Calculate a simple single sales tax and a total based on the entered tax percentage. How 2021 sales taxes are calculated in kenosha.

Sales Tax Calculator For Purchase Plus Tax Or Tax-included Price

There is no city sale tax for kenosha.

Wisconsin car sales tax calculator. The calculator will produce a chart with the total estimated annual fees and taxes. The national average state and local sales tax, by comparison, is 7.12 percent. Once you have the tax.

Wisconsin collects a 5% state sales tax rate on the purchase of all vehicles. Residents can also compare that cost to the same vehicle in four other midwestern states. All calculations are estimates based on all known state excise, sales, and environmental taxes and fees levied on gasoline, plus vehicle.

Auto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator. See our manual car tax calculator, and use the override option to fine tune your auto loan quote. This lookup does not identify any other taxes that may also apply such as the local exposition district taxes, premier resort area tax.

If you’ve opened this page (and reading this), chances are you are living in wisconsin and you intend to know the sales tax rate, right? Sales of boats, recreational vehicles as defined in sec. Wisconsin has a 5% statewide sales tax rate , but also has 265 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 0.46% on top.

If you are unsure, call any local car dealership and ask for the tax rate. The current total local sales tax rate in delavan, wi is 5.500%. 5% is the smallest possible tax rate ( brookfield, wisconsin) 5.1%, 5.5%, 5.6%, 6% are all the other possible sales tax rates of wisconsin cities.

The total amount represents the various taxes and fees, which are used to build and maintain wisconsin’s roads. Sales of motor vehicles, aircraft and truck bodies (including semitrailers) to nonresidents who do not use the property other than to remove it from wisconsin, are exempt from wisconsin sales and use tax. 7.75% for vehicle over $50,000.

Counties and cities can charge an additional local sales tax of up to 0.6%, for a maximum possible combined sales tax of 5.6%; 4.25% motor vehicle document fee. Well, speaking of wisconsin, the rate of the general sales tax is 5%, with all but 10 of 72 counties that charge an additional tax of 0.5% county tax.

The wisconsin (wi) state sales tax rate is currently 5%. For state, use and local taxes use state and local sales tax calculator. Wisconsin car loan calculator has options for trade in, taxes, extra payments, amortization schedule that shows you how much interest and principal that you are paying each month.

Car payment calculator wi to calculate monthly payment for your car loan. The wisconsin state sales tax rate is 5%, and the average wi sales tax after local surtaxes is 5.43%. Wisconsin auto loan calculator is a car payment calculator with trade in, taxes, extra payment and down payment to calculate your monthly car payments.

Total price is the final amount paid including sales tax. Wisconsin car payment calculator with amortization to give a monthly breakdown of the principal and interest that you will be paying each month. In addition to taxes, car purchases in wisconsin may be subject to other fees like registration, title, and.

There are also county taxes of up to 0.5%, and a stadium tax of up to 0.1%. Wisconsin is one of several states that taxes regular gasoline and diesel fuel at the same rate: Vehicle tax or sales tax, is based on the vehicle's net purchase price.

Some dealerships also have the option to charge a dealer service fee of 99 dollars. The kenosha, wisconsin, general sales tax rate is 5%.the sales tax rate is always 5.5% every 2021 combined rates mentioned above are the results of wisconsin state rate (5%), the county rate (0.5%). Dmv fees are about $ 318 on a $ 39750.

Wisconsin has 816 special sales tax jurisdictions with local sales taxes in addition to the. The december 2020 total local sales tax rate was also 5.500%. You may use this lookup to determine the wisconsin state, county, and baseball stadium district sales tax rates that apply to a location in wisconsin.

Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees. Also called “manufactured homes,” mobile homes used as a dwelling receive a 35% sales tax exemption, which means the remaining 65% is taxed at the full sales tax rate. They can also deduct any sales tax, but there are forms you can fill out to have this money refunded by the state.

Find your state below to determine the total cost of your new car, including the car tax. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Groceries and prescription drugs are exempt from the wisconsin sales tax;

The midwest driver fee calculator, a new online tool offered by the wisconsin department of transportation (wisdot) lets users calculate the taxes and fees they pay to drive several popular models of personal motor vehicles. We’ll review the vehicle property tax for each state in the table below. Wisconsin state rate (s) for 2021.

The combined rate used in this calculator (5.5%) is the result of the wisconsin state rate (5%), the 53955's county rate (0.5%). It's fairly simple to calculate, provided you know your region's sales tax. 6.35% for vehicle $50k or less.

Wisconsin residents must pay a 5 percent sales tax on car purchases, plus county taxes of up to 0.5 percent.some counties also charge a stadium tax of 0.1 percent , notes the wisconsin department of revenue.for example, the state and local sales tax on vehicles registered in bayfield county is 5.5 percent. Depending on local municipalities, the total tax rate can be as high as 5.6%. 6.75% is the highest possible tax rate ( lake delton, wisconsin) the average combined rate of every zip code in wisconsin is 5.441%.

Net price is the tag price or list price before any sales taxes are applied. Select view sales rates and taxes, then select city, and add percentages for total sales tax rate. Dealership employees are more in tune to tax rates than most government officials.

