Raffle tickets are not tax deductible. Be sure to check with local and state office website for guidelines.

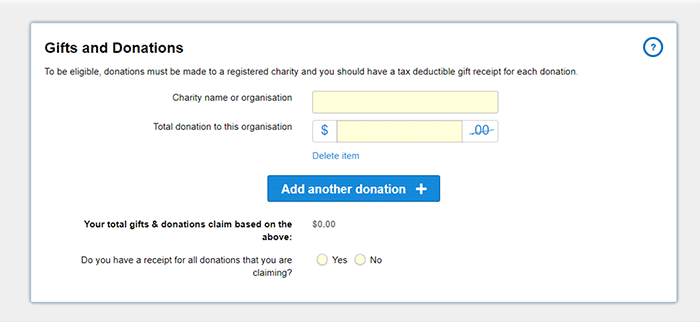

How To Claim Tax Deductible Donations On Your Tax Return

For information on how to report gambling winnings and losses, see expenses you can deduct in pub.

Are raffle tickets tax deductible irs. For complete information, the purchaser should consult their tax advisor. The irs has adopted the place that the $100 ticket value isn’t deductible as a charitable donation for federal earnings tax functions. 17) double d makes no claim regarding the actual value of any prize and is not responsible for the accuracy of any value estimate provided by prize donors or anyone else.

If the minimum is not reached by 11:59pm on december 15th, 2020 all entries will be refunded. You can't deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance. *raffle ticket sales are open to texas residents.

A single ticket costs $100, three tickets for $250, five tickets for $400, and 10 tickets for $500. What are the odds of winning? The fair market value of the prize will be treated as ordinary income to the winner for federal and state income tax purposes.

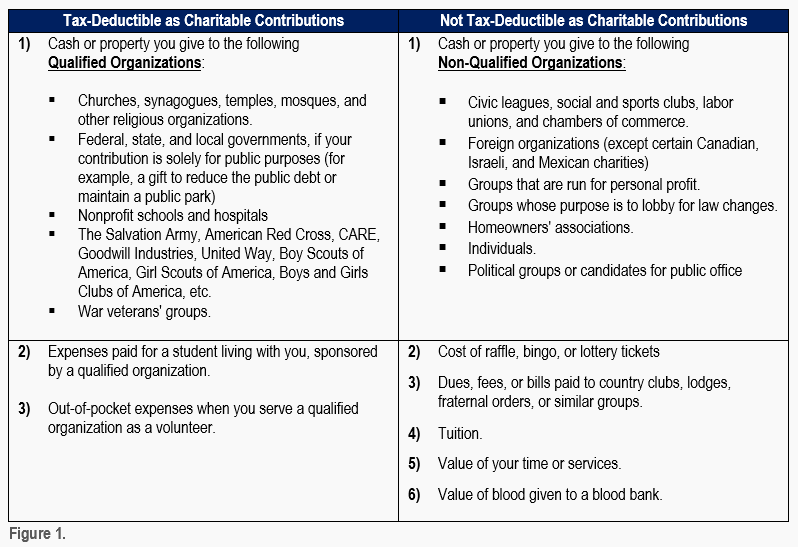

The donor must be able to show, however, that he or she knew that the value of the item was less than the amount paid. What taxes must i pay upon winning the apartment? The cost of a raffle ticket is not deductible as a charitable contribution, even if the ticket is sold by a nonprofit organization.

Withholding tax on raffle prizes regular gambling withholding: Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over its fair market value. The irs considers a raffle ticket to.

Laws regarding raffles differ in cities, counties and states, and some require a gaming license for raffles. The irs has taken the position that amounts paid for chances to participate in raffles, lotteries or similar programs are not gifts and, therefore, the price of the tickets does not qualify as a deductible charitable contribution for personal income tax purposes. Ticket purchases are tax deductible.

Does the winner of a raffle have taxable income? Winners will be announced on friday, july 30, 2021. Are dream house raffle tickets tax deductible.

The irs has adopted the place that the $100 ticket value isn’t deductible as a charitable donation for federal earnings tax functions. Purchaser of raffle ticket(s) must have their name, address and phone number legibly entered on each ticket. Regular donations to am yisrael chai are tax deductible in the usa but, according to the irs, raffle tickets do not qualify for a deduction and are therefore not tax deductible.

