Kansas has a 6.5% statewide sales tax rate , but also has 376 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.555% on top. This will start with a recording.

Car Tax By State Usa Manual Car Sales Tax Calculator

(the sales tax in sedgwick county is.

Kansas automobile sales tax calculator. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Subtract these values, if any, from the sale. In addition to taxes, car purchases in kansas may be subject to other fees like registration, title, and plate fees.

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.kansas has a 6.5% statewide sales tax rate , but also. How 2021 sales taxes are calculated in topeka. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees.

Every 2021 combined rates mentioned above are the results of missouri state rate (4.225%), the county rate (0% to 3.125%), the missouri cities rate (0% to 5.454%. For lookup by zip code only, click here. There is no special rate for topeka.

For the sales tax use our sales tax rate lookup. When you enter the street address, the calculator uses geolocation to pinpoint the exact tax jurisdiction. You can find these fees further down on the page.

Auto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator. County administrator 100 gunsmoke dodge city, ks 67801 phone: Every 2021 combined rates mentioned above are the results of kansas state rate (6.5%), the county rate (1%).

Kansas sales tax calculator.you can use our kansas sales tax calculator to look up sales tax rates in kansas by address / zip code. In case of an item with a final price of $112 that includes a sales tax rate of 7% this application will return these results: The topeka, kansas, general sales tax rate is 6.5%.depending on the zipcode, the sales tax rate of topeka may vary from 6.2% to 9.15% every 2021 combined rates mentioned above are the results of kansas state rate (6.5%), the county rate (1.15%), the topeka tax rate (0% to 1.5%).

Official website of the kansas department of revenue. There is no city sale tax for wichita. Kansas collects a 7.3% to 8.775% state sales tax rate on the purchase of all vehicles.

The wichita, kansas, general sales tax rate is 6.5%. Find your state below to determine the total cost of your new car, including the car tax. Do not push any buttons and you will get an information operator.

Kansas sales tax calculator vehicle. Sales tax rate by address. $30,000 × 8% = $2,400.

Both can be found on our website. Use this online tool from the kansas department of revenue to help calculate the amount of property tax you will owe on your vehicle. Depending on the zipcode, the sales tax rate of wichita may vary from 6.2% to 7.5%.

Kansas city vehicle sales tax calculator find your state's vehicle tax & tag fees when purchasing a vehicle, the tax and tag fees are calculated based on a number of factors, including: If purchased from a kansas dealer with the intention to register the vehicle in kansas, the sales tax rate charged is the combined state and local (city, county, and. Wichita, ks 67213 email sedgwick county tag office;

There are also local taxes up to 1%, which will vary depending on region. How 2021 sales taxes are calculated in wichita. This level of accuracy is important when determining sales tax rates.

Nj Car Sales Tax Everything You Need To Know

Car Tax By State Usa Manual Car Sales Tax Calculator

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Sales Tax On Cars And Vehicles In Kansas

Find Out If You Have To Pay Import Tax When Shipping A Car To The Usa And How Much It Costs As Well As Information On Exemptions Gas Guzzler Tax And More

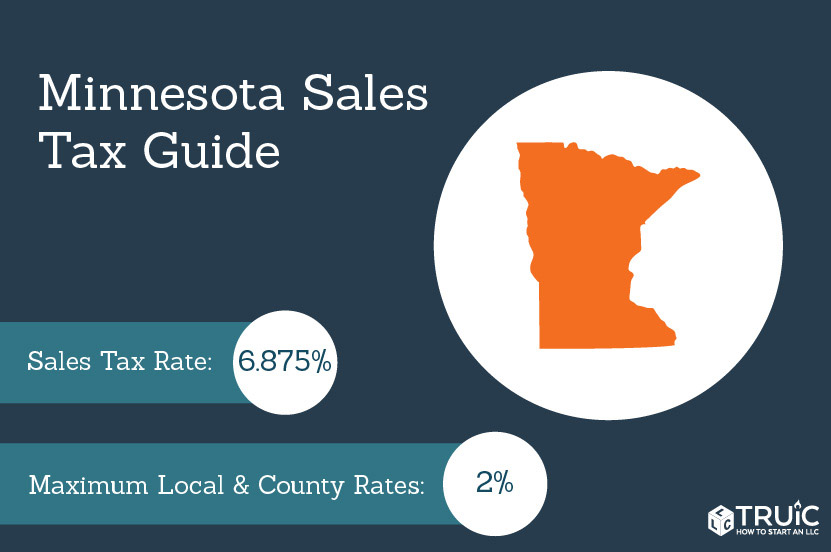

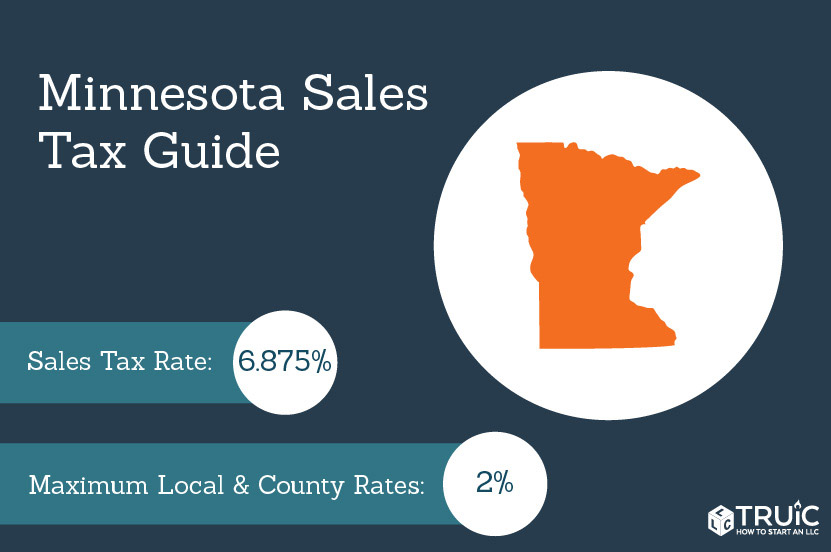

Minnesota Sales Tax - Small Business Guide Truic

Connecticut Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Calculator For Purchase Plus Tax Or Tax-included Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Missouri Car Sales Tax Calculator

States With Highest And Lowest Sales Tax Rates

Dmv Fees By State Usa Manual Car Registration Calculator

Auto Loan Calculator With Tax Calculate By State With Trade

Car Tax By State Usa Manual Car Sales Tax Calculator

Do You Have To Pay A Vehicle Tax Heres Some Good News The Motley Fool

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Simple Guide On Getting A Kansas Dealer License

Sales Tax Calculator

Do You Have To Pay A Vehicle Tax Heres Some Good News The Motley Fool

Comments

Post a Comment