Sales Tax Calculator

Mortgage Calculator 2019 How To Use The Monthly Payment Formula For Mortgagesloans Wi Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Calculator

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

55 Sales Tax Calculator Template

States With Highest And Lowest Sales Tax Rates

Connecticut Sales Tax Calculator Reverse Sales Dremployee

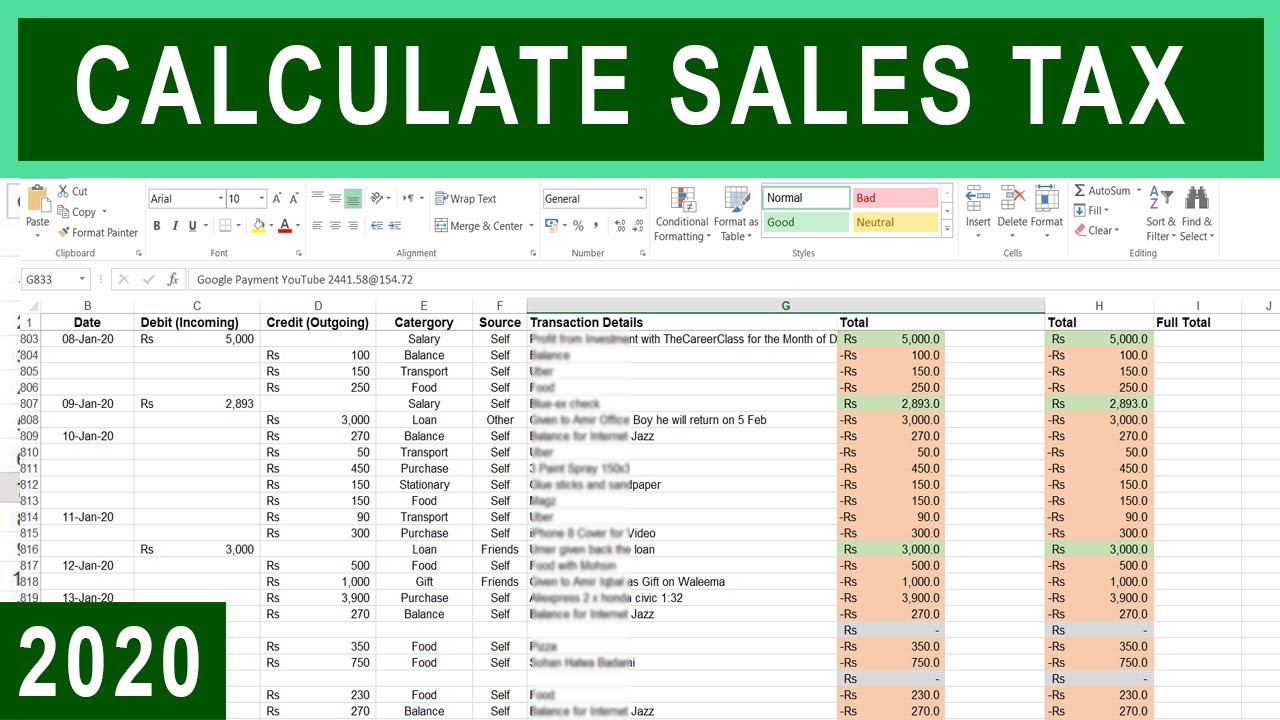

How To Calculate Sales Tax In Excel - Tutorial - Youtube

California Vehicle Sales Tax Fees Calculator

Nj Car Sales Tax Everything You Need To Know

Calculate Child Support Payments Child Support Calculator Toronto Ontario Wi - Child Support Humor Mot Child Support Quotes Child Support Child Support Laws

Which Cities And States Have The Highest Sales Tax Rates - Taxjar

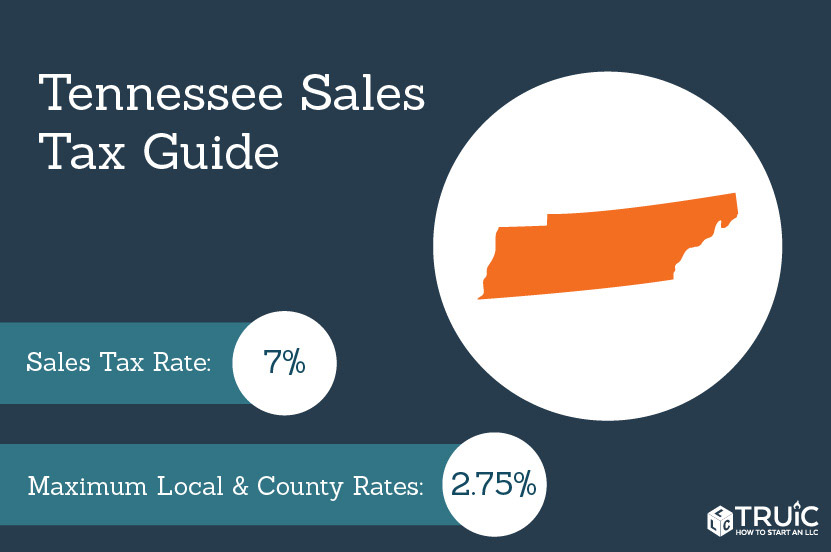

Tennessee Sales Tax - Small Business Guide Truic

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Calculator

Understanding Californias Sales Tax

Car Tax By State Usa Manual Car Sales Tax Calculator

Vintage 1978 Sinclair Pocket Calculator Advertisement Etsy Pocket Calculators Calculator Sinclair

Understanding Californias Sales Tax

Origin-based And Destination-based Sales Tax Rate - Taxjar

Comments

Post a Comment