Whilst cryptocurrency is a relatively new asset, the regulations surrounding it are still being formed. The rate you pay on crypto taxes depends on your income level and how long you have held the crypto.

Uk Crypto Tax Guide 2021 Cryptotradertax

Cryptocurrency tax in the uk is still an emerging area.

Cryptocurrency tax calculator uk. Uk cryptocurrency tax law compared to the eu. However, when it comes to taxing them, it depends on how the tokens are used. When to file uk crypto taxes.

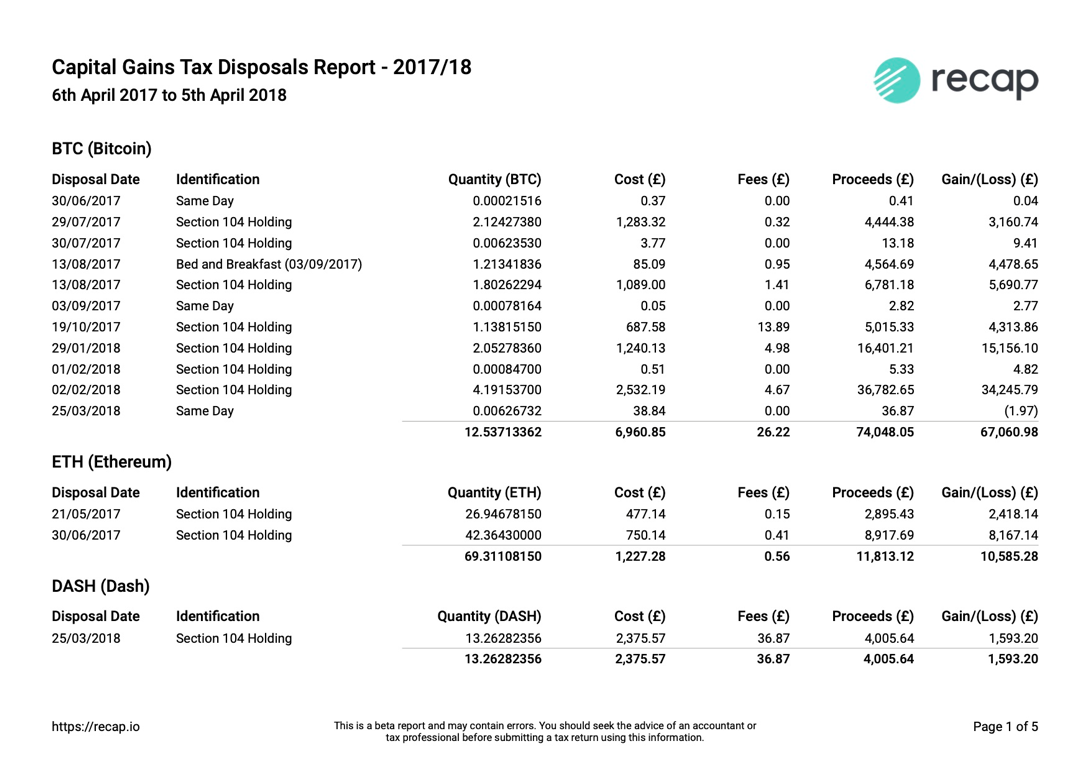

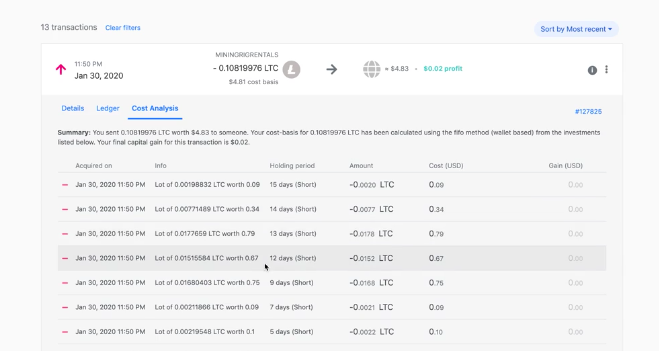

Simply upload or add the transaction from the exchanges and wallets you have used, along with any crypto you might already own, and we'll calculate your capital gains. With the government specifically targeting crypto, it’s essential that you understand the tax consequences of owning crypto. To check if you need to pay capital gains tax, you need to work out your gain for each transaction you make.

