One of best ways for high earners to save on taxes is to establish and fund retirement accounts. Once you have maxed out your 401k—the maximum contribution limit for 2021 is $19,500—contribute to a roth ira.

Playbook - The App For Growing Your Money In 2021 Money Management Advice Money Saving Plan Ways To Get Money

• increase deductions for charitable giving.

Tax strategies for high income earners 2021. The first way you can reduce your taxable income (and therefore your tax on that income) is through additional superannuation contributions. Instead of an estate tax increase, we have an expansion of the net investment income tax on high earners who use s corporations and partnership entities to shield themselves from this 3.8% tax, a. Moreover, you do not pay taxes on investment earnings from retirement accounts until you withdraw the funds (but early withdrawals before age 59 1/2 are subject to a 10%.

Ten income and estate tax planning strategies for 2021 key tax facts for 2021 highest marginal tax rates 37% on taxable income exceeding $523,600 for single filers ($628,300 for couples), 20% on capital gains and dividends applied on taxable income exceeding $445,850 ($501,600 for couples) medicare investment income surtax By hutch ashoo and chris snyder · updated november 16, 2021 · 8 min read. As taxes on the wealthy increase, strategies such as diversifying income sources and income splitting can.

The top rate for 2021 applies to individuals earning more than $523,600, or more than $628,300 for married couples filing jointly. Contribute to your superannuation fund. However, lawmakers change tax code regularly, both temporarily and permanently.

So, what are the top tax planning strategies for high income employees? As a refresher, for 2021 fy, the individual tax rates (including medicare levy) are: These penalties can range from fines to imprisonment for more serious offences.

Minimize the use of active management for brokerage accounts. When your income exceeds a certain limit, you are subject to high taxes, which can go up to rates of 50+% of your total income. Raise the top marginal income tax rate to 39.6 percent from 37 percent, starting with those earning more than $400,000.

Tax avoidance and evasion on the other hand is illegal and attracts heavy penalties from the australian tax office (ato). Your best bet is to talk with your accountant and financial advisor to get their input based on the current year. Single and head of household filers covered by a workplace retirement plan.

