If you did not withhold transit tax from your first july payroll (because it was paying wages earned in june), this report will not work for your company. Because employers will begin withholding the new transit tax on july 1, 2018, they will need to file a statewide transit tax return beginning for the third quarter 2018, due by october 31, 2018.

Oregon Transit Tax - Procare Support

Employees who aren’t subject to regular income tax withholding due to high exemptions, wages below the threshold for income tax withholding, or other factors are subject to statewide transit.

Oregon statewide transit tax filing. The statewide transit individual (sti) tax helps fund public transportation services within oregon. The statewide transit individual (sti) tax helps fund public transportation services within oregon. File electronically using revenue online.

Use the detail report to list employee names, wages, and withheld transit tax. There is no minimum threshold for filing the statewide transit taxreturn. This requirement mirrors the requirements for state income tax withholding.

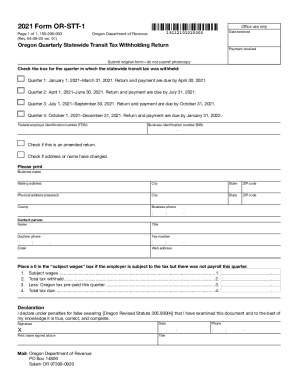

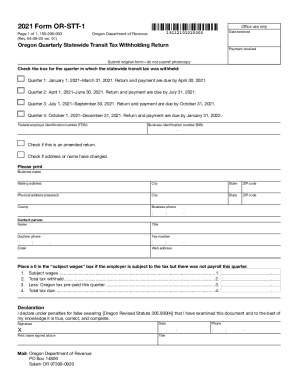

01) date received payment received submit original form—do not submit photocopy place a 0 in the “subject wages” box if the employer is subject to the tax but there was not payroll this quarter. The statewide transit tax is a tax on employee wages that are deducted, withheld, reported, and paid to the department of revenue by the employer. This report assumes that all wages paid in the quarter were subject to the new oregon statewide transit tax report.

The oregon department of revenue is still finalizing their process for filing and paying these taxes. Visit our forms page and search for stt. fill out the form and mail to: Available for pc, ios and android.

This tax is not related to the lane or trimet transit payroll taxes, it is in addition to all other local tax codes for oregon. To amend data on the oregon quarterly statewide transit tax return, make any necessary changes on the return and check the box identified as “amended” at the top half of the return. Click accounts affected , choose do not affect accounts or affect liability and expense accounts.

This tax will be strictly enforced and employers could face penalties if they do not withhold this tax in a timely manner. Even if the amount of statewide transit tax withholding is minimal, you still need to file the return and remit the amount of tax withheld each quarter (unless you’re an annual filer). The statewide transit tax is calculated based on the employee’s wages as defined in ors 316.162.

Oregon tax filing and payment deadline from april 15, 2020 to july 15, 2020. Dor requires all submitted forms to be complete, legible, and on approved agency forms. Send your amended return to.

(8) oregon residents subject to the tax imposed under ors 320.550 (tax on wages) who have wages earned outside of oregon from an employer not doing business within oregon, and whose tax was not withheld by the employer, must file a return and pay statewide transit tax due on or before the due date of the personal income tax return under ors 314.385 (form of returns)(1) for the tax year. All forms are printable and downloadable. Start a free trial now to save yourself time and money!

Employers that expect their statewide transit tax liability to be less than $50 per year may request to file and pay the tax annually instead of quarterly. — the statewide transit tax is not the same as transit payroll taxes (trimet and lane transit). The most secure digital platform to get legally binding, electronically signed documents in just a few seconds.

The sti tax is calculated on wages earned by an employee who is an oregon resident regardless of where the work is performed, or an employee who is a nonresident who performs. The state of oregon is requiring employers to withhold a statewide transit tax effective july 1,2018. There is no extension to the filing and payment deadline for the statewide transit tax.

2021 form or stt 1. Once completed you can sign your fillable form or send for signing. The statewide transit taxable wages field will still exist as an optional field in the department's manual entry, spreadsheet import, and bulk filing options.

Cannot use the oregon quarterly tax report (form oq) to report statewide transit taxes. Signature date phone title x The 2017 oregon legislature passed house bill (hb) 2017, which included the new statewide transit tax.

Use this spreadsheet to import information. As we previously reported, legislation enacted in 2017 created the new payroll tax on oregon residents and nonresidents working in oregon to fund state highway upgrades. As a result, interest and penalties with respect to the oregon tax filings and payments extended by this order will begin to accrue on july 16, 2020.

Oregon employers are responsible for withholding the new statewide transit tax from employee wages. There is no minimum dollar threshold for filing and remitting the statewide transit tax, even if the amount of statewide transit tax withholding is minimal. Employers must also report and remit the taxes withheld.

Enter a negative adjustment if it is a reduction in the liability balance and a positive adjustment if it is an increase in the tax liability. If employees don’t report or pay on time, they may be subject to penalties and interest. You need to file the return and remit the amount of tax withheld each quarter unless you’re an annual filer (agricultural employers).

Another crystal report, with date ranges, will need to be used to accommodate your statewide transit tax reporting.

Oregon Statewide Transit Tax

What Is The Oregon Transit Tax How To File More

Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

Oregongov

Oregongov

Oregon Transit Tax - Procare Support

Oregongov

Oregon Transit Tax - Procare Support

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

2021 Form Or Stt 1 - Fill Out And Sign Printable Pdf Template Signnow

Oregongov

Oregongov

Oregon Statewide Transit Tax

Oregongov

Comments

Post a Comment