Read the potential new law on ev tax credits sponsored by michigan senators and it currently looks like the “suv” category has a top end of $69,000. $0 $0 (you save $5,300) $79,990 tesla 2021 model s plaid;

Latest On Tesla Ev Tax Credit December 2021 - Current And Upcoming In 2022

That means you’ll spend 7 percent less on your solar equipment.

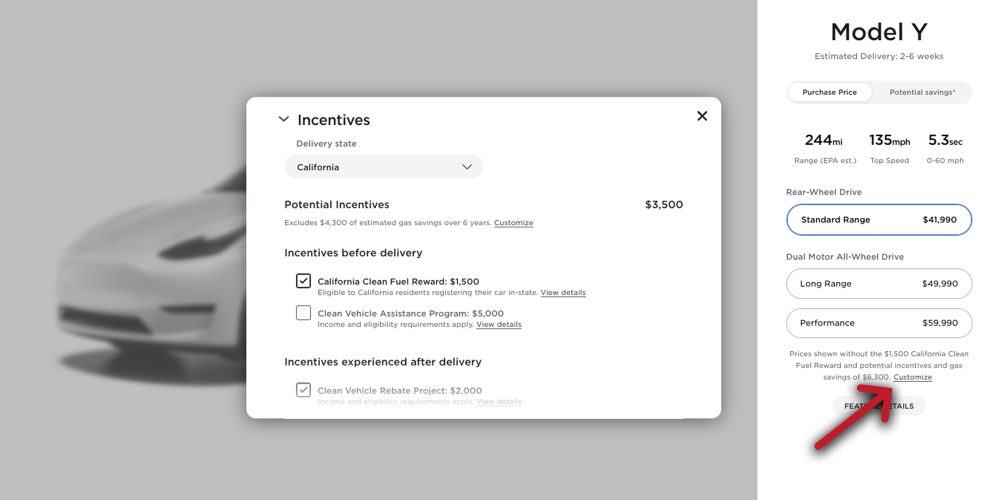

Nj tesla tax credit 2021. $5,000 $0 (you save $3,200) Tesla 2021 model y long range awd 326; The incentives could be combined with a current.

The state rebate also applies to. Both tesla and gm have finished this process; But when combined with the federal tax credit of up to $7,500, ev drivers in the garden state can get as much as $12,500 off new evs, depending on the car.

To claim the credit on efile.com, you can prepare and efileit form 8936 along with form 1040. Charge up nj * ev rebate nj state sales tax (6.625%) cost after incentives; Colorado offers a tax credit of up to $4,000 for purchasing a new ev and $2,000 for leasing one.

Not to mention tesla get's the credit back for model y. You could also be eligible for a tax credit of $5,000 for buying or converting a vehicle. Funding is allocated on a fiscal year basis and incentives are available only while funding lasts.

Combined with the federal tax credit of up to $7,500, ev drivers in the garden state were getting as much as $12,500 off the sticker price of their cars, depending on the make and model. A proposed reformation of the ev tax credit threshold will enable gm and tesla to regain access for their future ev customers up to $7,000 in tax credits on a new sales limit of 400,000 electric vehicles in the u.s. The risk you somehow get a tesla unexpectedly quick before year end and then the car wouldn't be eligible for any tax.

This means that any vehicle that can get an electric range. After already burning through their 200k credits. We have reached the funding cap for this fiscal year.

New jersey solar panel tax credits. It varies based on the size of the battery but because tesla uses big batteries they qualify for the full amount of federal tax credit. Budget reconciliation and ev credit.

If the updated incentive program bill is passed by congress this year (2021). I didn't qualify for nj rebate but waiting on federal which they agreed to include in budget reconciliation and hopefully keep purchase date after 5/24/2021 which approved in finance subcommittee to qualify: My 2021 gtpe comes in at $69,840 with rapid red, pano, camera and protection kit.

$14,500 approximate system cost in new jersey after the 26% itc in 2021: We have to wait and see what date they agree when budget passes. Tesla motors makes electric vehicles and, in the us, people had a federal tax credit of $7,500 for tesla.

The legislation creates a state rebate, giving consumers a credit of $25 per mile of electric range for their car, up to a max of $5,000. Btw, tesla y comes in under 69. The $7,500 tax credit to 200,000 electric vehicles per manufacturer.

Your charge up new jersey incentive application meets our eligibility criteria for your tesla model 3 for $5,000.00. $0 (you save $7,425) $112,090; I think i read on this forum it will be summer 2021 if i'm not mistakenm it seems like sales tax is still exempt for ev, but any idea if the $5,000 rebate will happen again?

On top of these revenue streams, new jersey has also granted residential solar a couple tax breaks to help keep the costs down. Relaxed area for all around discussion on tesla, this is the official lounge for. The residential itc drops to 22% in 2023 and ends in 2024.

It puts automakers who were early proponents of electric vehicles, like tesla and gm, at a disadvantage. Any idea on what phase 2 in nj will look like? Buy and install new solar panels in new jersey in 2021, with or without battery storage, and qualify for the 26% federal solar tax credit.

If you purchased either of these vehicles in 2021, they are not eligible for a tax credit. Let's say you owed the federal government $10,000 in taxes when filing your 2021 taxes. The full ev tax credit will be available to individuals reporting adjusted gross incomes of $250,000 or less, $500,000 for joint filers (decreased from $400,000 for individuals/$800,000 for joint.

When you purchase your home solar system, you will be 100 percent exempt from any sales tax, due to the pv energy sales tax exemption. Tesla 2021 model s long range 412; The new proposal limits the full ev tax credit for individual taxpayers reporting adjusted gross incomes of $250,000 or $500,000 for joint filers, down from $400,000 for individual filers and $800,000 for joint filers.

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit - Electrek

14 Best All Wheel Drive Electric Vehicles For 2021 - Truecar

Teslas 7500 Tax Credit Goes Poof But Buyers May Benefit Wired

Nj Drivers Miss Out On 5k Rebate For Electric Cars If They Bought Them Earlier This Year - Njcom

Tesla Double-charged Some Customers For New Cars

Pros And Cons Of Buying An Electric Vehicle In 2020 Vs 2021 Aspentimescom

/cloudfront-us-east-2.images.arcpublishing.com/reuters/H6Y6I2PVNFJ53PLNO3WBO7C3EY.jpg)

Elon Musk Can Afford Bidens Ev Snub Reuters

Nj Wants To Pay You To Buy An Electric Vehicle But It Hasnt Said When It Will Resume Doing So - Njcom

2022 Tesla Model Y Prices Reviews And Pictures Edmunds

Best New Used Electric Luxury Cars In 2021 - Carfax

How Much Tesla Car Insurance Costs - Nerdwallet

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits - Extremetech

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate - Roadshow

2021 Tesla Model Y Performance Awd - Pge Ev Savings Calculator

Tesla Is Back To A Full Vehicle Lineup But Delivery Timelines Slip Up To Almost A Year - Electrek

2022 Tesla Model X Prices Reviews And Pictures Edmunds

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate - Roadshow

Drivers Are Into Electric Cars Dealers Dont Know How To Sell Them - Bloomberg

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit - Electrek

Comments

Post a Comment