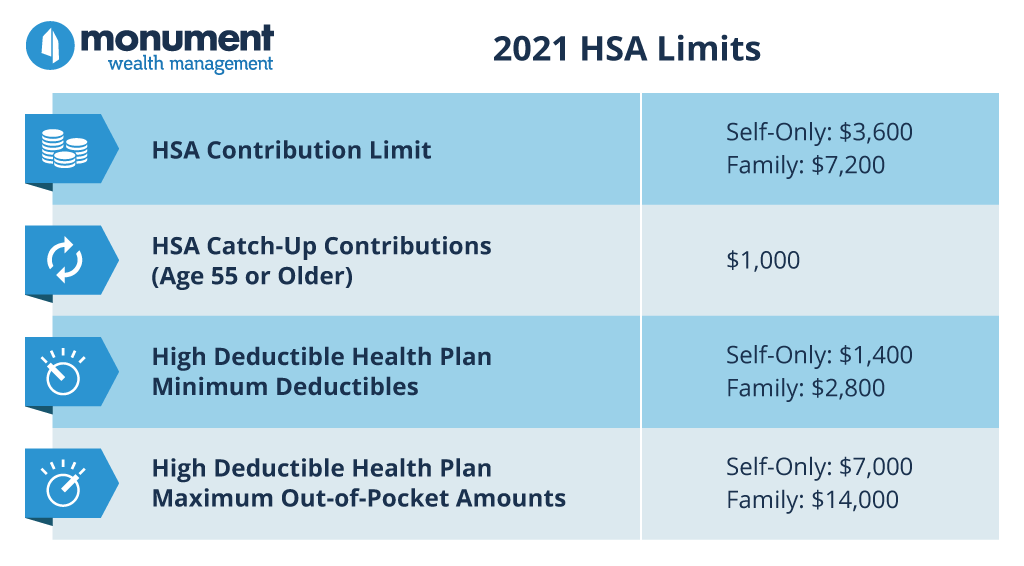

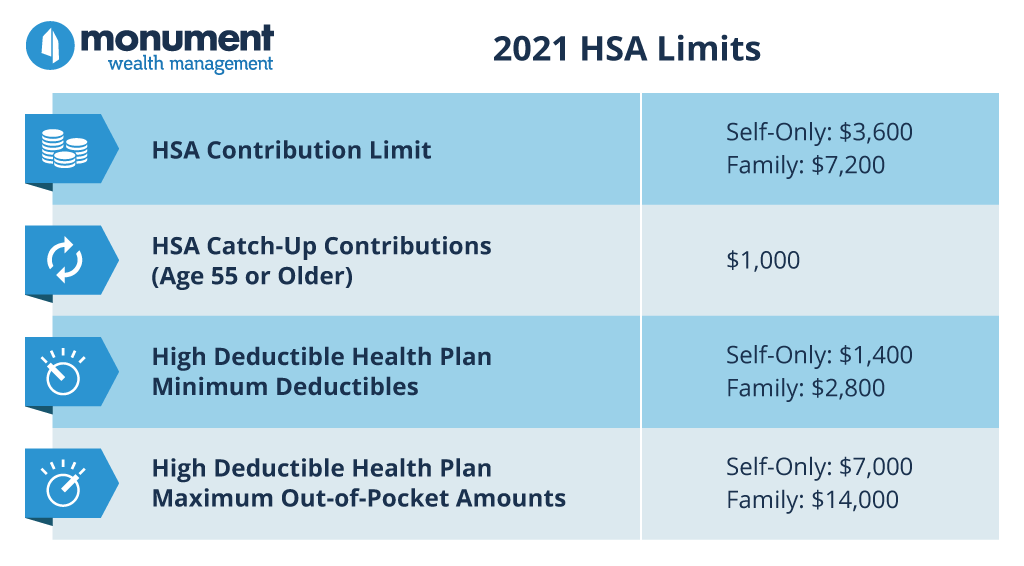

For 2021, the maximum 401 (k) contribution is $19,500 and the maximum 403 (b) contribution is the same, while the maximum contribution for simple iras is $13,500. Effective tax planning with a qualified accountant/tax specialist can help you to do that. • return the corporate tax rate to 28 percent from the current 21 percent.

Often, this can cause a great dent in your finances, especially if most of your wealth is tied. • lift current caps on deductions for state, local and real estate property taxes. Discover the proper strategy for avoiding estate tax that is best suited to your family's needs, wants, and goals in our published book 7 secrets to high net worth investment.

Tax Minimisation Strategies For High Income Earners

Playbook - The App For Growing Your Money In 2021 Money Management Advice Money Saving Plan Ways To Get Money

5 Outstanding Tax Strategies For High Income Earners

Top 2021 Tax Strategies For High Income Earners Pillarwm

Top 2021 Tax Strategies For High Income Earners Pillarwm

Irs Tax Code That You Need To Know Pinterest

High-income Earners Need Specialized Advice Investment Executive

5 Outstanding Tax Strategies For High Income Earners - Debt Free Dr - Dentaltown

Top 2021 Tax Strategies For High Income Earners Pillarwm

Bidens Tax Plan Explained For High-income Earners Making Over 400000

Budget 2018 - Income Tax Slabs For Fy 2018-19 Income Tax Income Quotation Format

The 4 Tax Strategies For High Income Earners You Should Bookmark - Monument Wealth Management

Biden Tax Plan And 2020 Year-end Planning Opportunities

Top 2021 Tax Strategies For High Income Earners Pillarwm

How Much Money Do The Top Income Earners Make By Percentage

Roth Iras Known For Their Tax-free Growth And Withdrawals Are Regularly Overlooked By High Earners And Retirees However With The Right Pl In 2021 Ira Roth Roth Ira

Irmaa 2021 High Income Retirees Avoid The Cliff - Fiphysiciancom In 2021 Higher Income Paying Taxes Tax Brackets

The 4 Tax Strategies For High Income Earners You Should Bookmark - Monument Wealth Management

The Top 9 Tax Planning Strategies For High Income Employees

Comments

Post a Comment