Annual union dues for membership in a trade union or association of public servants. These are regarded as personal in nature and therefore are not deductible.

Claiming A Deduction For Union Or Professional Dues - Virtus Group

And, because dues are tax deductible, it works out to be much less.

Are union dues tax deductible in canada. Tax tip you may be eligible for a rebate of any gst/hst you paid as part of your dues. For more information, see interpretation bulletins it103r, dues paid to a union or to a parity or advisory committee, and it158r2, employees’ professional membership dues. Can i claim the dues to the canadian legion and similar service clubs?

This is because by law you are not required to participate in these associations to maintain your credentials. What does the employer do with the union dues that are deducted from an employee’s pay? At 1.5 per cent of total earnings, moveup’s dues are lower than most canadian unions.

For example, if your annual income is $40,000 and you paid $1,000 as union dues, your taxable income will be only $39,000. For example, membership in the canadian medical association is not required to practise medicine, while membership in the provincial college of physicians and surgeons is necessary. Before sending in the requested document i decided to contact my employer about the matter and they told me that union dues are no longer tax deductible.

Only union membership dues are deductible, and union members may not deduct initiation fees, licenses or other charges. Through the regional pay system, public works and government services canada collects union dues directly from unionized employees’ pay. “the dues are not treated as income, so there is taxpayer subsidy to a degree.”

I work for a trade union. I claimed my union dues even though my employer put zero in box 212 of my t4. You can deduct any union dues paid by you from your taxable income.

However, most employees can no longer deduct union dues on their federal tax return in Workers used to be able to deduct union dues, but they could only do so if they had enough other eligible deductions that it was worthwhile to file an “itemized” tax return ― and even then, the eligible expenses had to amount to more than. Dues pay the cost of contract negotiations, grievance and arbitrations, training for members, legal fees, and much more so employees no longer have to go at it alone.

Union dues are set by the bargaining agents and calculated either by using a fixed rate or as a percentage of the employee’s salary. Annual dues of a member of a trade union are not deductible, however, to the extent that they are, in effect, levied. At 1.5 per cent of total earnings, moveup’s dues are lower than most canadian unions.

Ad get unlimited tax deduction questions answered online & save time. In the case of voluntary associations, dues are not deductible. Cra is requesting a copy of my union dues receipt and my t4.

You can only deduct union dues, membership fees and assessments to provide payments to unemployed union members. A recent tax case addressed this issue in the case of physiotherapy association. Under current federal law, union dues are generally not deductible.

Union dues are deductible only if you itemize on schedule a in lieu of taking the standard deduction. (a) for or under a superannuation fund or plan, (b) for or under a fund or plan for annuities, insurance or similar benefits, or. However, there are a few exceptions, and if your union dues meet one of them you are in luck

You can claim a tax deduction for these amounts on. Between now and the end of february 2020, canadians will receive a variety of receipts for expenditures made during the 2019 taxation year. The amount of union dues that you can claim is on box 44 of the t4 slip issued by your employer.

View solution in original post. You can only deduct certain types of union dues or professional membership fees from your income tax filings. Ad get unlimited tax deduction questions answered online & save time.

Dues are in investment in the improvements in pay, benefits and fair treatment won through collective bargaining. Claiming a deduction for union or professional dues. Accordingly, cma dues would not be deductible but provincial college fees would be.

Union dues and professional association fees are tax deductible.