If you actually win any of the prizes, you are required to report those additional earnings on your taxes. Is the cost of a raffle ticket tax deductible? Although you cannot take a tax deduction for buying a raffle ticket, you may be able to deduct the amount spent on losing tickets to the extent you had gambling winnings of at least that amount.

The organization may also be required to withhold and remit federal income taxes on prizes. The irs doesn’t allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses. If you win the raffle, you may even end up owing tax.

Tickets can be purchased until midnight on thursday, july 29, 2021. If you actually win any of the prizes, you are required to report those additional earnings on your taxes. There are 350 raffle tickets available and a minimum of 60 raffle tickets need to sell for there to be a winner.

Raffle tickets are not tax deductible. Expand_more we currently accept visa, mastercard, discover and american express. Are dream house raffle tickets tax deductible.

Websites like zacks provided some of the most clarity on how the irs treats charity raffle tickets. Exempt under section 501 of the internal revenue code. Buying a ticket lets you help your community, but it doesn't help you claim a deduction for a charitable donation.

Raffle tickets are not tax deductible. Raffle sponsors keep tickets under wraps until the drawing. The price of a raffle ticket is not deductible.

*winners are subject to all applicable federal taxes as outlined by the irs. Regular donations to am yisrael chai are tax deductible in the usa but, according to the irs, raffle tickets do not qualify for a deduction and are therefore not tax deductible. The internal revenue service taxes prize winnings at the rate that applies to your income tax bracket, and any organization that pays out a prize over $600 is required to report it.

The 50/50 raffle sellers will be selling tickets from the time gates open until the end of the 3rd quarter or end of the second intermission. The irs classes money spent on raffles and lotteries as contributions from which you benefit and therefore it is generally not deductible. Unfortunately, buying a raffle ticket to support a nonprofit organization is not a deductible expense.

Basically, the irs treats it like gambling or specifically “nondeductible gambling losses” because you’re not selflessly donating to charity, but rather playing the odds in hopes of receiving something of. No more than 1,000 tickets will be sold. Raffle tickets are not tax deductible.

What methods of payment do you accept? Although winning a sweepstakes, lottery or raffle drawing may come as a pleasant surprise, it also boosts your taxable income.

How To Claim Tax Deductible Donations On Your Tax Return

Fun Fact - Charity Raffle Tickets Are Not Tax-deductible

Are Nonprofit Raffle Ticket Donations Tax Deductible Legalzoomcom

Tbt A Night In Old Havana Gala Bsaz Creates Havana Nights Party Havana Theme Party Havana Party

Best Tax Deductible Donation Letter Template Word In 2021 Donation Letter Fundraising Letter Donation Letter Template

40 Donation Receipt Templates Letters Goodwill Non Profit Donation Letter Template Donation Letter Receipt Template

Charitable Deductions On Your Tax Return Cash And Gifts

Which Charitable Contributions Are Tax Deductible Infographic - Turbotax Tax Tips Videos

5 Most Overlooked Rental Property Tax Deductions - Accidental Rental Rental Property Real Estate Rentals Rental Property Management

How To Make Sure Your Charitable Donation Is Tax-deductible Capstone Financial Advisors

Small Business Guide To Deducting Charitable Donations Fox Business

Fun Fact - Charity Raffle Tickets Are Not Tax-deductible

Explore Our Image Of In Kind Donation Receipt Template Donation Letter Template Receipt Template Teacher Resume Template

Did You Know There Was Medical Tax Deductions Available To You Healthcare Savemoney Business Tax Deductions Tax Deductions Business Tax

How To Claim Tax Deductible Donations On Your Tax Return

A Quick Guide To Deducting Your Donations Charity Navigator

Standards For Excellence Institute Landing Pages Are Tickets To My Nonprofits Fundraiser Tax-deductible

How To Make Sure Your Charitable Donation Is Tax-deductible Capstone Financial Advisors

When Is A Nonprofit Gift Not Tax Deductible - Church Law Center

Comments

Post a Comment