If your real estate account does not show on the my accounts screen, it is because real estate account types generally do not automatically link when registering. Houses (4 days ago) property tax records prince william county va real estate.

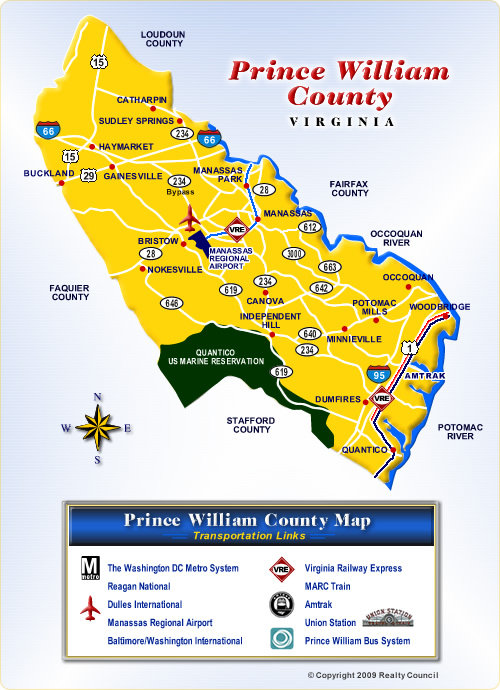

Map Search Realty Council

3, 2021, the amount of the installment is past due.

Prince william county real estate tax due dates 2021. During a meeting on nov. (1 days ago) prince william county real estate taxes for the first half of 2020 are due on july 15, 2020. Personal property taxes and vehicle.

Prince william county real estate tax search. During the july 14 meeting, the prince william board of county supervisors voted to defer payments for the first half of the real estate taxes due on july 15, 2020, until oct. Prince william county has one of the highest median property taxes in the united states, and is ranked 120th of the.

(4 days ago) all real property in prince william county, except public service properties (operating railroads, interstate pipelines, and public utilities), is assessed annually by the real estate assessments office. Board extends due date for real estate taxes. City of manassas park (e.g.

By creating an account, you will have access to balance and account information, notifications, etc. All real property in prince william county, except public service properties (operating railroads, interstate pipelines, and public utilities), is assessed annually by the real estate assessments office.the assessments office mailed the 2021 assessment notices beginning march 9, 2021. The extension applies to both commercial and residential real property.

There are several convenient ways property owners may. Prince william county collects, on average, 0.9% of a property's assessed fair market value as property tax. In 2021, at a 7% increase.

By mail to po box 1600, merrifield, va 22116. Prince william county real estate taxes for the first half of 2021 are due on july 15, 2021. The assessments office mailed the 2021 assessment notices beginning march 9, 2021.

The next thing tax due dates for prince william county all about deepening the connection with news 1780 millville ave hamilton oh realtor hamilton county ohio real estate tax bills hamilton county ohio auditor real estate county auditor butler county auditor hamilton oh county auditor real estate taxes hamilton county there are approximately 160 000 real estate parcels in butler. Prince william county virginia property tax The median property tax in prince william county, virginia is $3,402 per year for a home worth the median value of $377,700.

The change would lower the average residential real estate tax bill increase from $306 to $264, wheeler said. The deadline has been changed from dec. 17, 2020, the prince william board of county supervisors passed a resolution extending the payment deadline for real estate taxes for the second half of 2020 for 60 days.

4, 2021, a 10% penalty is applied, and. The due date for 2nd half 2021 real estate taxes is december 6, 2021. The due date for 2 nd half 2021 real estate taxes is december 6, 2021.

Houses (5 days ago) deed & land records faqs. The extension applies to both commercial and residential real property. You can pay a bill without logging in using this screen.

Electronic check or credit card online at tax.pwcgov.org; However, we can assist you in linking your real estate account. Prince william county real estate taxes for the first half of 2020 are due on july 15, 2020.

Prince william supervisors extend deadline for real estate taxes to oct. Click here to register for an account (or here to login if you already have an account). During a meeting on nov.

The special district taxes levy funds the operation of volunteer fire and rescue companies, storm water management programs, solid waste management programs, and other public. Prince william county supervisors are set for the first test of their stance on a potential 7% increase in real estate tax bills for county homeowners. There are several convenient ways property owners may make payments:

Best Of Prince William 2019 By Insidenova - Issuu

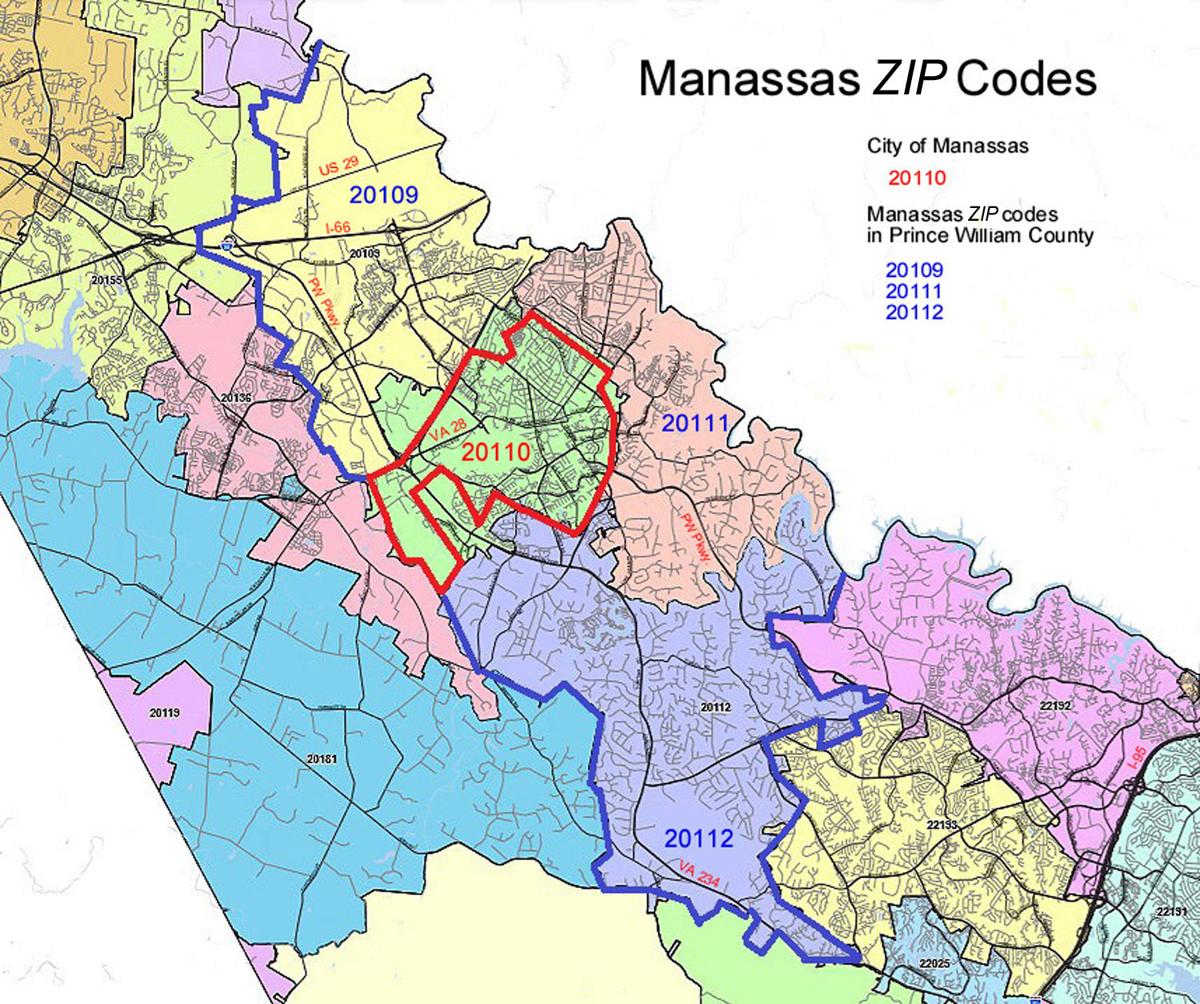

Guest Column When Is Manassas Not Manassas Opinion Princewilliamtimescom

Prince William Supervisors Approve Second Amendment Sanctuary Resolution Wtop News

Historic-preservation-coordinator Job Details Tab Career Pages

How Healthy Is Prince William County Virginia Us News Healthiest Communities

Personal Property Taxes For Prince William Residents Due October 5

Prince William County Looking To Attract More Offices Mixed-use Projects Prince William Insidenovacom

A Message From The Chief

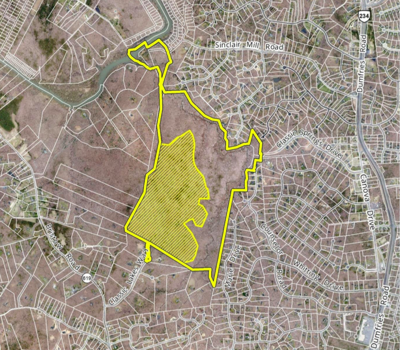

New 800-acre Data Center Campus Proposed In Prince William County Virginia - Dcd

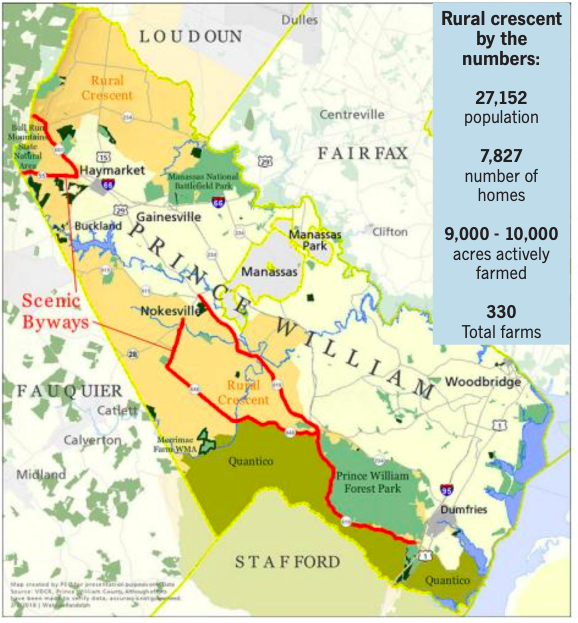

Prince William Board Approves Housing Development In Rural Crescent Headlines Insidenovacom

Whats So Great About Western Prince William County Manassas Va Patch

Heres How Metro Would Change Prince William County Development With A Quantico Extension - Washington Business Journal

About Us

Bocs Approves Land Purchase In Historic Thoroughfare Community Prince William Living

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Democratic Supervisors Open To More Homes Industrial Uses In The Rural Crescent News Princewilliamtimescom

2021 Best Places To Live In Prince William County Va - Niche

Prince William County Police Department - Home Facebook

Heres How Metro Would Change Prince William County Development With A Quantico Extension - Washington Business Journal

Comments

Post a Comment