for online file and pay. for calendar year filers, estimated payments are due april 15, june 15, and september 15 of the taxable year and.

On the first screen, select “estimated tax” as the reason for payment, “1040es” as the apply field, and the. To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. The calculator should not be used to determine your actual tax bill.

This varies across states, and can range from 0% to more than 8%. How to calculate taxes taken out of a paycheck

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

How To Record Paid Estimated Tax Payment

Pdf Property Tax In Indonesia Measuring And Explaining Administrative Under- Performance

How To Calculate Estimated Taxes The Motley Fool

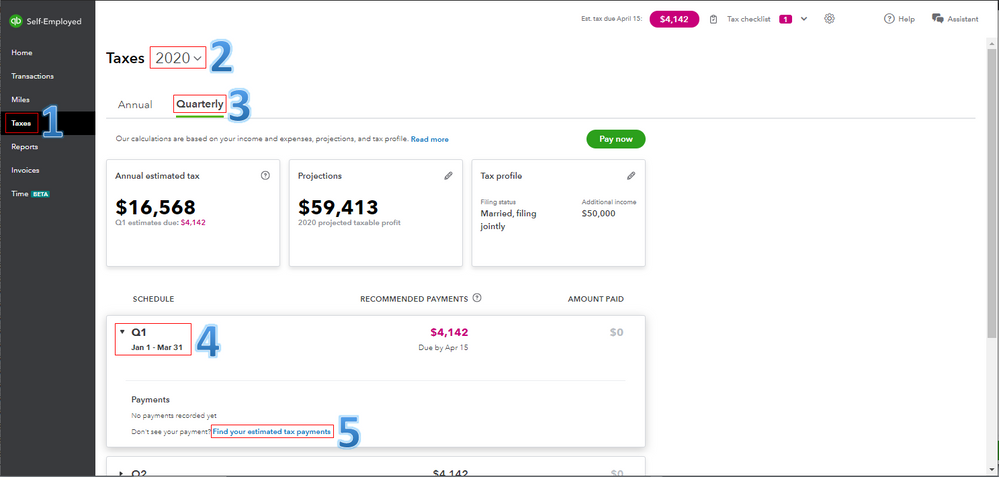

Quarterly Tax Calculator - Calculate Estimated Taxes

Quarterly Tax Payment For Doordash Grubhub Drivers - Entrecourier

Quarterly Tax Calculator - Calculate Estimated Taxes

Quarterly Tax Calculator - Calculate Estimated Taxes

How To Calculate Quarterly Estimated Taxes In 2021 1-800accountant

State Returns - Estimated Tax Vouchers Direct Debit

Selling Property In India Here Are Some Reminders - Property Lawyers In India Legal Services Consulting Business Properties Of Matter

What You Should Know About Estimated Tax Payments - Smartasset

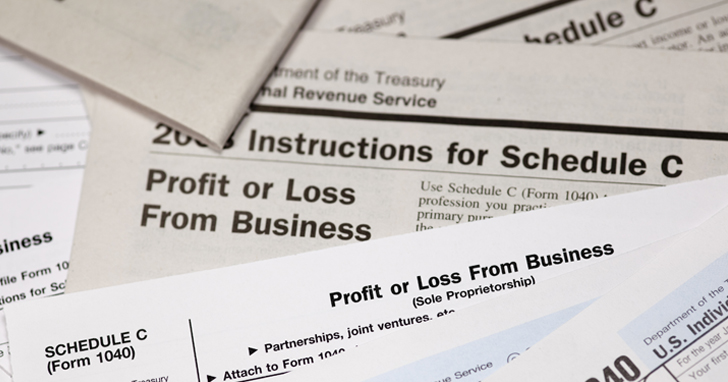

Business Taxes Annual V Quarterly Filing For Small Businesses - Synovus

Need A Household Employer Unified Registration Form Heres A Free Template Create Ready-to-use Forms At Formsbankcom Registration Form Employment Form

Pin On Us Tax Forms And Templates

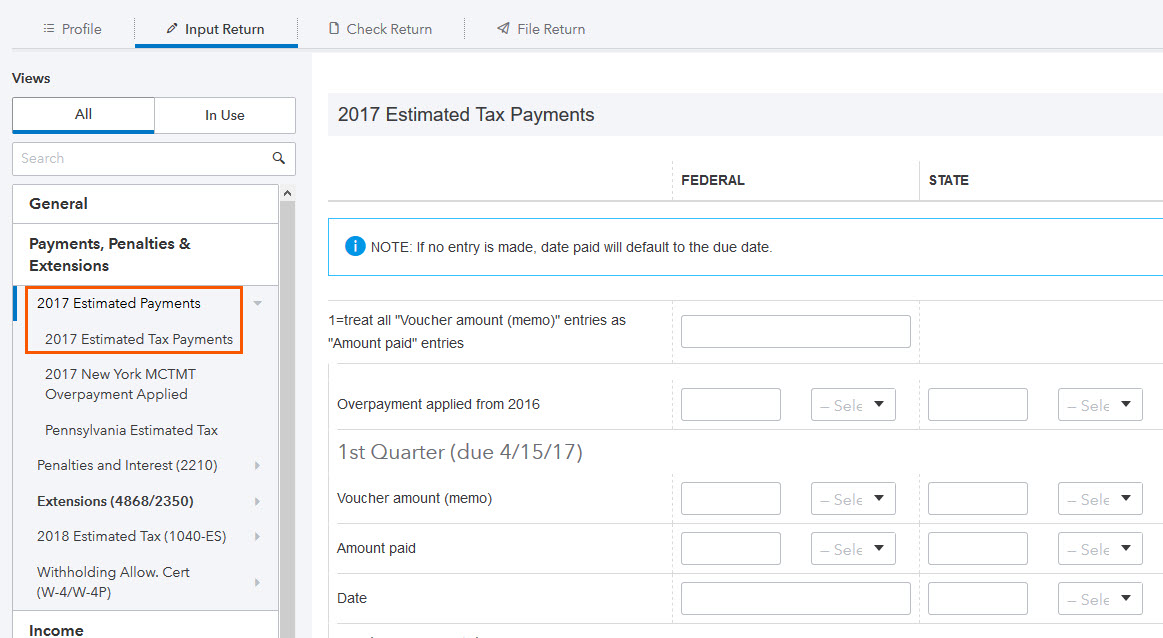

How Do I Enter Estimated Tax Payments In Proconnec - Intuit Accountants Community

How To Record Paid Estimated Tax Payment

Apply My Tax Refund To Next Years Taxes Hr Block

Pin On Taxes

Comments

Post a Comment