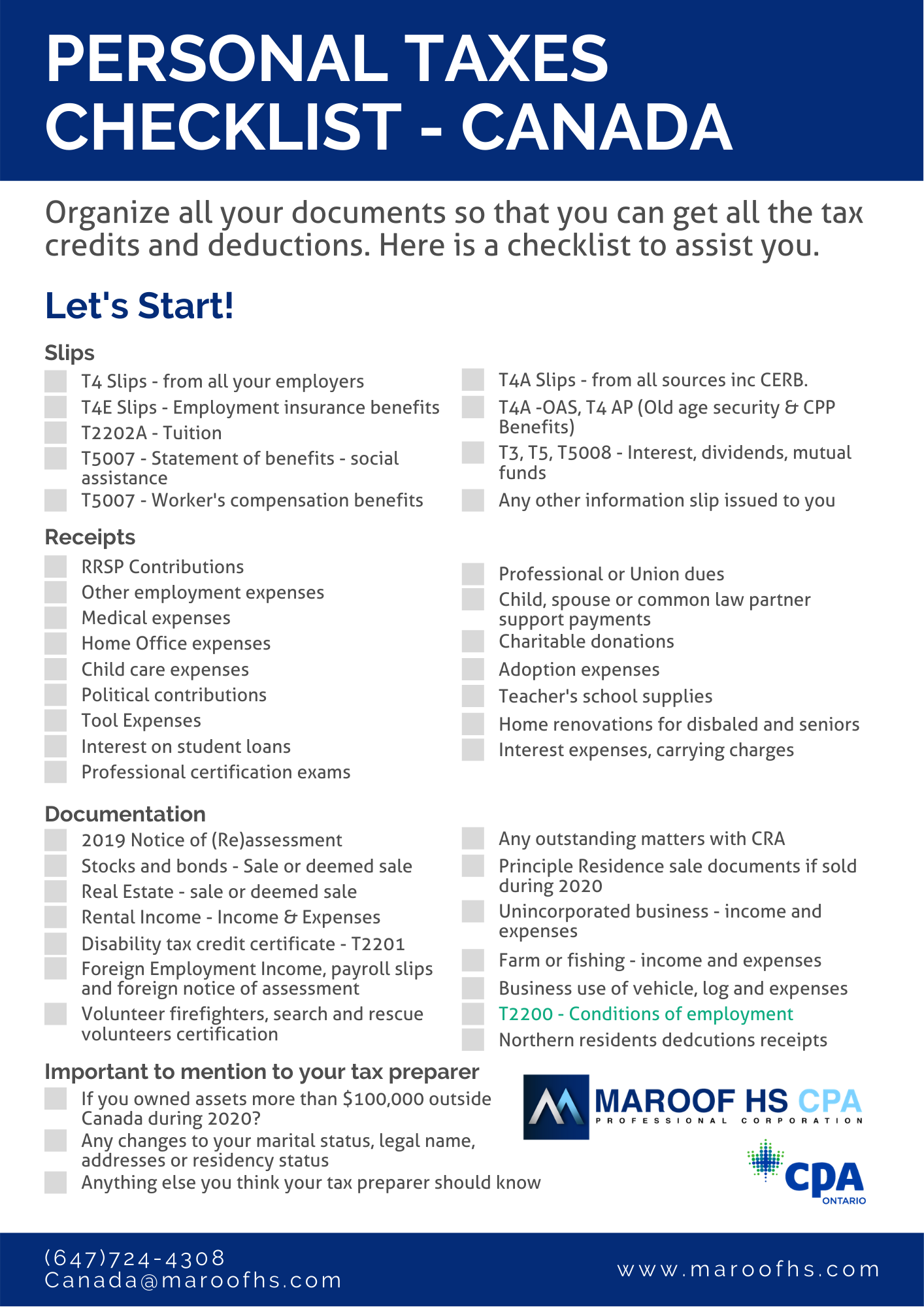

Tax Return Document Checklist Eng 17 Rev Pdf Welfare Taxes

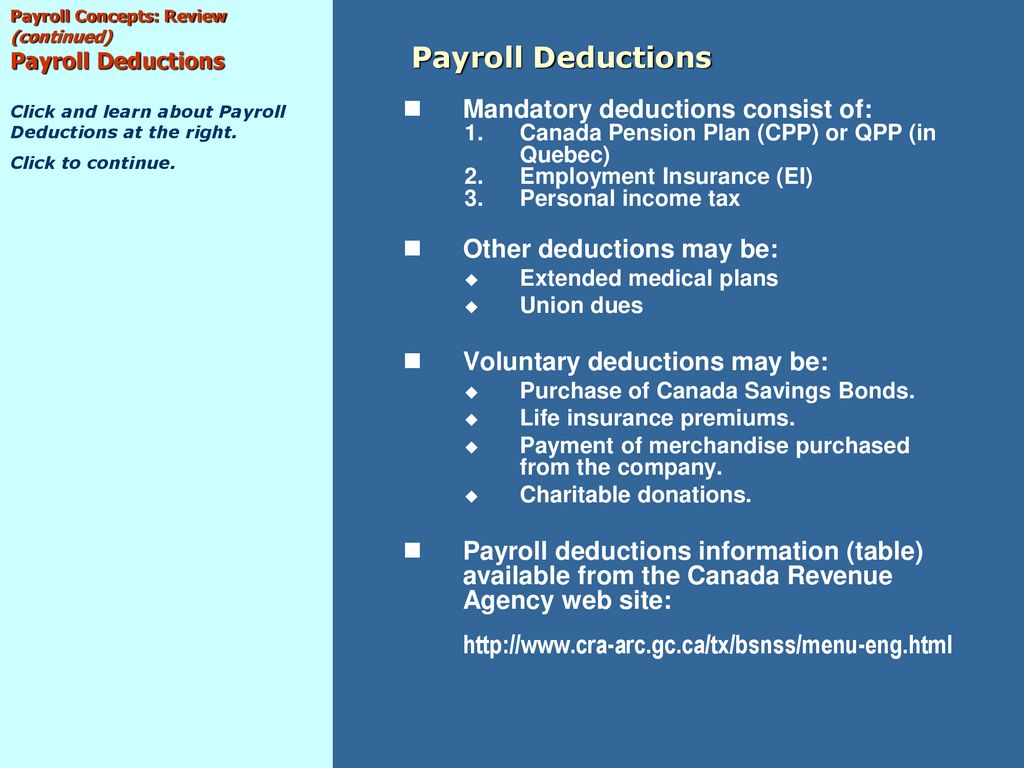

Setting Up The Payroll Module Slideshow 7 A

Payrolla Dollar Earned Personal Finance Employment Standards Employee

6 Overlooked Tax Deductions And Credits That Could Score You A Big Return - National Globalnewsca

Save Tax - Home Facebook

Buckchart - Home Facebook

The Top 9 Tax Deductions For Individuals In Canada

Union Dues Opseu Sefpo

Where Do I Enter My Union And Professional Dues Hr Block Canada

Deducting Union Dues Drake17 And Prior

Our Members Dues Usw Canada

Are Our Union Dues Tax-deductible In Canada Express Digest

Setting Up The Payroll Module - Ppt Download

2020 Individual Income Tax Return Checklist - Maroof Hs Cpa Professional Corporation Toronto

Just Got A Letter From Cra They Want My Union Dues Receipts Union Wont Give Them To Me Because They Are Not Dues They Are Admin Fees Ontario Canada Rpersonalfinancecanada

Claiming A Deduction For Professional And Union Dues

Your Union Dues Plain And Simple

2020 Year-end Tax Tips For Canadians - Cloudtax Simple Tax Application

What Are Payroll Deductions Mandatory Voluntary Defined Quickbooks

Comments

Post a Comment