So, reits have a somewhat complicated tax structure when it comes to their dividends. Second, your reit can also provide you with income in the form of share growth.

A Short Lesson On Reit Taxation - Intelligent Income By Simply Safe Dividends

The rate shareholders will pay depends on how long they owned the reit and their marginal tax rate.

Reit dividend tax rate 2021. However, reit dividends are typically made up of. Listed reits in malaysia are exempted from annual tax assessment if they distribute 90% of the year’s total income to unitholders. The following four tables break down the current tax rates assessed on qualified dividends, depending on your taxable income and filing status in 2020 and 2021:

The majority of reit dividends are taxed as ordinary income up to the maximum rate of 37% (returning to 39.6% in 2026), plus a separate 3.8% surtax on investment income. Such dividends may qualify for tax exemption if certain conditions are met. Recipient’s country (alphabetical order) maximum tax rates (%) remarks dividends interest redemption australia 10/15 *1 0 *2 /10 0 *2 /10 *1:

The brackets are slightly lower than 2021, but the same rates apply. Again, this could reach a combined rate of 51%. Are great for american investors since they do not charge withholding taxes for dividends.

With most stocks, taxation is fairly straightforward. However, since a reit pays no corporate tax, the dividends from reit stocks are not qualified. Individuals and trusts tax rates from 1 march 2021 to 28 february 2022:

Eligible for the annual dividend tax allowance (which is £2k in 2021/22). Investor after tax return from uk company after tax return from uk reit enhancement of return uk pension funds/isas, sipps and sovereign wealth funds 75 100 33.3% overseas investor (beneficial tax treaty)75 85 13.3% uk individual basic rate (20%) tax payer 69 80 15.8% uk individual higher rate (40%) tax. The withholding tax rate is 10% plus surcharge.

Effective withholding tax rate (including surcharge and cess) individuals, trusts, body of individuals, association of persons : The tax rate on qualified dividends is a smaller amount — 0 or 15 percent for most taxpayers — compared to investor’s regular income tax bracket. There's no single tax rate that is applied to reit dividends, and in fact, the same reit dividend could be made up of several different kinds of income.

You may pay tax at more than. Taxpayers may also generally deduct 20% of the combined qualified business income amount which includes qualified reit dividends through dec. Reits and return of capital

To work out your tax band, add your total dividend income to your other income. Exceeds inr 2 crore but does not exceed inr 5 crore; The following dividends are subject to income tax:

All reit dividends will be reported to the shareholders as qualified reit dividends that are subject to the passthrough deduction under sec. 5 if payment source is from capital contribution reserves then the dividend will be subject to a withholding tax rate of 0%. 2020 qualified dividend tax rate.

In most cases, those dividends are taxed as regular income and are subject to an investor’s marginal tax rate, which could be as much as 37 percent for taxpayers reporting taxable income greater than $523,600 for single filers and $628,300 for married couples who file a joint return in 2021.¹. This sars tax pocket guide provides a synopsis of the most important tax, duty and levy related information for 2021/22. For companies, such tax may be the normal rate of 25% plus surcharge and cess, or the concessional rate of 22% plus surcharge and cess.

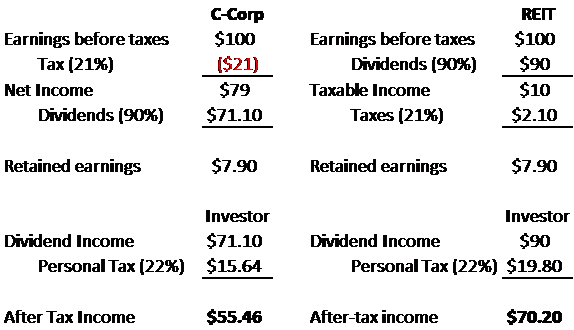

Therefore, if the portfolio can qualify for both a ric and a reit, the reit shareholders would not have to pay tax on 20% of the income of the reit, which results in significant tax savings for the reit shareholders. Certain countries such as singapore, uk (excluding reits), etc. Company profits are subject to corporate taxes and dividends paid are typically subject to qualified dividend tax rates.

