Public records within the register of deeds office include all land transactions, liens, and dd214 military discharges. Property tax lookup link to gis.

2

Our office is open to the public from 8:00 am until 5:00 pm, monday through friday.

Laurens county tax assessor office sc. For comparison, the median home value in laurens county is $85,800.00. As of november 22, laurens county, sc shows 269 tax liens. © 2015 laurens county, sc

Laurens county tax assessors contact information. Laurens county assessor's office services. Box 1049 laurens, sc 29360 other county offices:

Find 1 listings related to tax assessors office in laurens on yp.com. The laurens county tax assessor is the local official who is responsible for assessing the taxable value of all properties within laurens county, and may establish the amount of tax due on that property based. Remember to have your property's tax id number or parcel number available when you call!

Welcome to the laurens county assessors office web site! When are my property taxes due in county of laurens, sc? The laurens county treasurer and tax collector's office is part of the laurens county finance department that encompasses all financial functions of the local government.

Address, phone number, fax number, and hours for laurens county tax assessors, an assessor office, at east jackson street, dublin ga. If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the laurens county tax appraiser's office. By law, property tax bills have to be mailed out at least 30 days prior to the due date.

The goal of the laurens county assessors office is to provide the people of laurens county with a web site that is easy to use. Laurens county, south carolina treasurer the treasurer is an elected constitutional officer responsible for the collection of property taxes, including the processing of homestead exemptions, preparation of the county tax digest, billing of taxes, and the accounting for and distribution of those taxes. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property.

For vehicle tax payments, the confirmation receipt that you print after completing your tax payment is only a confirmation of your payment. You can search our site for a wealth of information on any property in. If you have documents to send, you can fax them to the.

To avoid lines, you may mail your payments to the treasurer's office: Looking up property owners by name and address. The goal of the laurens county assessors office is to provide the people of laurens county with a web site that is easy to use.

Interested in a tax lien in laurens county, sc? Monday through friday 9:00 a.m. See reviews, photos, directions, phone numbers and more for tax assessors office locations in laurens, sc.

The laurens county gis maps search (south carolina) links below open in a new window and take you to third party websites that provide access to laurens county public records. You may contact the laurens county tax collector's office for questions about: Welcome to the laurens county, sc website the register of deeds office is within the office of the clerk of court for laurens county.

Box 1049, laurens, sc 29360. Perform a free laurens county, sc public gis maps search, including geographic information systems, gis services, and gis databases. Laurens county assessor’s office david e.

The office of delinquent tax collector in laurens county is under the general supervision of the county treasurer and is operated by the appointed delinquent tax collector. Click here for property search lookup. On march 17th each year all delinquent taxes are turned over to the delinquent tax collector for collection.

How does a tax lien sale work? Our office is open to the public from 8:00 am until 5:00 pm, monday through friday. Welcome to the laurens county assessors office web site!

Property records requests for laurens county, sc. The laurens county assessor's office, located in laurens, south carolina, determines the value of all taxable property in laurens county, sc. They are due by january 15th without penalty unless the 15th falls on a weekend or a holiday.

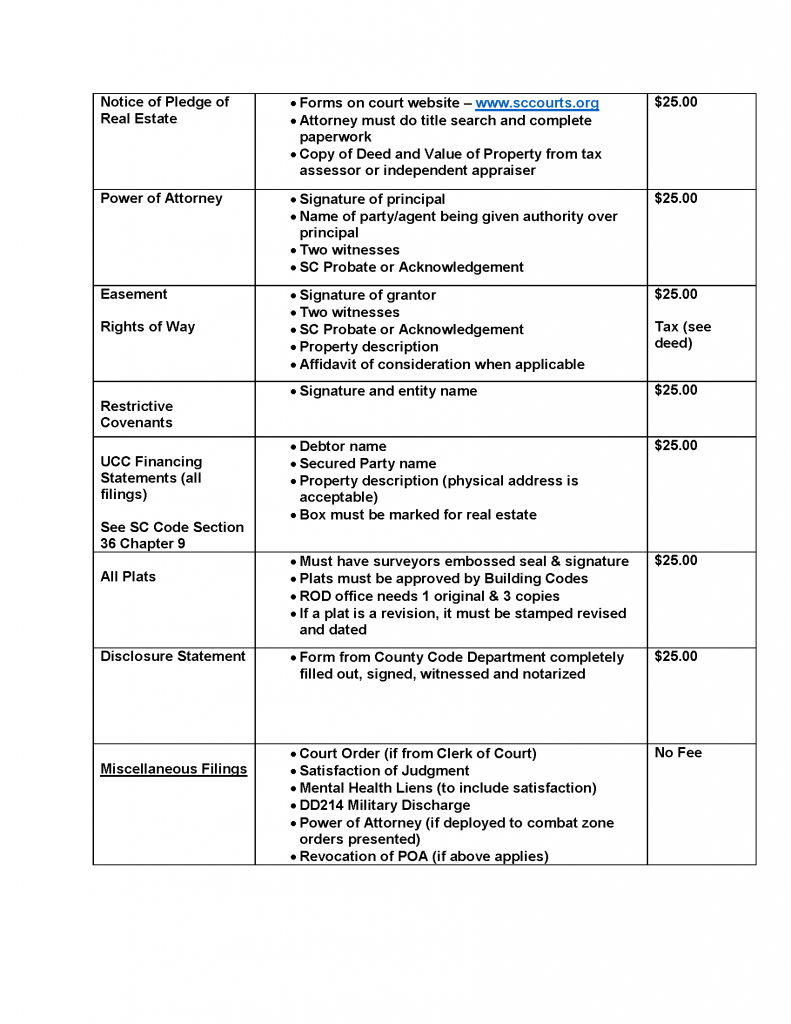

Recording Fees Laurens County

Ultimate Guide To Understanding South Carolina Property Taxes

Treasurer

Helpful Links Laurens Co Development Corporation

Logo Cynthia Burke Treasurer Donna Waldrop Deputy Treasurer Phone 864-984-4742 Fax 864-984-3922 Office Hours Monday Through Friday 900 Am To 500 Pm Physical Address 100 Hillcrest Square-suite E Laurens Sc 29360 Mailing Address Po

2

Laurens County Suspending Public Access To Hillcrest Square Due To Covid-19 Cases News Golaurenscom

Laurens County Real Property Search Gis - Property Walls

Laurens County Real Property Search Gis - Property Walls

Laurens County Tax Assessors Office

Treasurer

Laurens County Real Property Search Gis - Property Walls

2

Helpful Links Laurens Co Development Corporation

2

Laurens County Real Property Search Gis - Property Walls

South Carolina Assessor And Property Tax Records Search Directory

Tax Commissioner Laurens County Ga

Helpful Links Laurens Co Development Corporation

Comments

Post a Comment