The kaufman county treasurer and tax collector's office is part of the kaufman county finance department that encompasses all financial functions of the local government. Use just the first or last name alone.

2

Try using the advanced search above and add more info to narrow the field.

Kaufman county tax assessor collector. Kaufman county tax office p.o. Kaufman county court c tax assessor see 2021 tax worksheets here. “improving and maintaining the accuracy and uniformity of appraisals of all property in kaufman county”.

The rate of the ad valorem tax (section 2051.202) if applicable, the sales and use tax rate (section 2051.202) any tax rate hearing notice The kaufman county tax collector, located in kaufman, texas is responsible for financial transactions, including issuing kaufman county tax bills, collecting personal and real property tax payments. Tax description assessed value tax rate tax amount ;

The kaufman county tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in kaufman county. Having trouble searching by name? Kaufman county tax assessor 100 n.

Find results quickly by selecting the owner, address, id or advanced search tabs above. Try a more simple search like just the street name. Tax assessor/collector brenda samples kaufman county tax assessor/collector p.o.

464,208,589 the reported totals above are based on data from the certified tax roll provided by the kaufman county appraisal district and other (972) 932 4331 (phone) the kaufman county tax assessor's office is located in kaufman, texas. Change of address on motor vehicle records;

The name of the person representing the tax assessor/collector, including mailing address and telephone number. Utility tax service, llc was established in october 2004 and we are committed to providing our clients with the highest quality service in the property tax industry. Get driving directions to this office.

Having trouble searching by address? The name of the person representing the tax assessor/collector, including mailing address and telephone number (hb 1154) kaufman county tax. With over 60 years of property tax assessment and collection experience, mike arterburn, rta, and joann ramos, rta, are ready to put that knowledge to work for you.

The kaufman county property appraiser is responsible for determining the taxable value of each piece of real estate, which the tax assessor will use to determine the owed property tax. Registration renewals (license plates and registration stickers) vehicle title transfers; Services to be rendered by the tax assessor/collector (tac) the kaufman county tax assessor/collector shall assess and collect lump sum assessments as calculated according to the district formation documents and approved annually by the forney city council on all properties situated within the villages of fox hollow

Who Represents Me - Kaufman County Gop Club

2

400 E Grove St Kaufman Tx 75142 Mls 14511132 Redfin

Kaufman-county Property Tax Records - Kaufman-county Property Taxes Tx

Tax Information Wilson Cad Official Site

2

Kaufman Cad Property Search

Home Kaufman County

Kaufman County Texas Fha Va And Usda Loan Information

2

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/XMIFG7GE7D6TUDEFWUWHPVMEHQ.jpg)

Another Way To Fight Property Taxes A Mayor Sues County Appraisal District Over Faulty Appraisals

Kaufman Central Appraisal District Facebook

2

Board Terminates Kaufman County Chief Appraiser Local News Inforneycom

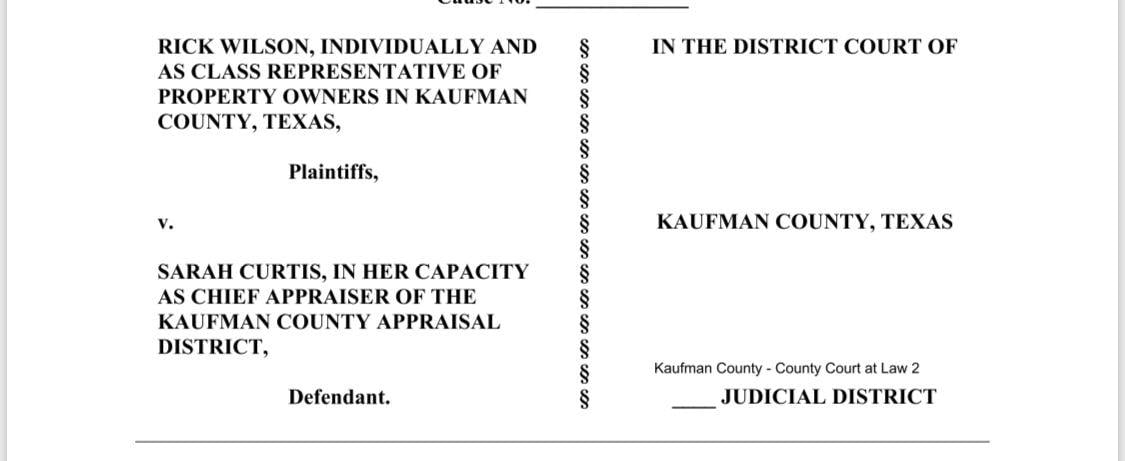

Forney Mayor Files Suit Against County Appraisal District Business Inforneycom

Another Way To Fight Property Taxes A Mayor Sues County Appraisal District Over Faulty Appraisals

Jordan Kaufman Kern County Treasurer-tax Collector - Home Facebook

Cpkjqfr_bcsobm

Kaufman-county Property Tax Records - Kaufman-county Property Taxes Tx

Comments

Post a Comment