How do cryptocurrency taxes work? Hmrc doesn’t consider cryptoassets to be a form of money, whether exchange tokens, utility tokens or security tokens. 20 are subject to tax.

If you don’t do this, you could face a fine from hmrc. The uk tax deadline is the 31st of january 2022. The guidance provided by regulators is only at an initial stage, and will no doubt evolve over time.

So if the profit from selling your cryptocurrency, in addition to any other. Investors, traders, miners, and thieves. When you sell or trade crypto you have to pay tax on the difference between the selling price and the price you bought it for (minus any exchange fees).

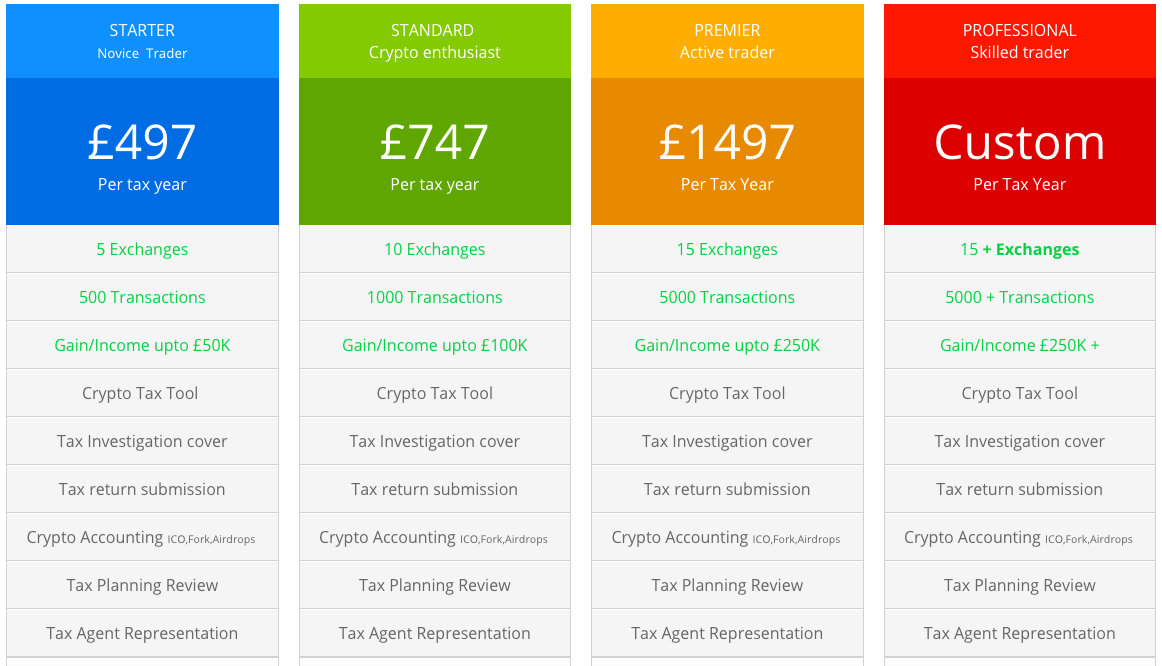

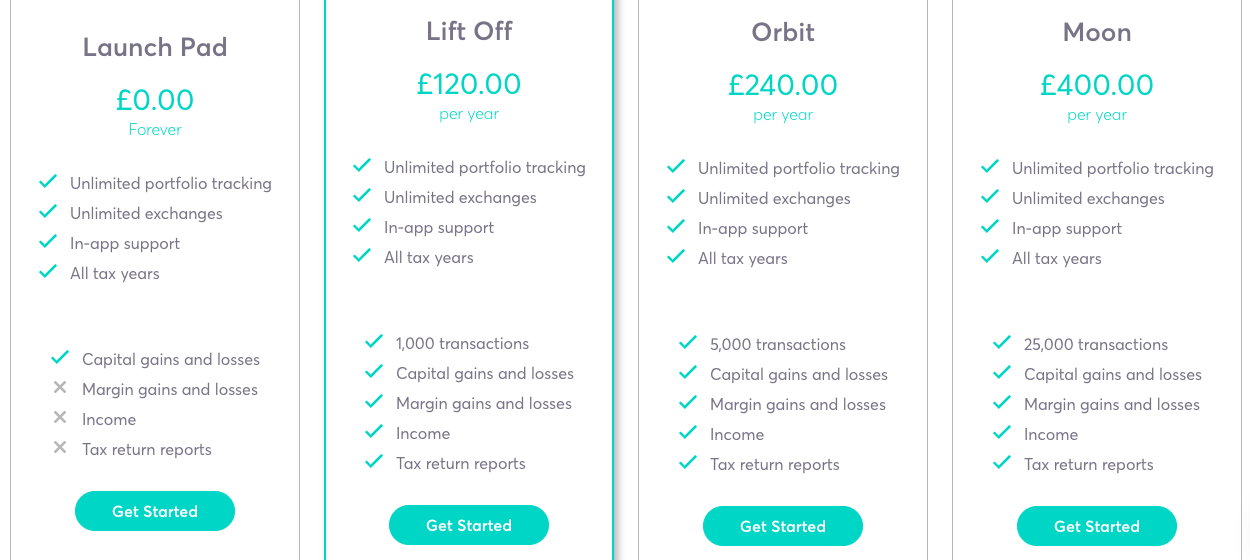

Taxscouts is a team of accountants who can help you file your tax form for just £119. As the cryptosphere gained more traction, revenue authorities came knocking and started talking about the need for crypto traders and investors to pay tax. As with mining, income tax takes precedence over cgt when the change of value is calculated.

