• tax is imposed on the sum of member’s new jersey sourced share of distributive proceeds, which is $500,000. If you do not have a fein, your new jersey tax id number is usually the social security number of the primary business owner followed by three zeroes.

Center For Consumer Protection Monthly

How to file like many other new jersey taxes, bait forms and payments must be submitted

Nj bait tax example. 20 this would seem to. The distributive proceeds (sourced to new jersey) are allocated $50,000 to member a and $50,000 to member b. The new jersey business alternative income tax — also referred to as bait or nj bait — helps business owners mitigate the negative impact of the federal state and local tax (salt).

By passing through a net amount of income reduced by the salt deduction, the owner is able to fully deduct their new jersey taxes for federal purposes. The bait provides a workaround to the federal limitation on state income tax deductions. Mechanics of the bait election.

If you do not have a suffix, enter three zeroes. New jersey sourced income was $500,000. Consider the following simplified example:

Consequently, the bait may only provide effective federal tax relief for resident owners of ptes that have a significant presence in the state. The entity must have at least one member who is liable for tax on their share of distributive proceeds pursuant to the new jersey gross income tax act, n.j.s.a. New jersey’s most recent guidance addresses some issues regarding estimated tax payments and calculating the bait.

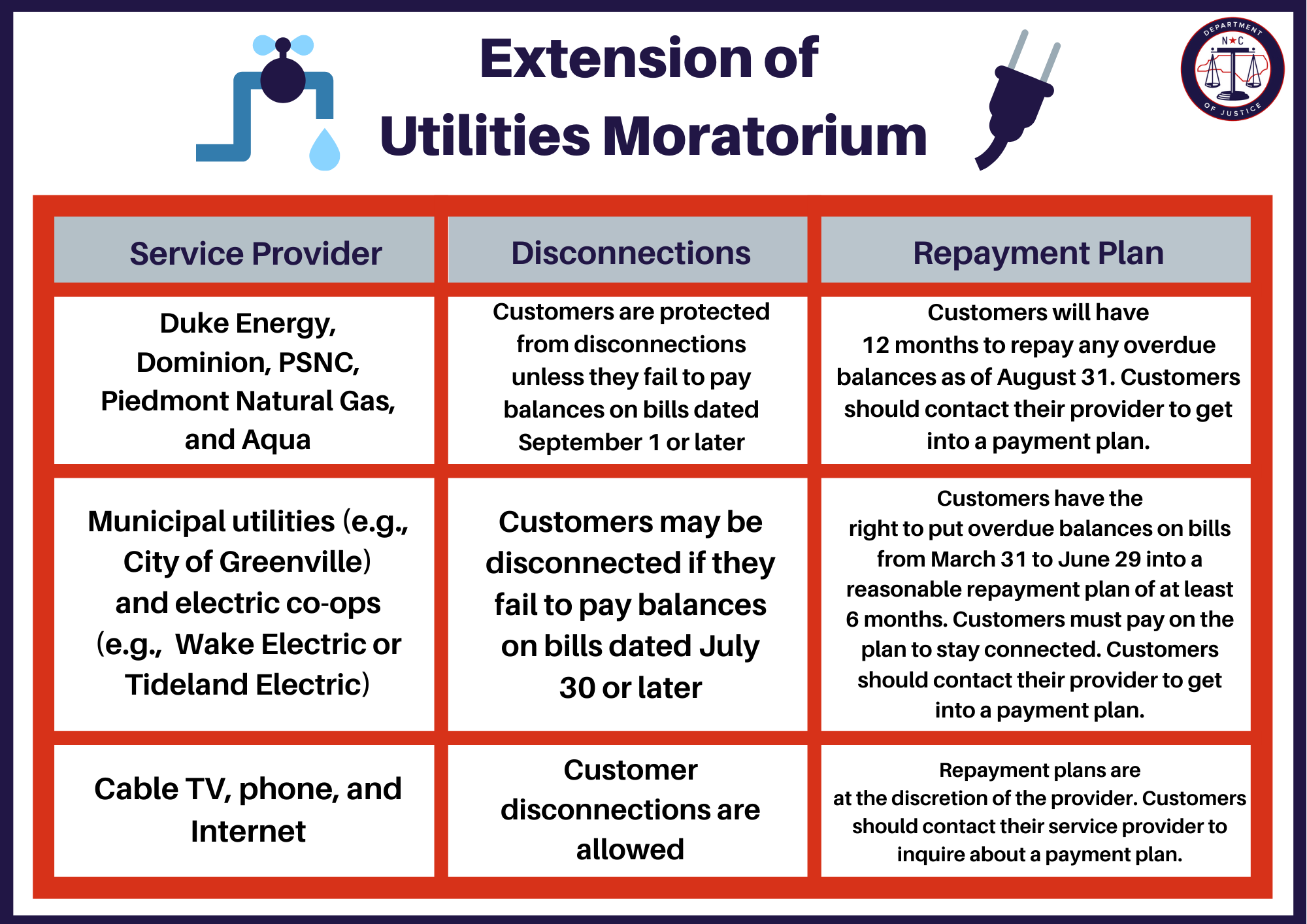

In response to federal tax reform enacted in december 2017, new jersey was one of several states searching for workarounds to help its residents manage the federal $10,000 salt deduction limitation and amended internal revenue code (irc) section 164. The bait is calculated based on the entity’s income sourced to new jersey, with a graduated tax rate ranging from 5.675% (for income under $250,000) to 10.9% (for income over $5,000,000). Also, if electing to calculate nj bait, the s corporation must apply gross income tax (i.e., new jersey's personal income tax) methodologies for sourcing income while, at the same time, for purposes of reporting the net pro rata share of s corporation income to owners, the s corporation will need to use corporation business tax methodologies.

