This new honda car is priced at $48375 and available for a test drive at south tacoma honda. The tacoma, washington sales tax is 10.00%, consisting of 6.50% washington state sales tax and 3.50% tacoma local sales taxes.the local sales tax consists of a 3.60% city sales tax.

2

Utilize quick add to cart and more!.

Sales tax calculator tacoma wa. Your brand can grow seamlessly with wix. Groceries are exempt from the tacoma and washington state sales taxes Click below to find your next car.

Utilize quick add to cart and more!. Working together to fund washington's future. You’ll find rates for sales and use tax, motor vehicle taxes, and lodging tax.

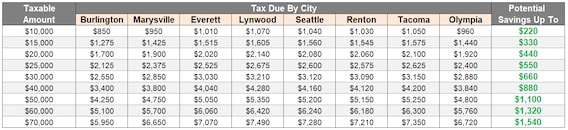

This means that, depending on your location within washington, the total tax you pay can be significantly higher than the 6.5% state sales tax. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Search by address, zip plus four, or use the map to find the rate for a specific location.

Ad create an online store. New 2022 honda ridgeline black edition for sale in tacoma, wa. The december 2020 total local sales tax rate was 10.200%.

See inventory get a quote. The washington (wa) state sales tax rate is currently 6.5%. Ad create an online store.

The current total local sales tax rate in tacoma, wa is 10.300%. See reviews, photos, directions, phone numbers and more for sales tax calculator locations in tacoma, wa. When searching your next new vehicle, not only do we have a toyota to fit every lifestyle, but some of the best deals you’ll find in washington!

What is the sales tax rate in tacoma, washington? The second is a volume tax, called the spirits liter tax, which is equal to $3.7708 per liter (retail) or $2.4408 per liter (restaurants and bars). Tacoma, wa sales tax rate.

These cars are a great deal for undefined shoppers. Tacoma in washington has a tax rate of 10% for 2022, this includes the washington sales tax rate of 6.5% and local sales tax rates in tacoma totaling 3.5%. Depending on local municipalities, the total tax rate can be as high as 10.4%.

Homeowner, no child care, taxes not considered: Find 1148 listings related to sales tax calculator in tacoma on yp.com. Your brand can grow seamlessly with wix.

The full address for this home is 6640 south alder street, tacoma, washington 98409. Decimal degrees (between 45.0° and 49.005°) longitude: This is the total of state, county and city sales tax rates.

Washington has a 6.5% statewide sales tax rate, but also has 218 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 2.252% on top of the state tax. The minimum combined 2021 sales tax rate for tacoma, washington is. The tacoma sales tax is collected by the merchant on all qualifying sales made within tacoma;

The washington sales tax rate is currently %. The first is a sales tax of 20.5% for retail sales and 13.7% for sales made in restaurants and bars. To calculate sales and use tax only.

You can find more tax rates and allowances for tacoma and washington in the 2022 washington tax tables. Undefined undefined for sale near quincy, wa 98848. Here at foothills toyota, our priority is to provide the best possible customer experience.

Which Cities And States Have The Highest Sales Tax Rates - Taxjar

Washington Income Tax Calculator - Smartasset

What Is The Washington State Vehicle Sales Tax

States With Highest And Lowest Sales Tax Rates

Washington Sales Tax Rates By City County 2021

Auto Sales Tax Calculator Buy A Vw Near Marysville Wa

Washington Income Tax Calculator - Smartasset

Washington Sales Tax - Taxjar

Sales Tax Calculator - Foothills Toyota

Sales Tax By State Non-taxable Items - Taxjar

2

Sales Tax Calculator - Foothills Toyota

Sales Tax Calculator - Foothills Toyota

Which Cities And States Have The Highest Sales Tax Rates - Taxjar

Cost Of Living In Tacoma 2021 Is Tacoma Affordable Guide

New Toyota Tacoma Trd Off-road For Sale In Burlington Wa - Foothills Toyota

85 Sales Tax - Foothills Toyota

States With Highest And Lowest Sales Tax Rates

Washington Sales Tax - Small Business Guide Truic

Comments

Post a Comment