If you're wondering how much tax do you have to pay on crypto income in the uk, the answer depends on your income tax band. The deadline to file your tax return in the uk is january 31—and holding cryptocurrency introduces an additional layer of complexity to the process.

Bitcoin Futures Big Banks Program Your Own Bitcoin Trading Bot Coinbase Pro Gundhig

When you dispose of cryptoasset exchange tokens (known as cryptocurrency), you may need to pay capital gains tax.

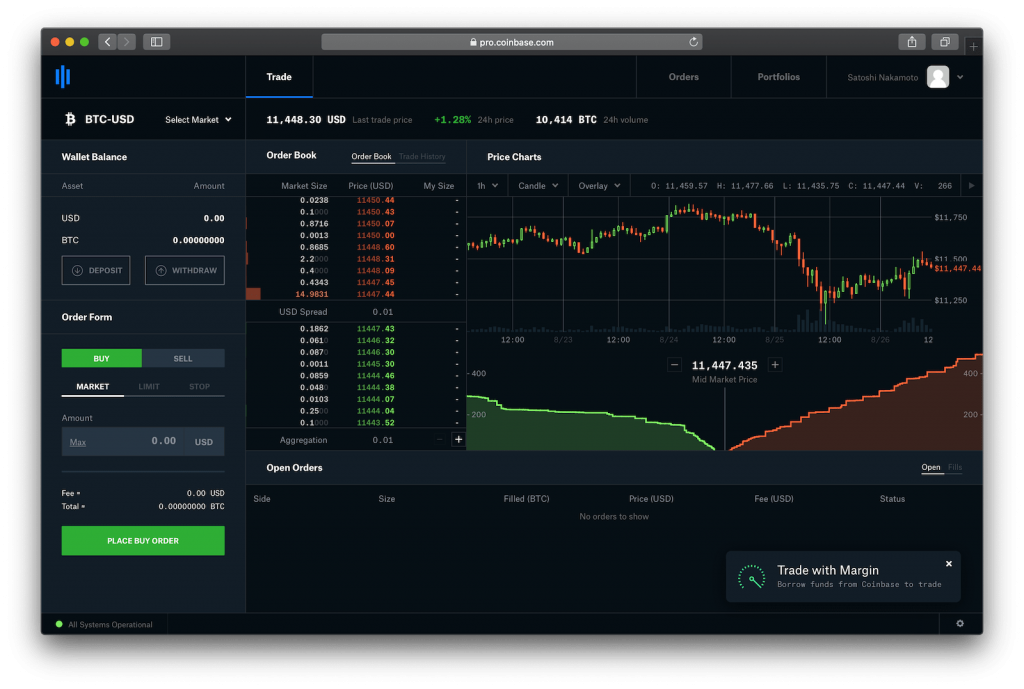

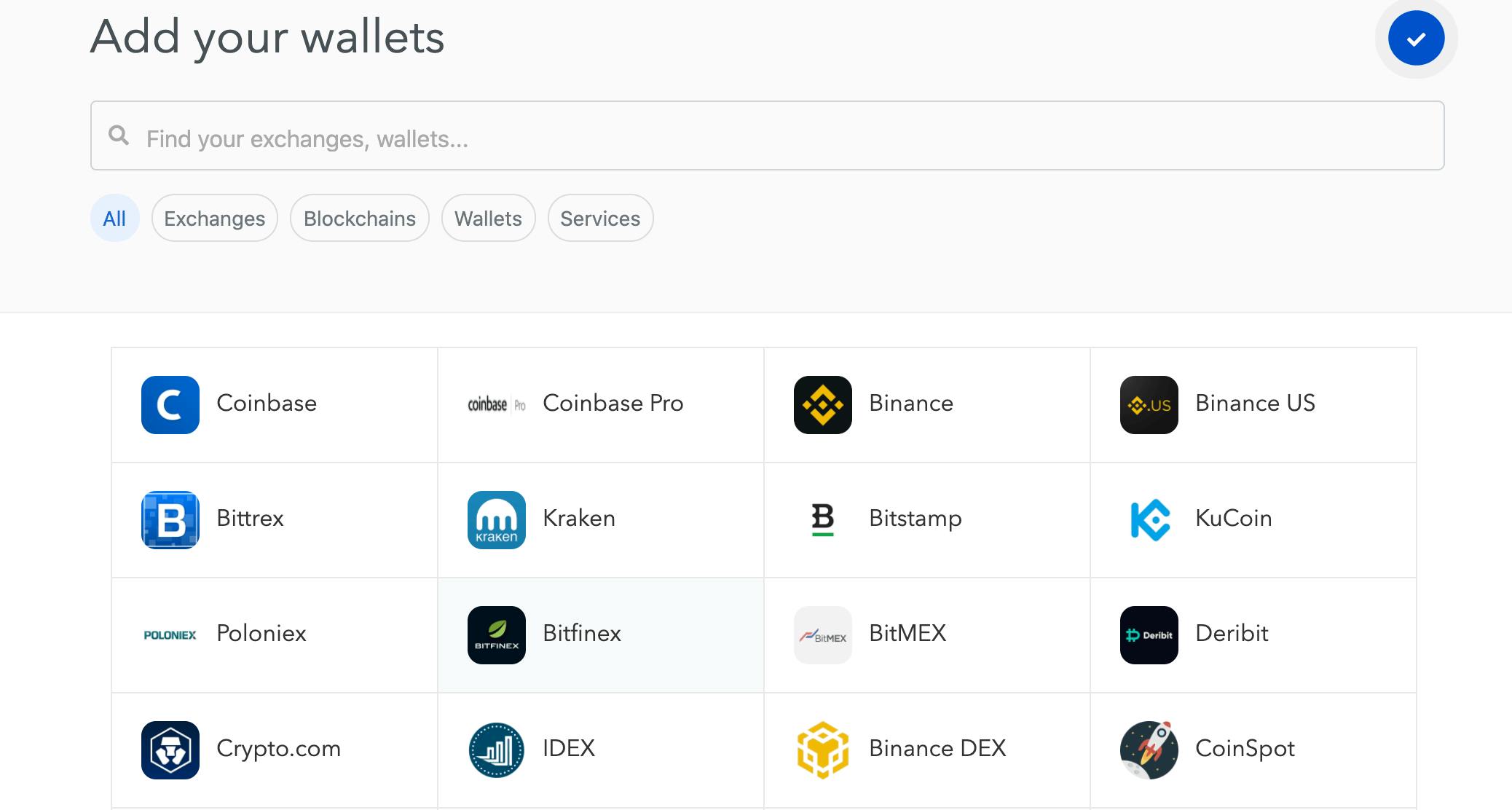

Coinbase pro taxes uk. Easy, safe, and securejoin 73+ million customers. United kingdombuy, sell, and convert cryptocurrency on coinbase. There are a couple different ways to connect your account and import your data:

If you are buying or selling from $26.50 to $51.99, the trading fee is $1.99. What about coinbase pro tax documents? Taxes, reports and financial services.

If you’re a uk crypto holder, keep your receipts—every single one of them, whether for a novelty cup of coffee bought with bitcoin, or the tab of acid you bought from the dark web—because otherwise, her majesty’s revenue and customs is going. But, the fees vary based on your location and payment method. Easily deposit funds via coinbase, bank transfer, wire transfer, or cryptocurrency wallet.

To create your account go here and select log in. You have been invited to use cointracker to calculate your cryptocurrency taxes. You’ll get 10% off our tax plans by signing up now.

Sign up with coinbase and manage your crypto easily and securely. Now that we’ve covered the flat fees, here are the variables. In the united kingdom, your crypto income tax rate will be the same as the highest tax band you fall into, and will be considered miscellaneous income.

This report on its own should balance correctly. Coinbase has told some of its users it is passing their details onto the u.k. You can generate your gains, losses, and income tax reports from your coinbase pro investing activity by connecting your account with cryptotrader.tax.

Corporate or institutional bank accounts are not supported unless you have completed our institutional onboarding process Today, coinbase sent out the following notice to its users’ subject to this crackdown. As first reported by decrypt, the popular crypto exchange emailed some.

The tax report that cointracking.info gives you all the information you need to do your tax, no matter where you reside. Other countries have similar rules for filing crypto taxes, but differences do exist. Support for fix api and rest api.

By doing this, your coinbase account is automatically linked, and transferring funds of any currency between your coinbase balance and your coinbase pro account is integrated into the experience. You’ll pay anywhere between 0% to 45% in tax. Users of the coinbase exchange to own more than £5000 in cryptocurrency in the uk are going to have the details sent over to the hmrc.