These profits are taxed at different rates. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. The european union is still not unified enough to view it as a monolithic body.

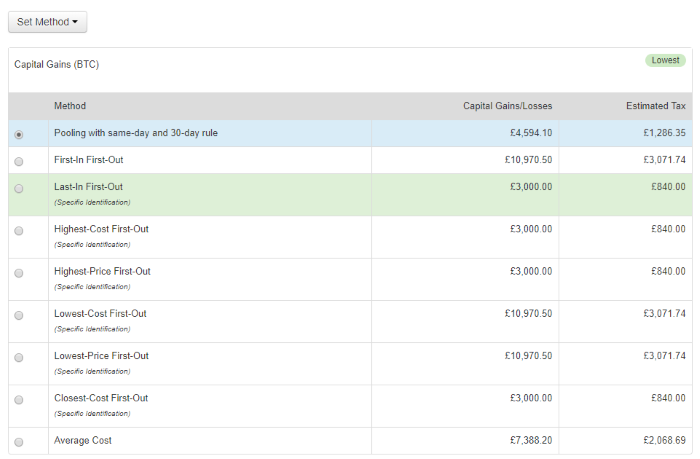

The way you work out your gain is different if you sell tokens within 30. Ideally, you’ll want to submit your tax return before this point as you also need to pay any taxes due by midnight on the 31st january 2022. Calculating cryptocurrency in the uk is fairly difficult due to the unique rules around accounting for capital gains set out by the hmrc.

This is a local company that knows all ins and outs in order to stick to all the regulations we have in our kingdom. This is known as a capital gains tax and has to be paid in most countries such as the usa, uk, canada etc. Crypto is taxed in the same way as gold and real estate.

Bitcoin.tax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes. You should still keep records of these transactions so that you can. Automatically classify and calculate your crypto taxes.

