If the investor dies owning the eis shares, the gain will be eliminated. This would defer the capital gain all the while the money is invested in to an eis and could potentially defer the gain indefinitely.

Enterprise Investment Scheme What Is The Eis The

The enterprise investment scheme (eis) offers tax breaks for investors who invest in small, new trading businesses.

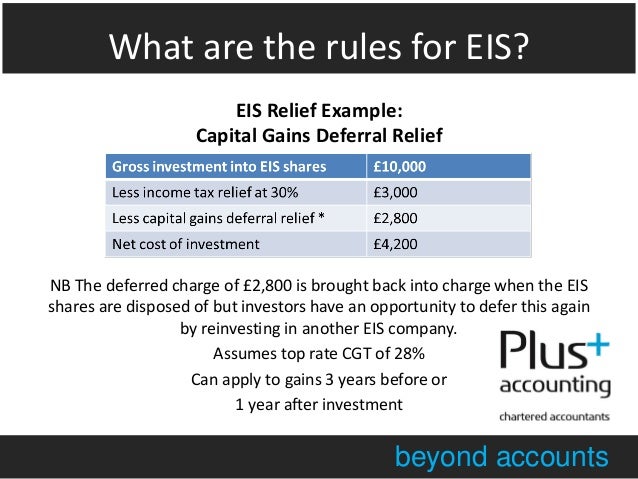

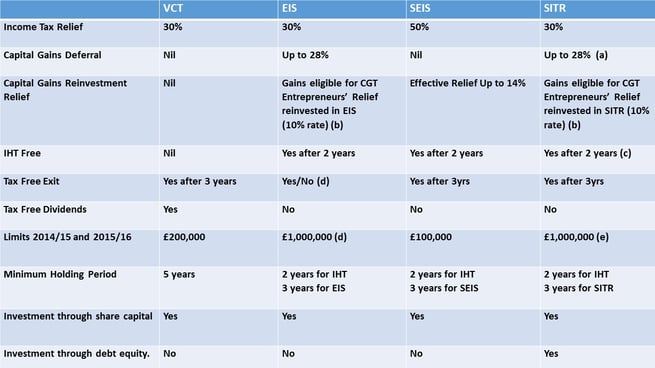

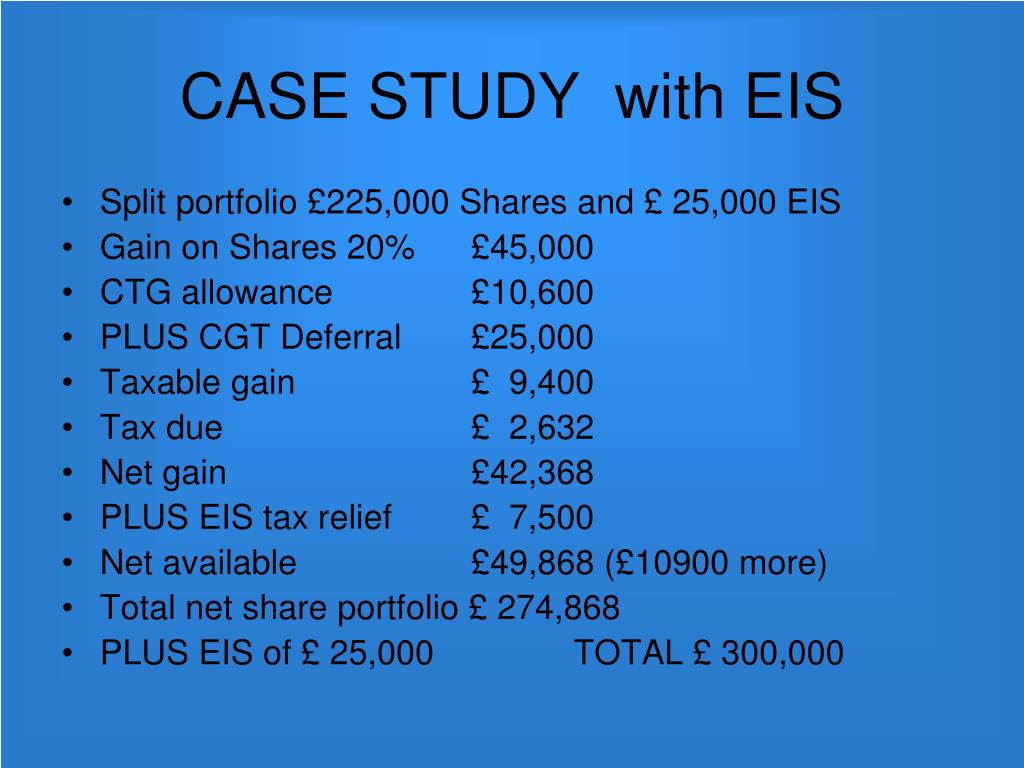

Defer capital gains tax eis. Income tax relief equivalent to 30% of the amount invested in eis. This provides a ready supply of venture capital to growing businesses. Cgt on gains which occur up to 12 months after the eis share purchase date can also be deferred.

Invest capital gains in eis to defer tax. Interestingly, this still applies beyond the income tax relief limit in a year, so any amount can be reinvested in eis shares and the deferral claimed, even if one a part of this amount obtains income tax relief. This is my first eis investment.