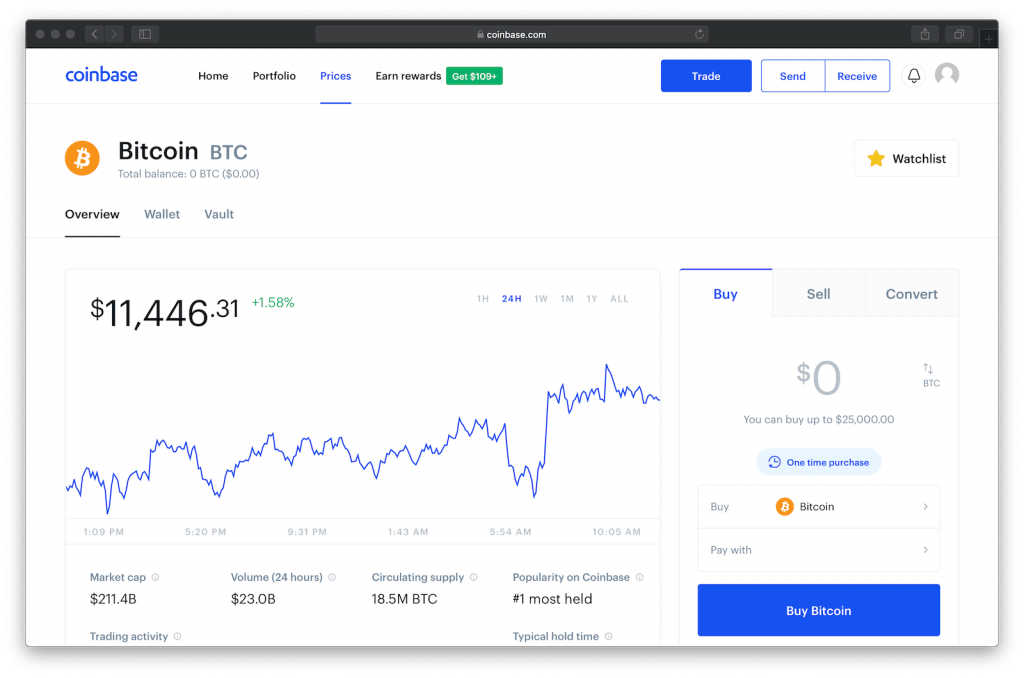

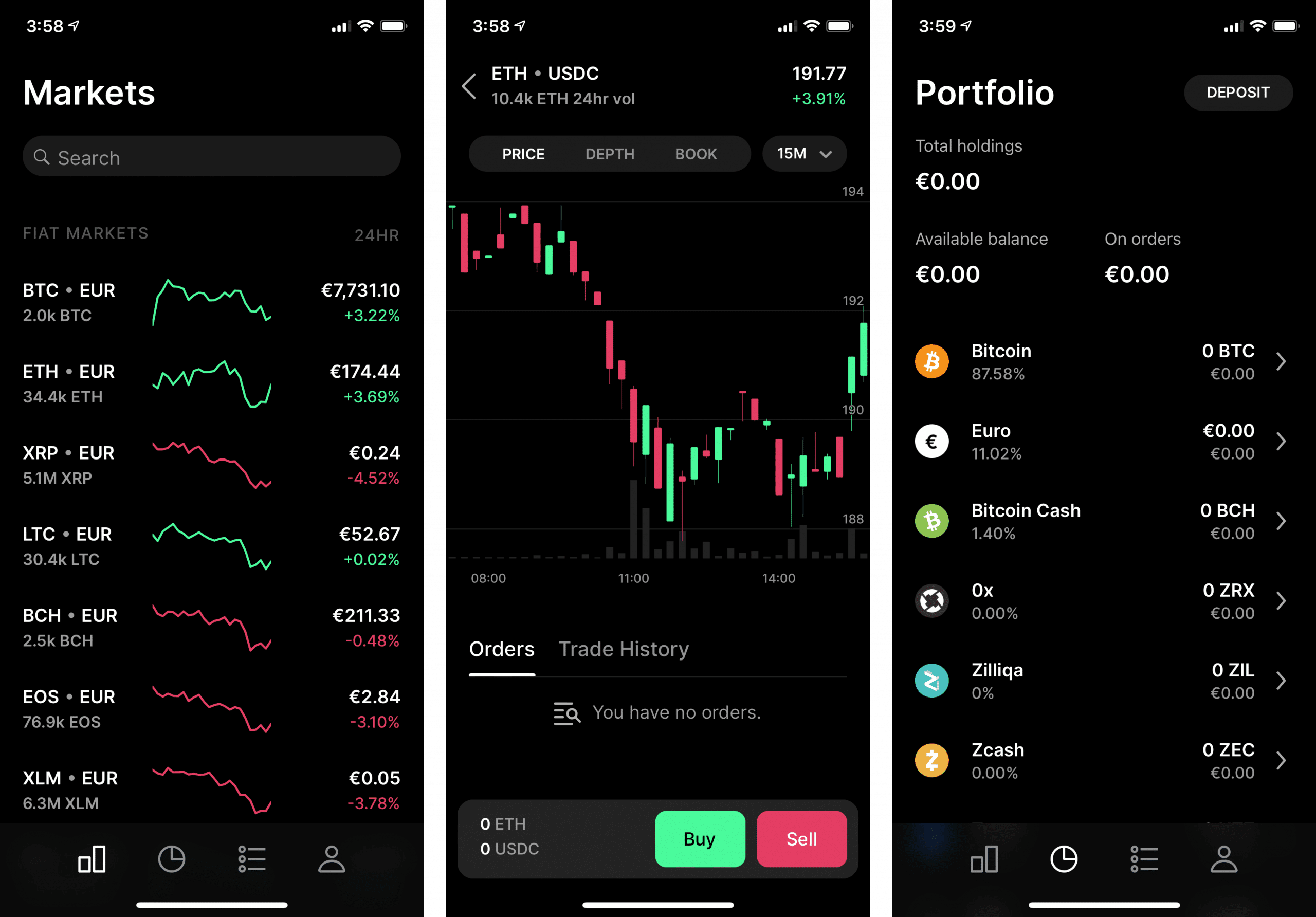

Trade bitcoin (btc), ethereum (eth), and more for usd, eur, and gbp. You pay capital gains tax when your gains from selling certain assets go. Ensure that the name on your bank account matches the name on your coinbase account.

Posted on 07/10/2020 author paul lynam categories tax investigation news. If you are buying or selling from $52 to $78.05, the trading fee is $2.99. For example, australia’s ato (australian tax office), the uk’s hmrc (her majesty's revenue and customs) both use different tax metrics.

If you are buying or selling between $11 and 26.49, the trading fee is $1.49. If you were already logged in to coinbase.com, you will be prompted to accept the coinbase pro user terms and may be prompted to provide additional. Coinbase notice to uk users

File these crypto tax forms yourself, send them to your tax professional, or import them into your preferred tax filing software like turbotax or taxact. Accurately tracking cryptocurrency investment performance and taxes is hard. In order for coinbase to process your gbp deposit, follow these steps:

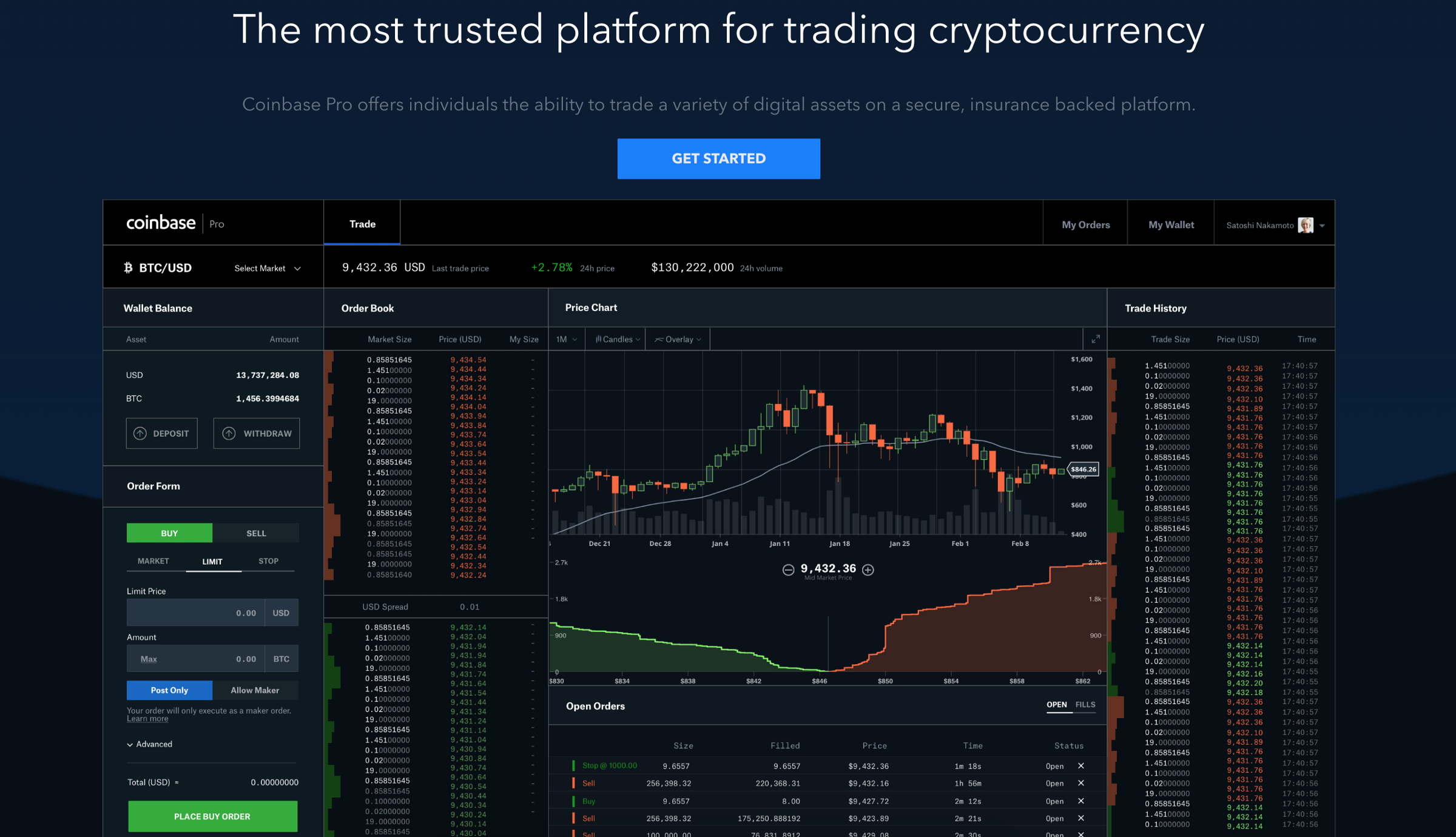

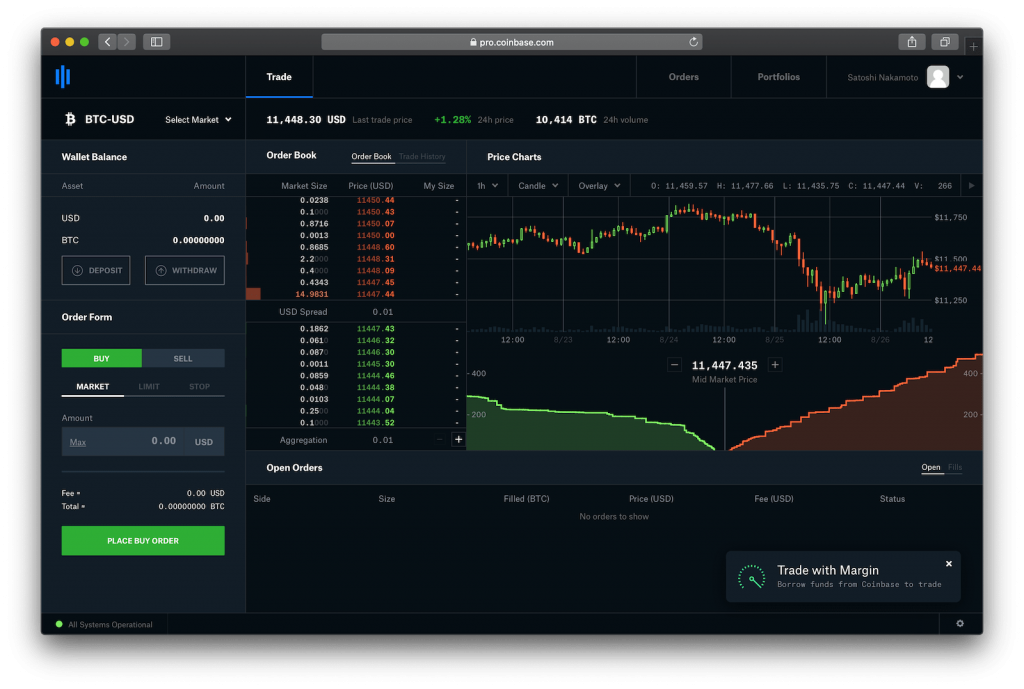

Coinbase is the most trusted place for crypto in united kingdom. Orders that provide liquidity (maker orders) are charged different fees than orders that take liquidity (taker orders). Let cryptotrader.tax import your data and automatically generate your gains, losses, and income tax reports.