The individual members of the pte are allowed a refundable new jersey gross income tax credit equal to their pro rata share of the bait tax paid by the bte. The faqs illustrate the mechanics of the bait in the following example: The bait tax rate ranges from 5.675% (distributive share under $250,000) to 10.9% (distributive share over $5 million).

Payments for the tax year are less than 80% of the total tax liability reported on the current year’s tax return or less than 100% of the total tax liability reported on the prior year’s tax return. S corporation (s) has net income of $1,000,000 in 2020, and one individual shareholder (a). Using the table above, tax is calculated on the $500,000 as follows:

Assuming there are two owners that each own 50% of the business, each owner will get a credit of $5,675 on its respective tax return. Member a is a resident and member b is a nonresident. As of january 2020, nj has signed into law the nj bait tax, or business alternative income tax (bait), how it works:

While there are several implications businesses should consider, businesses that meet the following three conditions should. Income, gain, or loss attributable to real property that is physically located in new jersey must be allocated entirely to this state. The bait act was one of those responses and was introduced over a year ago.

Do not use hyphens, slashes, or other punctuation. New jersey joined the salt workaround bandwagon this year by establishing its business alternative income tax (bait).

Trying To Make Sense Of The Troubles At Jetsmarter

Burger King Whopper Wednesday Promo How To Get 2 Whoppers Today - Thrillist

2

Center For Consumer Protection Monthly

2

2020 Jeep Compass Lease Near Fort Lee Nj

2

2

Hotel In New Providence Best Western Plus Murray Hill Hotel And Suites

Used 2012 Dodge Durango For Sale With Photos - Cargurus

2

Kaws Companion Open Edition Vinyl Figure Black In 2021 Vinyl Figures Kaws Wallpaper Vinyl

Hotel In New Providence Best Western Plus Murray Hill Hotel And Suites

2019 Chrysler Pacifica For Sale Near Hawthorne Nj

2

The 2nd Type Of Loan The Fha Title I Loan Belongs To An Us Government Sponsored Program Meant To Enable Ho Home Improvement Loans Home Improvement Home Goods

Letter Template Hmrc Penalty Appeal Letter Example Five Easy Ways To Facilitate Letter Templ Letter Example Letter Templates Business Letter Template

Gmc Sierra 1500hd For Sale In Chicago Il Prices Reviews And Photos - Cargurus

2

Comments

Post a Comment