Exceeds inr 50 lakhs but does not exceed inr 1 crore ; When it comes to real estate investment trusts, or reits, taxation is a bit more complicated.not only can reits avoid corporate tax altogether, but reit dividends have a complex tax treatment you. Exceeds inr 1 crore but does not exceed inr 2 crore;

The list below gives general information on maximum withholding tax rates in japan on dividends and interest under japan’s tax treaties (as of 18 january 2021). 15% for reit under certain conditions. Malaysia reits 10% 1 if payment source is from profits after january 1, 2020, argentinian dividends are subject to a withholding tax rate of 13%.

Announces august 2021 dividend rate per common share An irish resident individual, owning shares in an irish reit, will be subject to income tax and usc on the dividends from the reit. The industry has welcomed the move.

When you go to sell appreciated reit shares, however, this growth will be subject to capital gains taxes. The dividend withholding tax rates by country for 2021 has been published by s&p global.

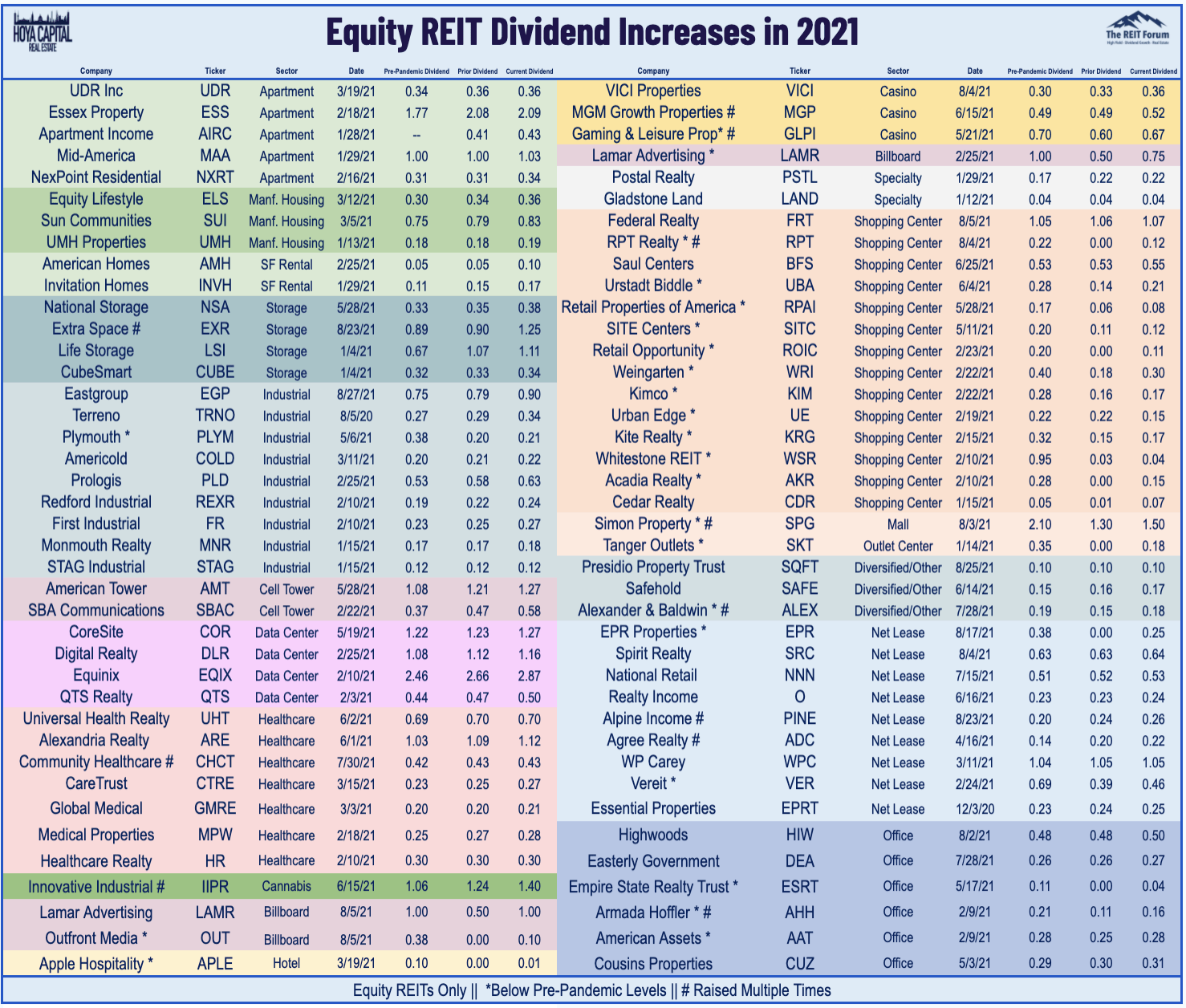

100 Reit Dividend Hikes Seeking Alpha

Indonesia Stock Exchange

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof