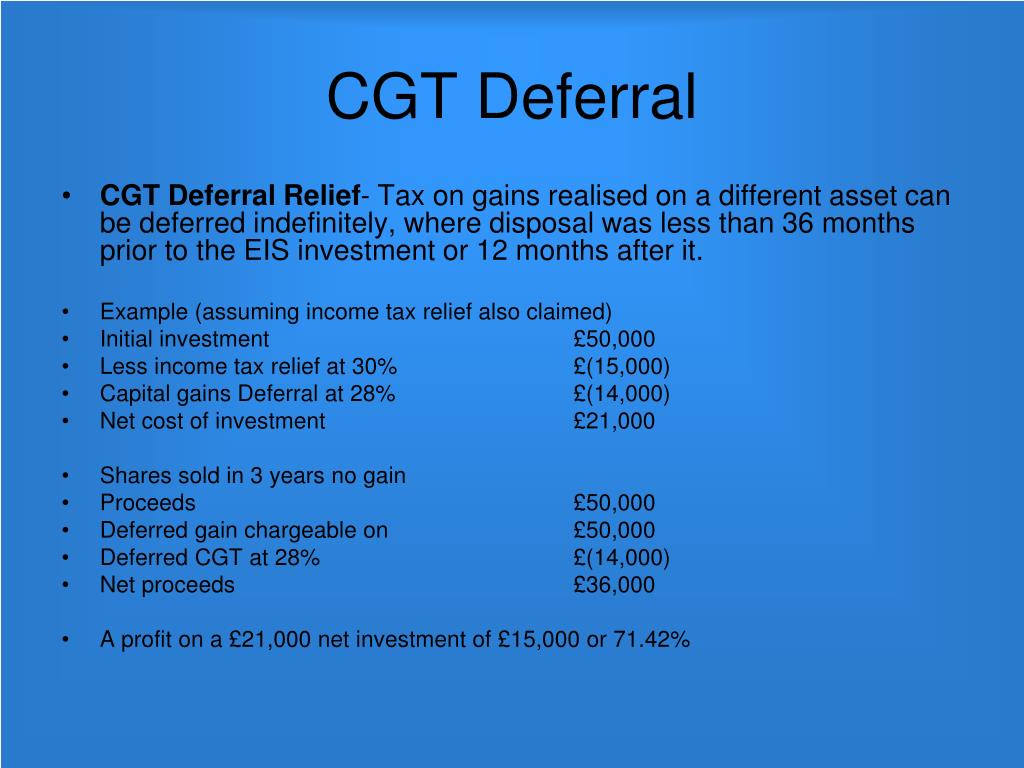

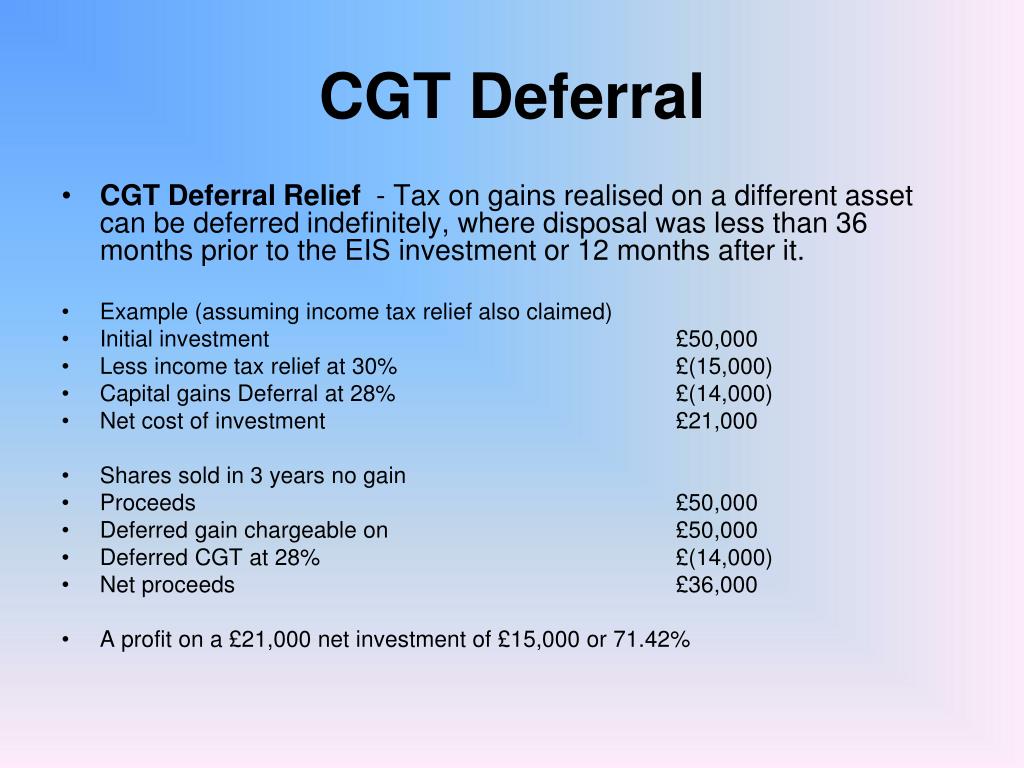

By subscribing for £100,000 of ordinary shares in an eis and claiming capital gains tax deferral relief, the investor will defer between £28,000 of capital gains tax. In practice, you can defer paying capital gains tax on this money indefinitely if you continue to reinvest it in an eis each time you dispose of your shares (providing you have held them for three years, before disposing of them, each time). Cgt deferral can be applied to gains that occurred up to three years before the date that eis shares are purchased.

Find out about capital gains tax treatment for disposal relief and deferral relief for the enterprise investment scheme (eis). You normally have to pay capital gains tax in the same year as you dispose of the asset. As such, it’s possible that ms.

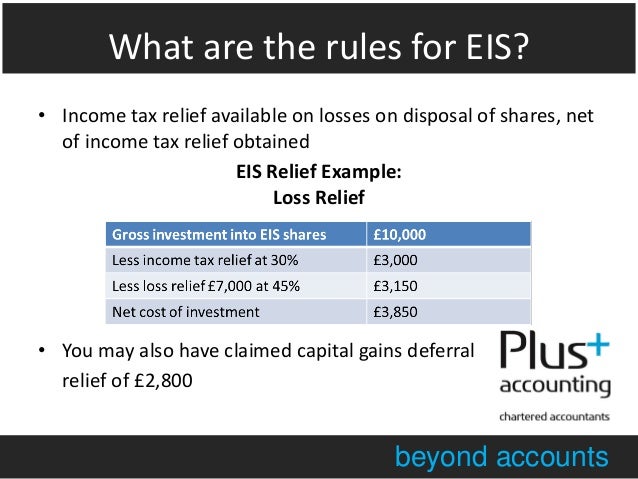

I would like to defer a capital gain made in 17/18. Deferral relief can be claimed against any amount of chargeable gain arising on the disposal of any asset where the gain is invested in eis shares. The ability to defer paying capital gains on the sale of a previous asset (this deferral lasts until profit, or loss, from the eis fund is realised.

In some circumstances the deferral will become indefinite. You must give details of the disposal on the capital gains tax summary pages of your tax return if either: But fewer people are probably aware of the capital gains tax benefits which can also arise from an eis investment, whereby not only are any gains on a sale of the eis shares (once held for three years) free from capital gains tax, but the amount invested in the eis shares can also be used to defer capital gains made on other assets, generally within a four year window beginning one year before the eis share are.

