Currently, estates under $11.4 million are exempt, but this reverts back to $5 million in 2026. The standard inheritance tax rate is 40%.

The New Death Tax In The Biden Tax Proposal Major Tax Change

Each individual is granted a rebate of r3.5 million and estate duty is therefore only taxed on.

How much tax on death. This tax generally isn't levied against the entire value of an estate but only on the amount by which it exceeds certain thresholds called exemptions. One is estate duty and the other is capital gains tax. All death benefit payments will be disbursed pro rata

Example your estate is worth £500,000 and your tax. Beginning in 2019, the cap on the connecticut state estate and gift tax is reduced from $20 million to $15 million (which represents the tax due on a connecticut estate of approximately $129 million). It’s only charged on the part of your estate that’s above the threshold.

Two separate taxes are levied on a deceased estate: However, if the person died after october, their tax return may be filed within six months of the person’s death. A lump sum superannuation death benefit paid to someone who is not a death benefit dependent for tax purposes is subject to 17% or 32% tax.

The deemed disposition rules of the income tax act treat all. When someone dies, their personal representative (also known as an executor) is normally required to file a tax return for the deceased by april 30 of the following year. There is no federal inheritance tax.

The exemptions for state inheritance taxes are much lower, so many heirs will be responsible for paying this tax. There are no inheritance or estate taxes in australia. When someone dies, the australian taxation office (ato) advises that who their super balance gets paid out to will determine how the benefit is treated for tax purposes.

Ways to avoid paying death taxes By definition, estate taxes are taxes on someone’s right to transfer ownership of their entire estate to their loved ones when they die. Type of death benefit age of beneficiary age of deceased tax on taxable component;

Federal exemption for deaths on or after january 1, 2023. Tax treatment of capital gains at death when an asset is sold that has appreciated in value, such as a share of stock, the gain is taxed at rates of 0%, 15%, or Any amount over and above r300 000 will have an inclusion rate of 40% and this amount will then attract the applicable tax as per the deceased individual’s marginal rate.

The estate tax is, as the irs puts it, a tax on your right to transfer property at your death. all the cash and property you own at the time of death is added up and subjected to. Also included in income at death is the net capital gain recognized under the deemed disposition rules. In the year of death, a final (terminal) tax return must be filed by the estate's executor/liquidator that includes all income earned by the deceased up to the date of death.

This tax is levied on each individual heir based on the value of the assets that they inherited. More specifically, factors such as whether the beneficiary is a dependant or not, along with their age and whether they receive the benefit as a lump sum or income stream can play a part in determining how the benefit is taxed. It will sunset in 2025 unless congress chooses to renew it.

When a person dies, the legal personal representative dealing with the deceased person's tax affairs have some important tax and superannuation issues to attend to. Estate duty is determined based on the gross value of the estate. Which taxes apply when someone dies?

The Generation-skipping Transfer Tax A Quick Guide

Using Form 1041 For Filing Taxes For The Deceased Hr Block

How Is My Tax Collected Low Incomes Tax Reform Group

The Generation-skipping Transfer Tax A Quick Guide

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

5 Ways The Rich Can Avoid The Estate Tax - Smartasset

Social Security Survivor Benefits Can Give Your Loved Ones A Big Check - Feb 2 2000

Annuity Taxation How Various Annuities Are Taxed

Is Life Insurance Taxable Forbes Advisor

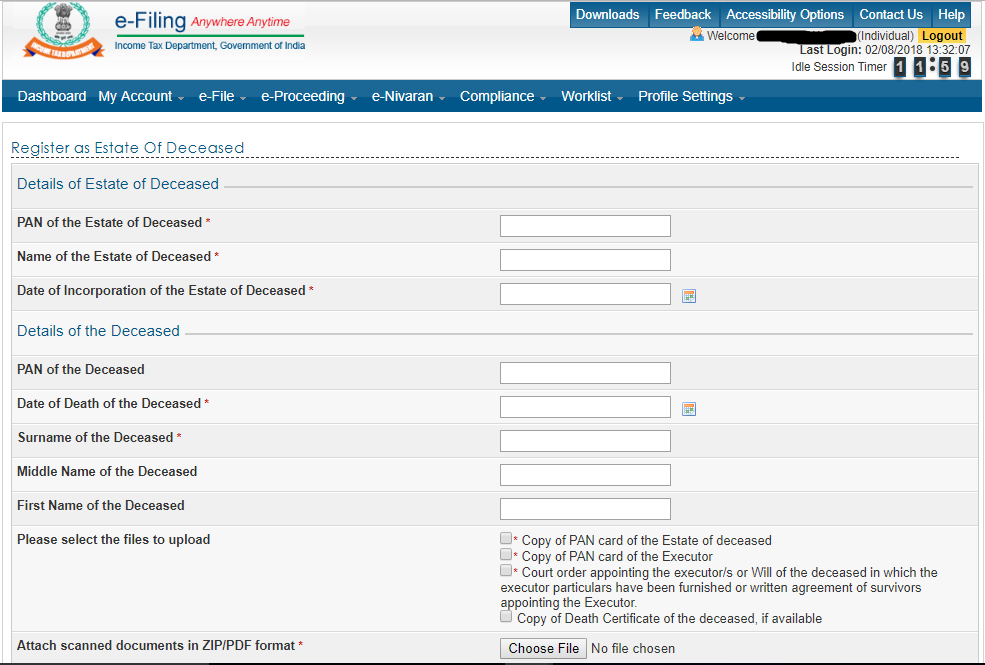

How To File Income Tax Return For The Deceased By Legal Heir

The Death Of A Spouse Is Hard Taxes Make It Harder - Wsj

What Reliefs And Exemptions Are There From Inheritance Tax Low Incomes Tax Reform Group

Qa Where Do I Pay Inheritance Tax From My Deceased Irish Uncle

On Death And Taxes Estate Tax Under The Train Law - Law Firm In Metro Manila Philippines Corporate Family Ip Law And Litigation Lawyers

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

What Is A Step-up In Basis Cost Basis Of Inherited Assets

What Reliefs And Exemptions Are There From Inheritance Tax Low Incomes Tax Reform Group

Comments

Post a Comment