11 Best Canadian Dividend Stocks For Currentyear Dividend Stocks Dividend Tech Stocks

The High Yield Potential From Reit Dividends Considering Taxes And Safety

Taxation On Embassy Reit Dividend - Stocks - Trading Qa By Zerodha - All Your Queries On Trading And Markets Answered

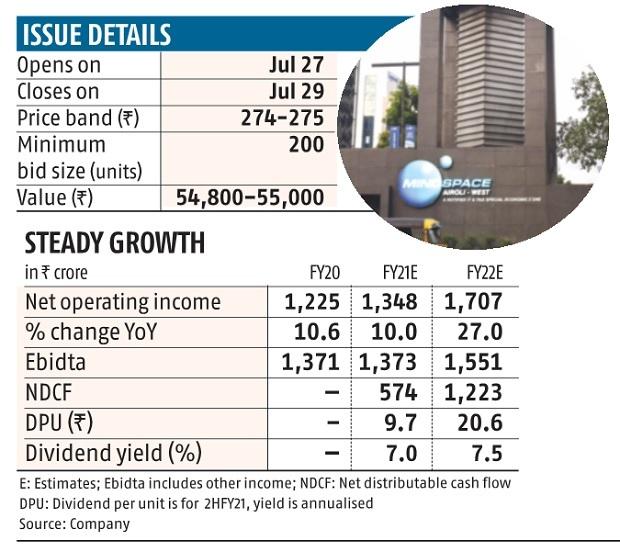

Mindspace Reit Stable Dividend Yields Make It A Good Long-term Bet Business Standard News

Sec 199a And Subchapter M Rics Vs Reits

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Indonesia Stock Exchange

Stag Industrial Stag I Recently Wrote An Article For Sure Dividend Entitled Consider Equity Reits For Your Next Investmen Investing Enterprise Value Equity

/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit

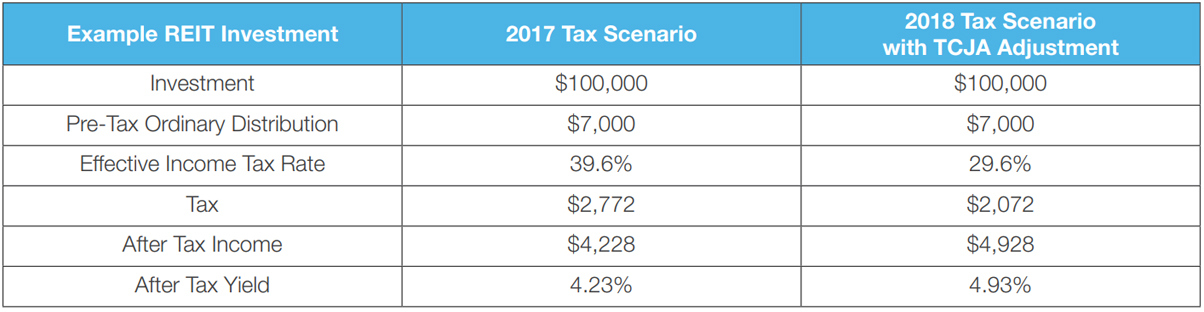

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

A Short Lesson On Reit Taxation - Intelligent Income By Simply Safe Dividends

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

Guide To Reits Reit Tax Advantages More - Wall Street Prep

Indonesia Stock Exchange

Simply Safe Dividends Safe Growing Income For Retirement Dividend Investing Investing Money Investing

Going Offensive With Reits The Star

Comments

Post a Comment