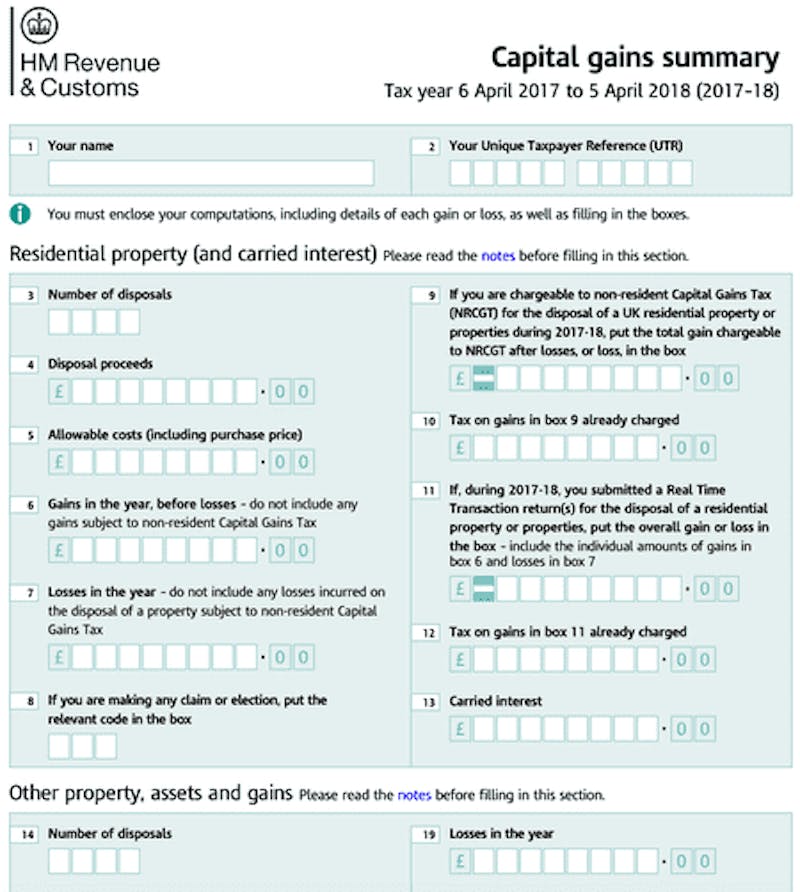

You need to report any income from crypto or capital gains from crypto in your self assessment tax return by this date. Since then, its developers have been creating native apps for mobile devices and other upgrades. With over 300,000 users, cointracking.info is one of the oldest and most trusted cryptocurrency tax calculators on the market today.

To add clarity, the hmrc (uk tax agency) recently explicitly stated that you cannot claim all fees, all the time, straight up, and that you need to have a methodology for assigning fees equitably when swapping currency. Accointing.com is the only cryptocurrency tax calculator partnered with myna and is fully compliant with the hmrc’s crypto tax guidance. This means that capital gains and losses rules apply when you dispose of your cryptocurrency.

So, is there a crypto tax in the uk? Accordingly, the eu taxation may range widely. We expect other tax agencies to follow suit.

Best crypto tax calculators to use in the uk taxscouts. “disposal” is a broad term that essentially means whenever you get rid of a cryptocurrency. 2020 capital gains tax changes if you sell a residential property, you now need to declare your profits within 30 days and pay any tax you owe.

For uk residents, the capital gains tax on cryptocurrency transactions is taxed at 10% for the basic rate (up to £37500), up to a maximum of 20%. Hmrc has published guidance for people who hold cryptoassets (or cryptocurrency as they are also known), explaining what taxes they may need to pay, and what records they need to keep. Hmrc also suggests what cost you can deduct from disposal proceeds to calculate capital gain.

Accounting and cryptocurrency tax in the uk. The original software debuted in 2014. Now, in the uk, the tax of digital value, the investment or transactions price, or secured income has to be turned into fiat at the exchange rate of a cryptocurrency (market price) working on the date of acceptance of the interest or profits.

How are bitcoin and other cryptocurrencies taxed in the uk and usa? How accointing.com simplifies your crypto tax filing. See the full hmrc guidance here.

Be aware that this includes both uk residents and those who own uk property but live abroad. Crypto tax calculator help center. This rule has been in place since 6th april 2020.

![]()

Cointracking - Crypto Tax Calculator

Crypto Tax Calculator

Top 8 Crypto Tax Software Alternatives To Cointracking Updated 2021 Coincodex

How To Calculate Your Crypto Taxes For Your Self-assessement Tax Return Recap Blog

![]()

Cointracking - Crypto Tax Calculator

Cryptocurrency Taxes In The Uk The 2022 Guide Koinly

Best Bitcoin Tax Calculator In The Uk 2021

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

Best Bitcoin Tax Calculator In The Uk 2021

Uk Cryptocurrency Tax Guide Cointracker

Best Bitcoin Tax Calculator In The Uk 2021

Best Bitcoin Tax Calculator In The Uk 2021

How Are Bitcoin And Other Crytpocurrencies Taxed Jean Galea

Bitcoin And Crypto Tax In The Uk With New Hmrc Policy

The Uk Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Uk Cryptocurrency Tax Guide Cointracker

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

Best Bitcoin Tax Calculator In The Uk 2021

Wades Cryptocurrency Trading Journal Tax Calculator Spreadsheet Amazoncouk Software

Comments

Post a Comment