Uk residents who have invested through the american based firm coinbase will have their details passed to hmrc. There are two ways to trade on coinbase pro either by being a market maker (limit order) or a market taker (market order) which option you choose will affect the fees you pay. Track your crypto portfolio & taxes.

According to coinbase, “the base rate for all purchase and sale transactions in the u.s. Fees are calculated based on the current pricing tier you are in when the order is placed, and not on the tier you would be in after a trade is completed. The email said that hmrc originally required coinbase to provide certain records of its uk customers, between 2017 and 2019.

However, after discussions with the tax authority, the notice was. Coinbase owners in the uk who have received more than £5,000 ($6,474) in cryptocurrency will have their details passed to the uk's tax authority hmrc, according to an email from coinbase seen by decrypt. This report on its own should balance correctly.

Verify your uk id and your mobile phone number in your coinbase account; We make it easy and help you save money. If you are also using coinbase, the only way to get these accounts to both balance, is to manually add the missing relayed deposit/withdrawal transaction records into your coinbase.

Pursuant to a legal notice received from the uk tax authority (hmrc), coinbase is disclosing information on its users with more £5,000 worth of crypto assets on the platform during the 2019/2020 tax year.

Coinbase Pro Funds On Hold Adinasinc

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog

Coinbase Pro Review 2020 Still Worth It Beginners Exchange Guide

Coinbase Euro Wallet Fees

Coinbase Pro Full Tutorial Cryptocurrency Trading For Beginners - Youtube

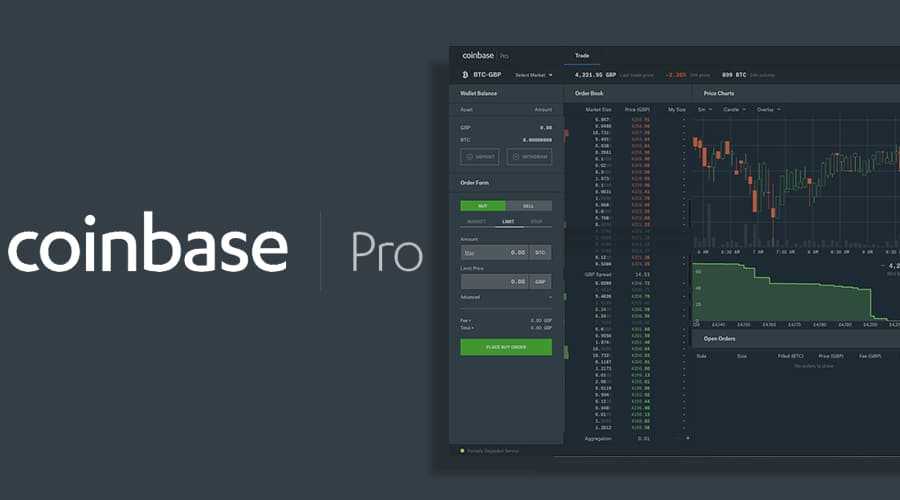

Coinbase Vs Coinbase Pro What The Difference - Crypto Pro

Coinbase Vs Coinbase Pro What The Difference - Crypto Pro

How To Get Live Trading Data For Stocks Like On Coinbase Pro Reupersonalfinance

Coinbase Pro App By Coinbase Mobile Design Inspiration App Infographic Design Process

Coinbase 1099 What To Do With Your Coinbase Tax Documents - Lexology

Beginners Guide To Coinbase Pro Coinbases Advanced Exchange To Trade Btc Eth Ltc Zrx Bat Bch Hacker Noon

Coinbase Vs Coinbase Pro What The Difference - Crypto Pro

Learn How To Do Your 2021 Cryptocurrency Tax With Koinly Watch

Coinbase Btc Fees

84 Coinbase Pro Reviews Ratings Crypto Exchange

Coinbase Pro Sign Up Coinbase Pro Sign In Coinbase Sign-in Issues - Cardshure Signup Facebook Help Bitcoin Transaction

Coinbase Trading Platform Review Beginners Guide 2021

84 Coinbase Pro Reviews Ratings Crypto Exchange

Uk Cryptocurrency Tax Guide Cointracker

Comments

Post a Comment