I was hoping to not pay capital gains tax on 31st. Take advantage of a section 1031 exchange. Capital gains tax eis deferral relief.

When the deferred gain comes back into charge, it’s subject to capital gains tax at the relevant rate at that time. Mrs smith’s advisor mentioned that she could defer payment of capital gains tax by investing the capital gain, minus her annual cgt allowance, of £57,700 in to an eis. In tax year 17/18 i made an eis qualifiing investment and have recieved an eis tax certificate.

Among these tax breaks is a capital gains tax deferral relief which means that gains that would otherwise be taxable can be deferred to the extent that an eis investment is made. Cgt deferral relief capital gains tax on gains realised on different assets can be deferred if you invest your gain into eis qualifying shares. Capital gains tax and enterprise investment scheme (self assessment.

Evans may need to pay cgt. In principle, this means that you can sell any asset that you own, use the profits to buy shares in an eis eligible company, and defer the tax bill of. Deferral relief allows a uk.

The total value of the eis shares and any other assets you disposed of in the tax year. To receive this relief you must subscribe for eis shares during the period one year before or three Tax relief for reinvestment of gains in qualifying schemes is intended to stimulate investment in small businesses, and is incorporated into the enterprise investment scheme (eis), as eis deferral relief.

Eis capital gains tax deferral relief this relief is covered in sch 5b taxation of chargeable gains act (tcga) 1992. Depending on the nature of the asset disposed of, this can result in the individual paying capital gains tax (cgt) at 20% or 28% in tax years where their taxable income and gains exceed the basic rate threshold (£37,700 for the 2021/22 and 2022/23 tax years) but only 10% or 18% on gains in years where their net income and gains are lower than that. However, cgt deferrals and other eis tax reliefs are only available once the investor has received an eis3 certificate from hmrc.

However, with eis deferral relief you can defer the gain, and therefore also the tax bill, to a later date if you use your gain to buy shares in an eis eligible company. Investing a taxable gain in an eis allows you to defer it for as long as that money remains invested.

Ppt - Enterprise Investment Scheme Powerpoint Presentation Free Download - Id5999460

Offset Capital Gains With Eis Seis Reinvestment Moneysavingexpert Forum

Enterprise Investment Schemes Eis - Ppt Download

Enterprise Investment Scheme What Is The Eis The

Eis Seis Relief Workshop - Plus Accounting Chartered Accountants

Armcocouk

Can A Seis Investment Be Used To Defer Cgt Accounts Lab

.png)

What Is Cgt Deferral Relief - Rlc Ventures

Ppt - Enterprise Investment Scheme Powerpoint Presentation Free Download - Id7022954

Enterprise Investment Schemes Eis - Ppt Download

How To Claim Eis And Seis Tax Relief - The English Investor

Tax Efficient Investment Schemes Which Is Best

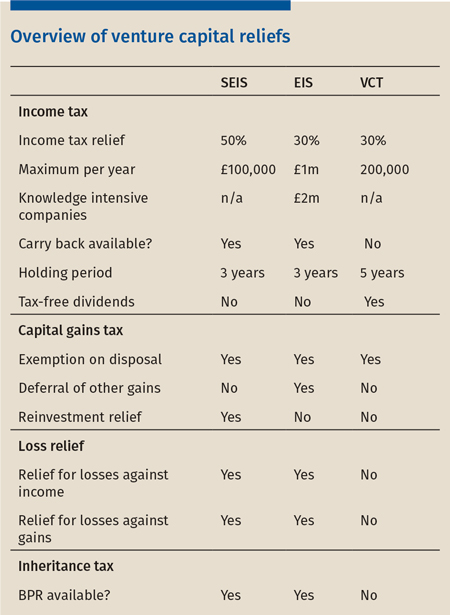

How To Handle Venture Capital Tax Reliefs

Eis Tax Relief Guide How To Save Tax When You Invest Under Eis

Eis Information Sapphire Capital Partners Llp

Ppt - Enterprise Investment Scheme Powerpoint Presentation Free Download - Id5999460

Eis Seis Relief Workshop - Plus Accounting Chartered Accountants

Eis Tax Reliefs Explained - Part Two - Capital Gains Tax Reliefs

Enterprise Investment Schemes Eis - Ppt Download

Comments

Post a Comment